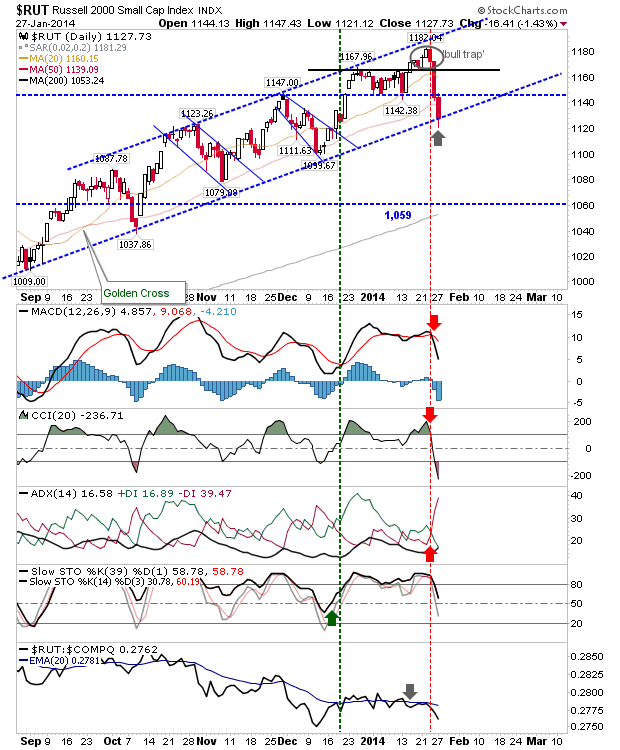

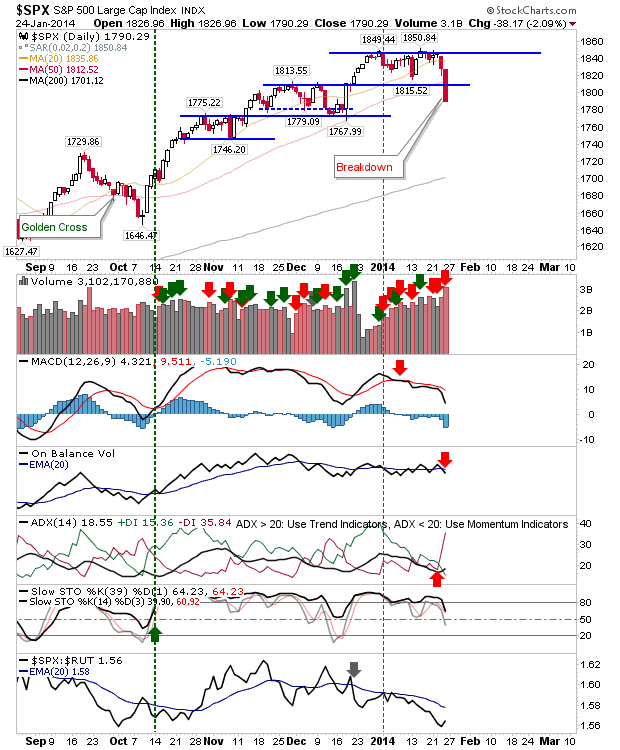

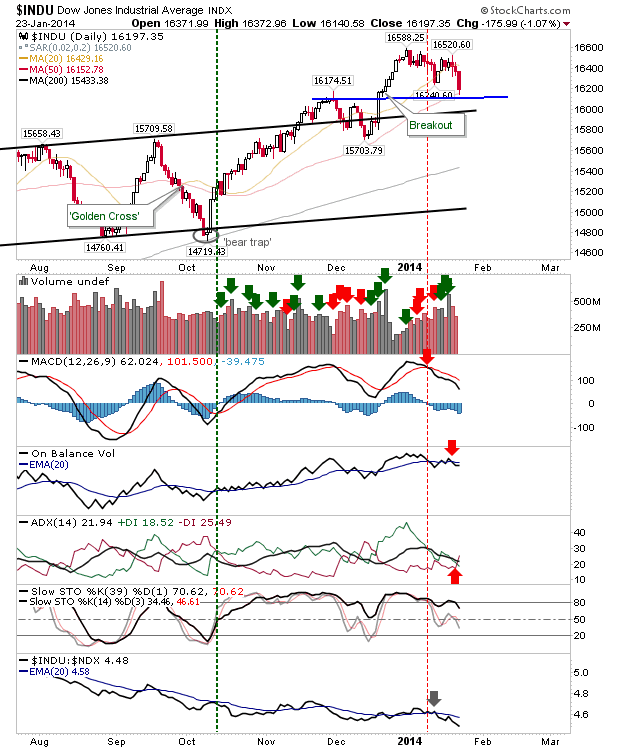

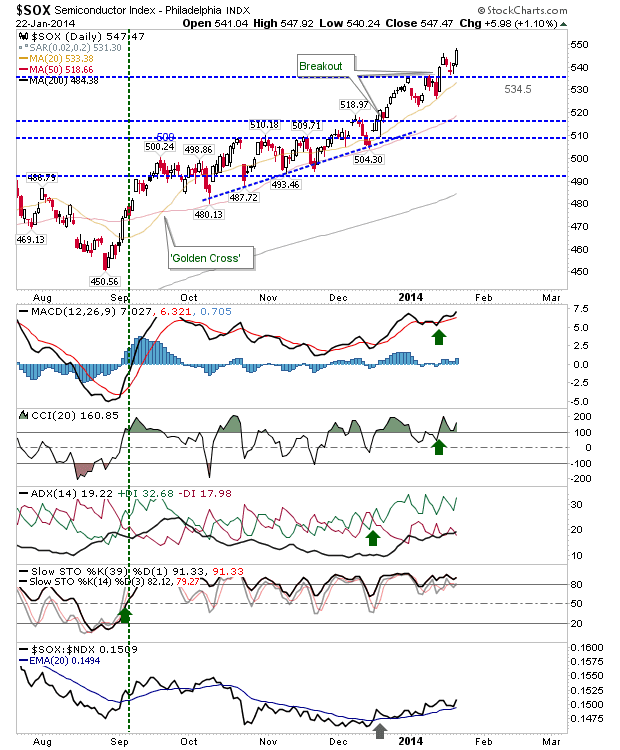

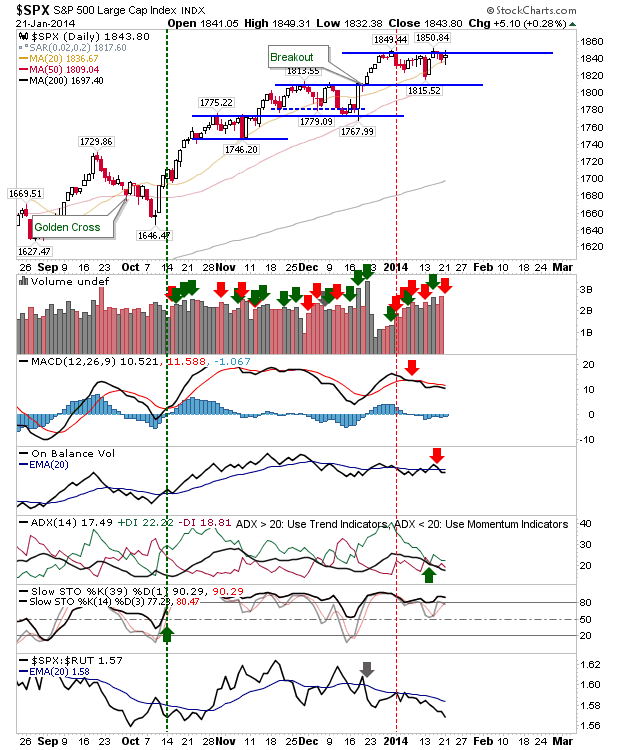

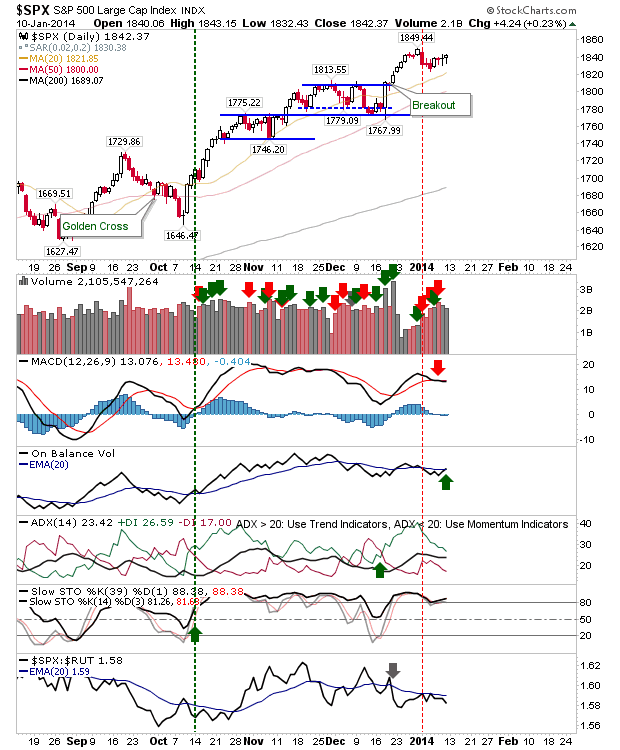

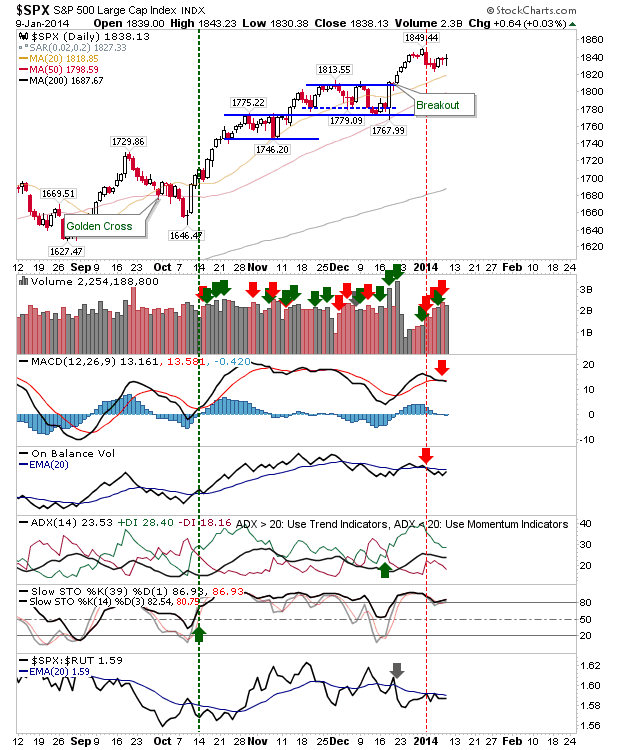

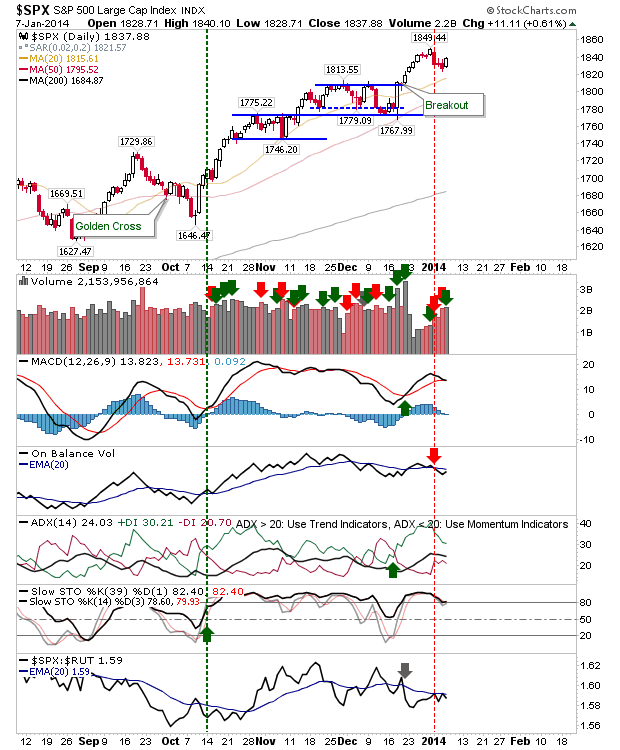

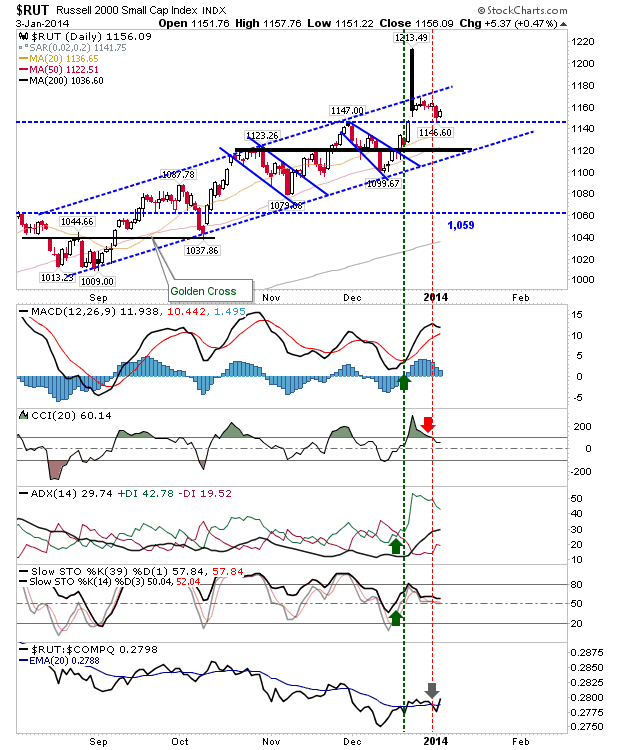

Surprising losses when markets were set up for gains. The losses were substantial, fueled by upcoming earnings rather than any confirmed bearish action. The S&P fell back-and-below its 20-day MA, setting up a test of its 50-day MA. There is a MACD trigger 'sell' to navigate, with a pending bearish cross in +DI/-DI on the way. Given the degree of losses, it could come back to its 50-day MA by the end of the week. The Russell 2000 also had a rough day, although it didn't fall enough to violate the breakout. The index closed at its 20-day MA. If bulls are to mount a challenge, this is the index to do it. The Nasdaq took the hardest hit. It lost the converged support, and overshot the 20-day MA on higher volume distribution. The 50-day MA is next up at the target Prepare for some fight from bulls, because it looks like they were taken by surprise today on the selling, and failed to generate the afternoon buying which occurred in previous days. However, bea...