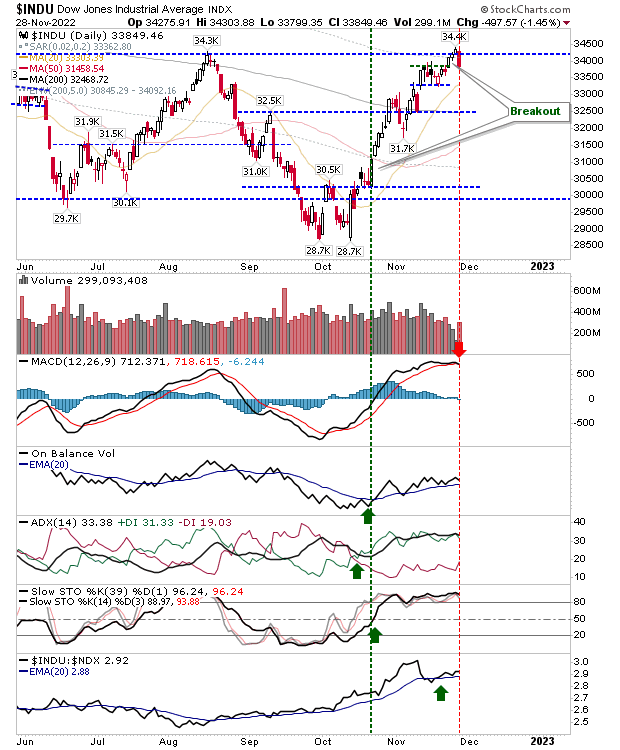

Sellers attack resistance in the Dow Industrials

Traders booted the juniors off the trading desks following the holidays and they weren't happy. Selling in the Dow Industrial Average came off the challenge of resistance defined from the last swing high. The only technical change was the MACD trigger 'sell' but relative strength remained in the Dow's favor. Look for a move back to the 20-day MA.