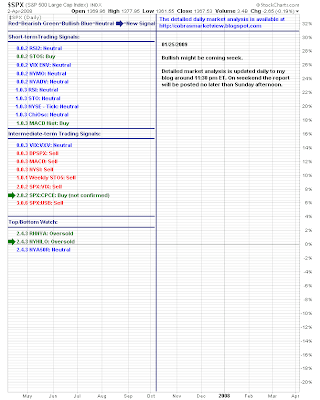

Weekend Review: Neutral once more

Early attempts at a buy signal for the Nasdaq and S&P drifted as stochastics again dropped into oversold territory. Their respective MACD's maintain a 'buy' but for all intent and purposes it looks like both indices want to check out November lows. Nasdaq Bullish Percents also kissed good-bye to its breakout, leaving instead a bull trap and a sell trigger in stochastics; best bet for bulls is a new higher low which shouldn't be too difficult, particularly if it is associated with a new low in the Nasdaq. The Nasdaq Summation Index could not have played better resistance; when it breaks it will have great significance and likely confirm the next cyclical bull market. The NYSE Summation Index has fallen into line with the Nasdaq. It too has a clear definition of resistance The sensible thing to do is to wait for breadth indicators to enter more oversold conditions before considering long side positions. Dr. Declan Fallon, Senior Market Technician, Zignals.com the fr...