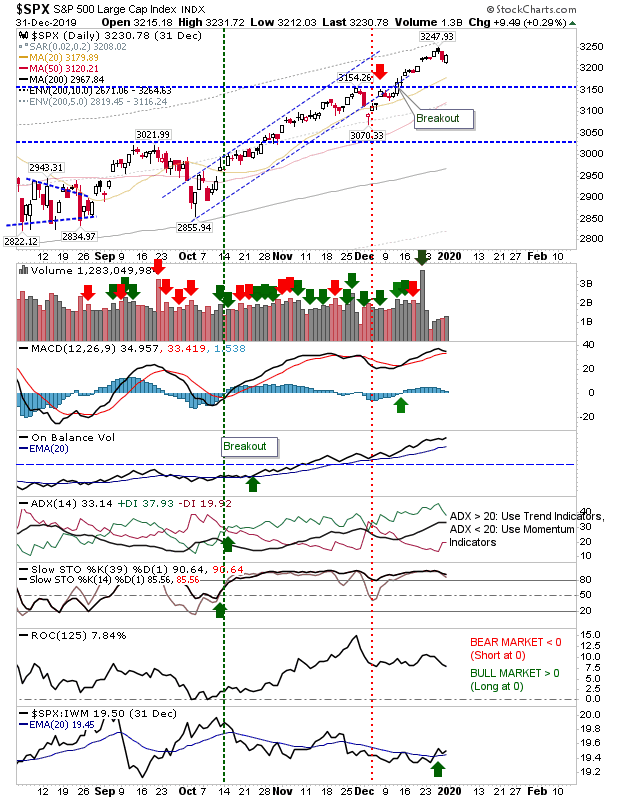

Buyers Return

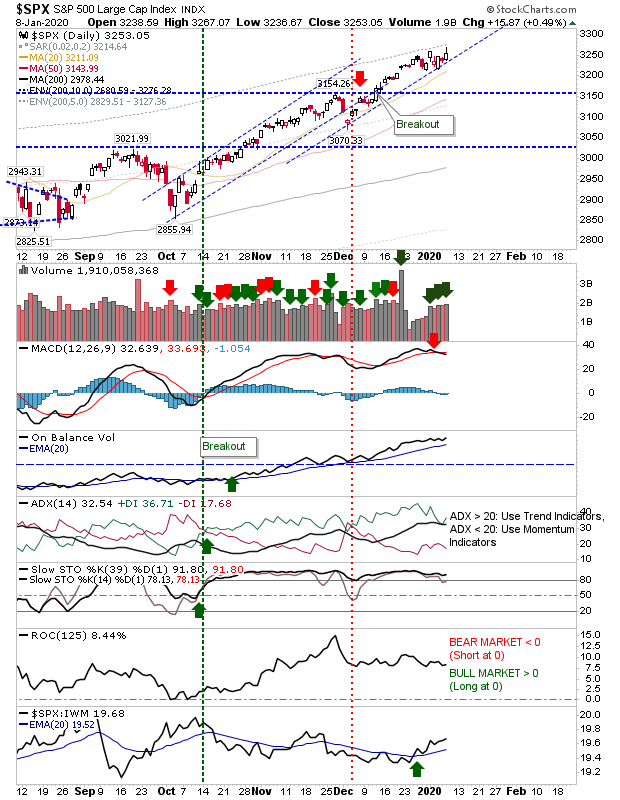

The gap down at the start of the week is still the dominant pattern but today helped stabilize the losses. Indices did have support to work with, the Dow in particular is still trading inside its channel. The Dow has been chugging along channel support with today's buying registering as accumulation. The MACD is on a trigger 'sell' along with a 'sell' trigger in the ADX.