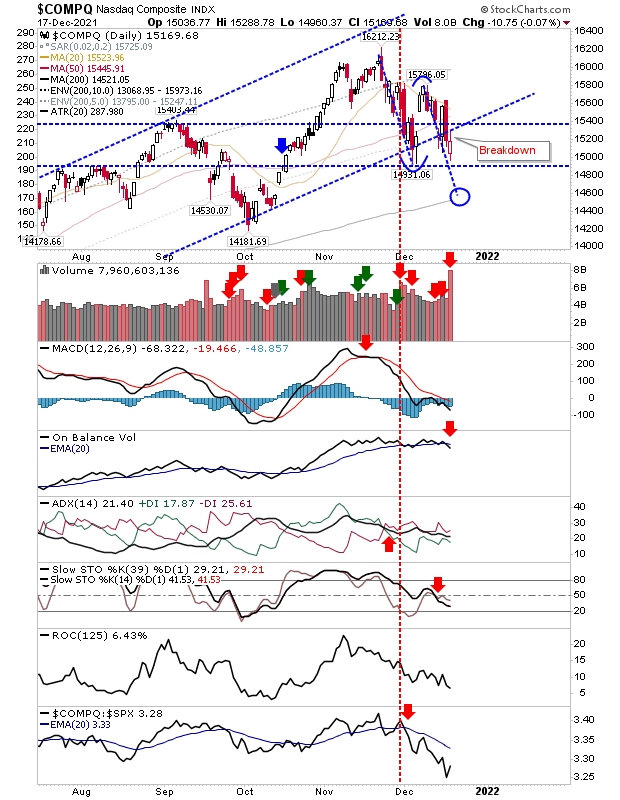

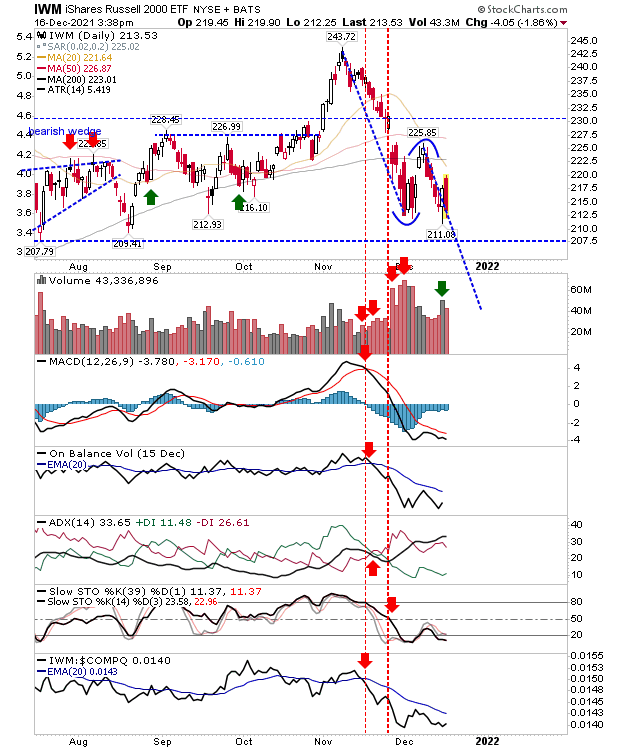

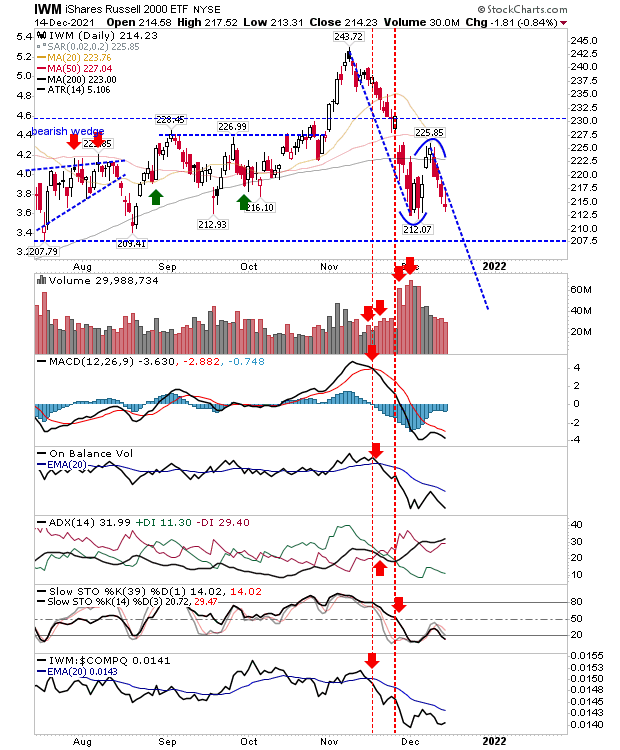

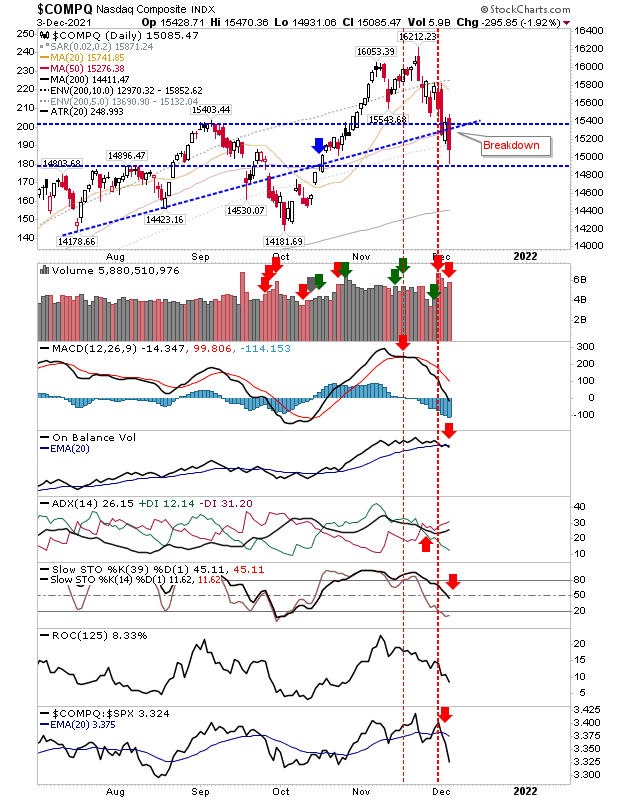

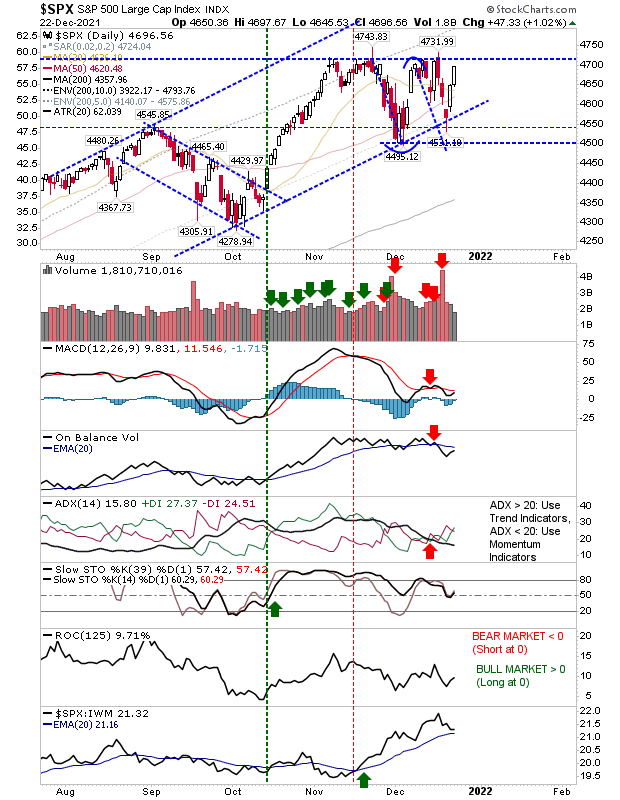

Indices Shift To Trading Ranges

The past few days has seen indices rally back to resistance, or at least reaffirmed support. Given the action, it's looking increasingly likely this status quo will continue through to the end of the year and it will be the New Year before there is a decisive move one way or the other. For the S&P, this measn we have a trading range defined by the highs of November and the swing lows of December. Another tag of resistance would likely mean a breakout will follow as triple tops are rare and it seems unlikely we would see one here.