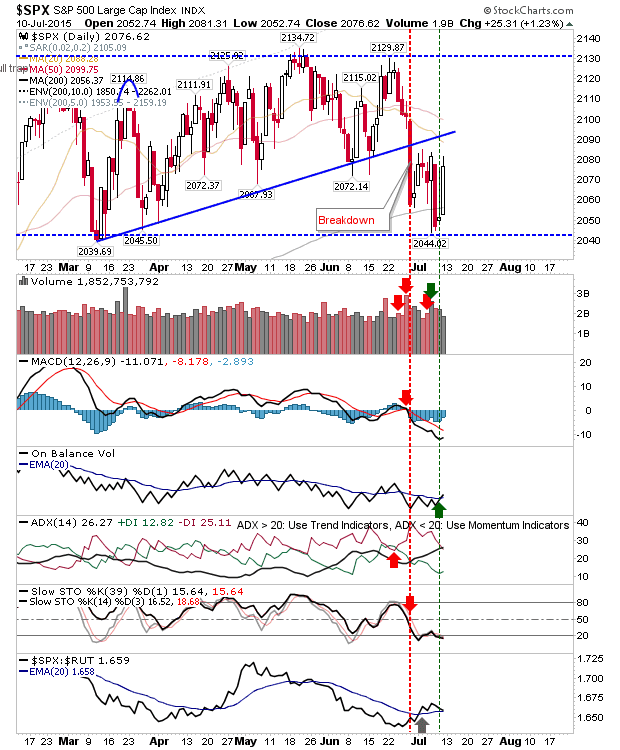

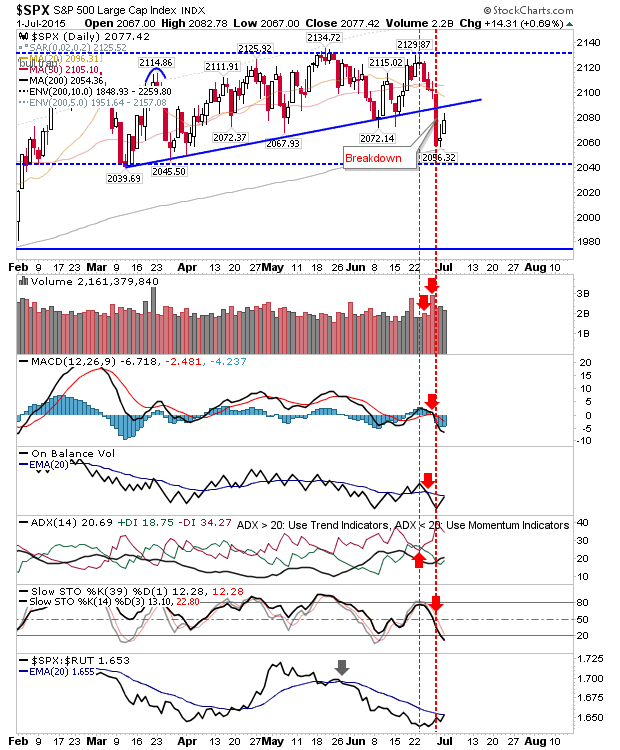

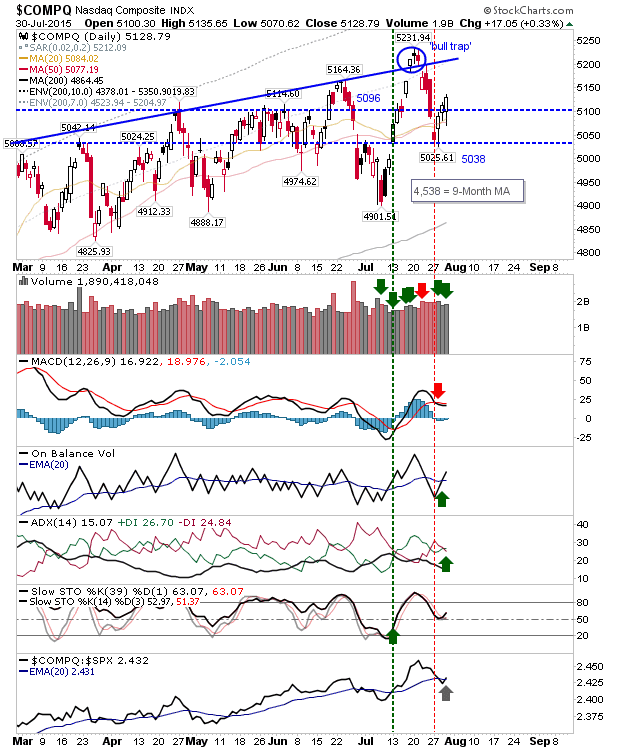

Markets Remain Near and Above, Yesterday's Highs

Tech indices finished strong after they overcame the opening half hour of selling. The Fed statement was greeted favorably , although market breadth is not looking pretty. The Nasdaq still has a distance to travel to make back all of its losses, but has done well to hold up against Semiconductor weakness.