Stock Market Commentary: MACD 'Sell' For S&P

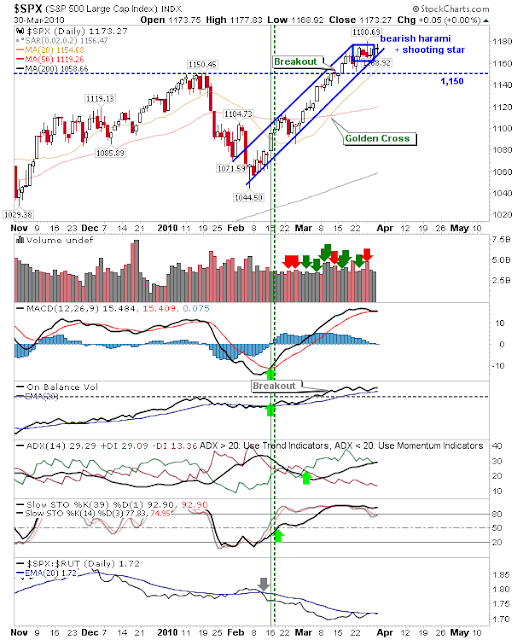

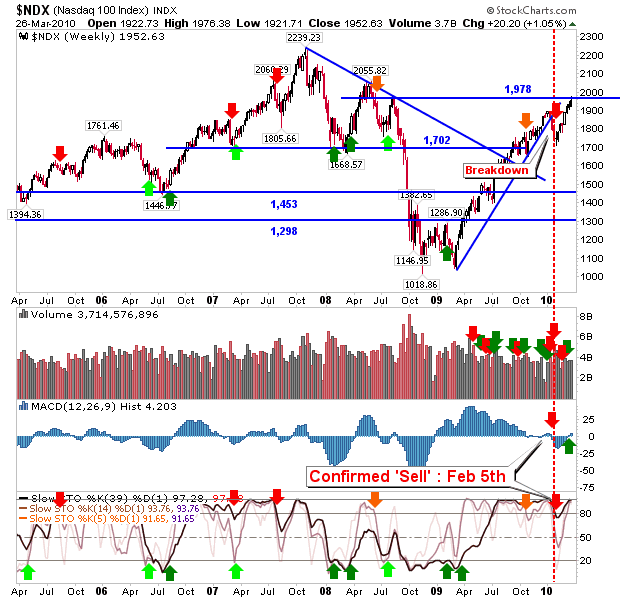

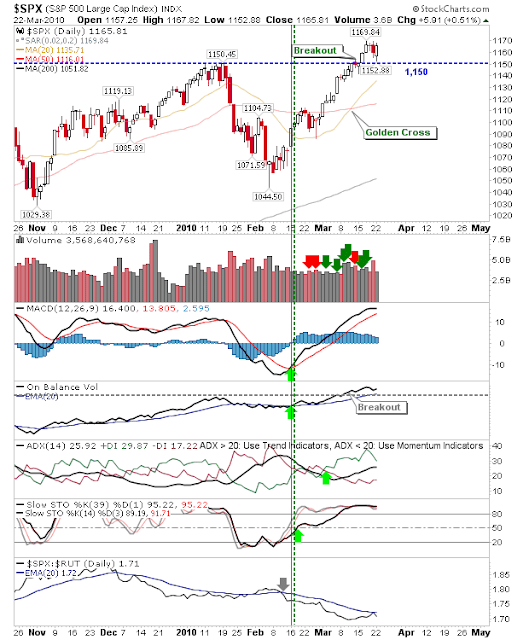

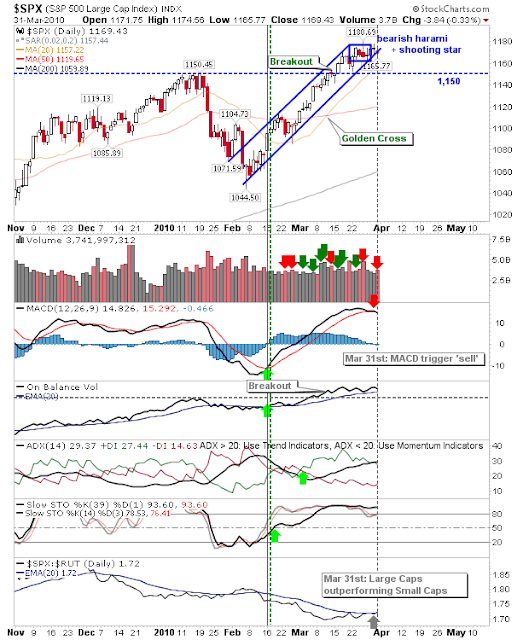

Following the weakness which has emerged in Tech and Small Caps, the S&P followed suit with a MACD trigger 'sell'. The index closed with a neutral spinning top which held on to channel support. The Nasdaq is approaching rising support too; Wednesday's mini-Shooting Star played on by confirmed distribution With the Nasdaq 100 joining the 'sell' side Looking for more of the same Thursday. Stock Breakouts Eighteen stocks qualified for my scan but looking through the charts didn't return much: ATSG gained 44% to gap through 20-day, 50-day and 200-day MAs but would need to stabilise above $2.80 to have merit, closed the day at $3.35. IMMR gapped and closed bang-on psychological $5.00 support. The MACD regained the bullish zero line after a 'buy' trigger. The much maligned OSTK surged off 200-day MA support but couldn't maintain all of its gains by the close; $15.00 support is the key area to watch, it closed the day at $16.23. ...