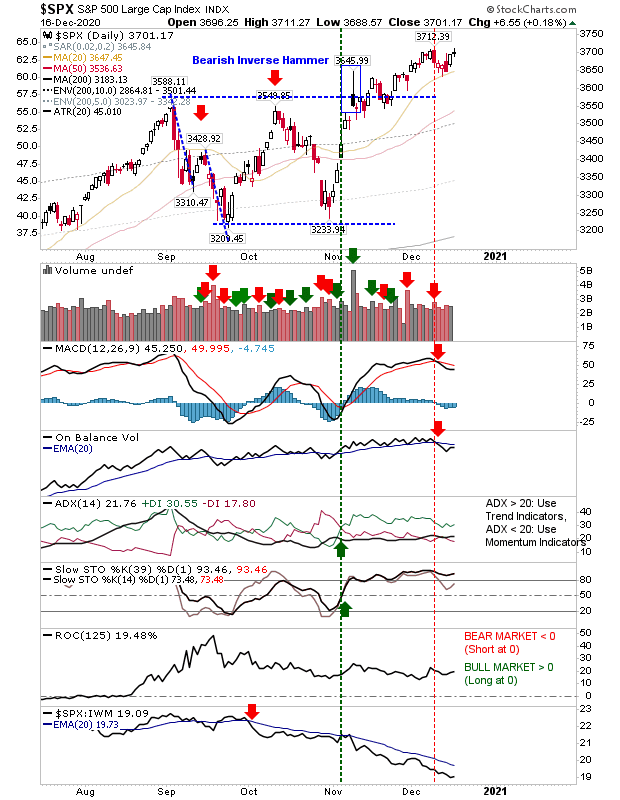

Large Caps Suffer Some Softness

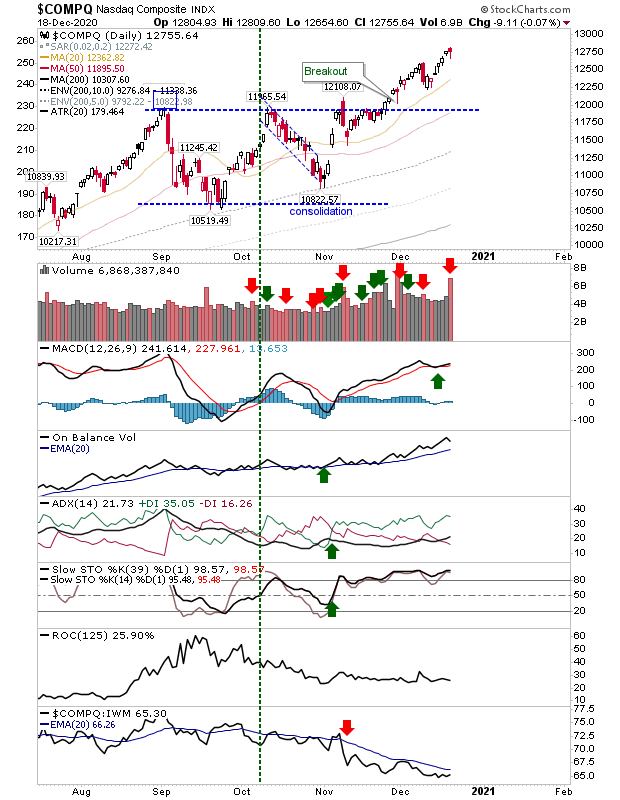

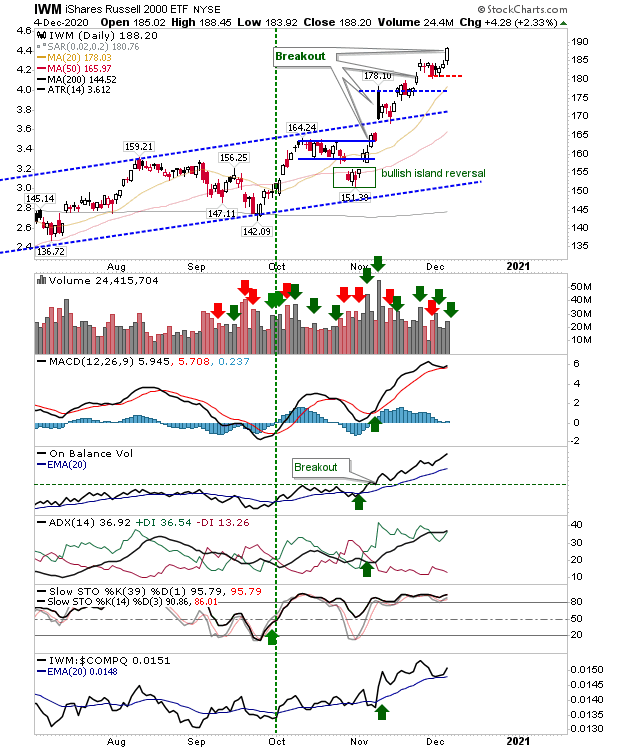

As Christmas approaches there wasn't a whole lot to add on today's trading. Indices were mostly able to add a little on yesterdays bullish reversals, although most of the games were booked at the open and stayed there for most of the day. Only Large Caps suffered some weakness, but it was pretty modest. The Nasdaq managed a new closing high on lighter volume. Technicals remain nest positive, although the index is still underperforming relative to the Russell 2000.