Time for a pause?

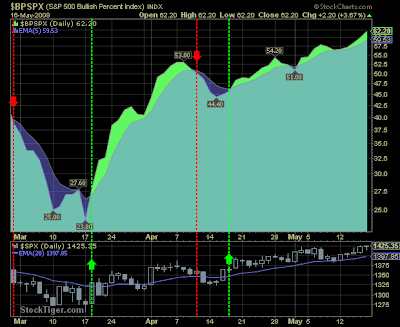

Before each of my market posts there is a buy/sell call (at owner's risk!). At the start of the month I usually try to call the flavour for the coming month based on overall market conditions; which I have marked on the chart below. What is clear is having waited so long for the market to roll over (basically spent most of 2007 waiting), I jumped too early on the bullish bandwagon this year. The past 3-months have been good for bulls. Like in late 2006 there is a reasonable chance June will be another upward month. However, it is unusual to get sequence runs beyond 4 months. Look at the early 2006 decline, late 2006 advance, early 2007 advance and the late 2007/early 08 decline; all lasted around 4 months. What we are likely to see after June is a period of sideways trading until the next 3/4 month sequence kicks in. June will likely be the last month I keep my 'Buy' call on the market. Get the Fallond Newsletter Dr. Declan Fallon, Senior Market Technician, Zignals.com th...