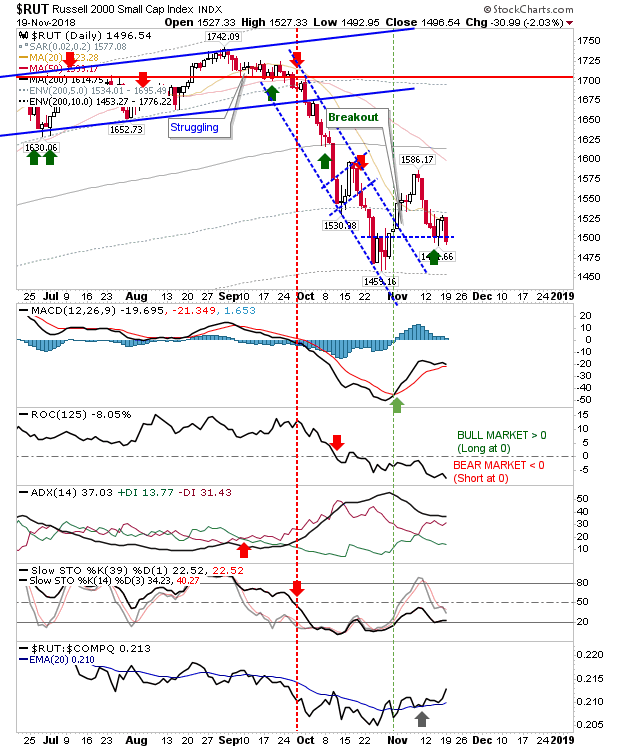

Bottom Building Picks Up The Pace

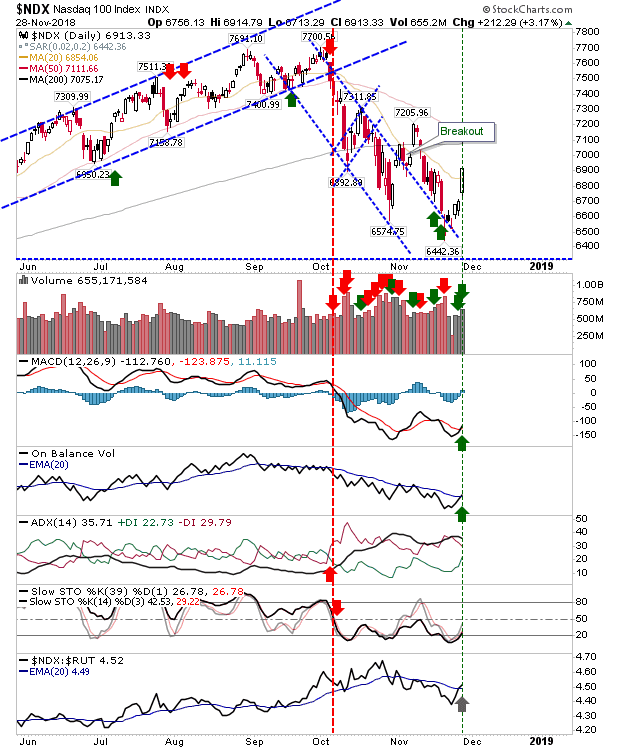

The Fed stepped in at a good time with positive comments on rate increases as markets put some distance on recent swing lows. All markets now have a bit of wiggle room to defend and with seasonal 'Santa Rally' ready to kick off then we yet have more good news to come. The biggest one-day gain was the Nasdaq 100, it gained over 3% on higher volume accumulation. These gains came with a bullish cross in relative performance against the Russell 2000 and 'buy' signals for the MACD and On-Balance-Volume. The first test will be the convergence of 50-day and 200-day MAs around 7,100.