Daily Market Commentary: Losses Recovered

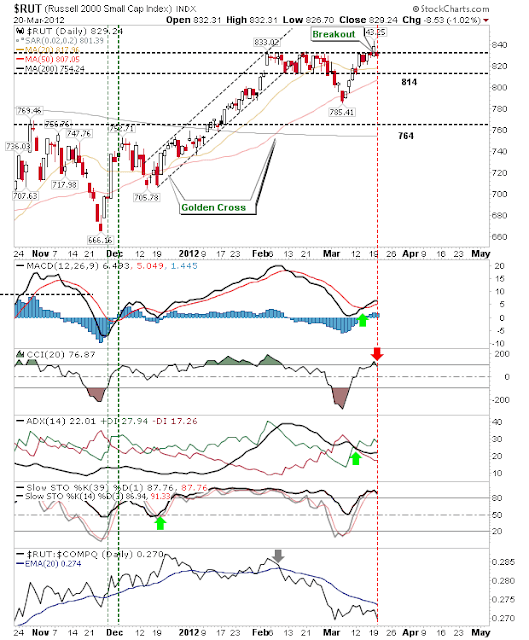

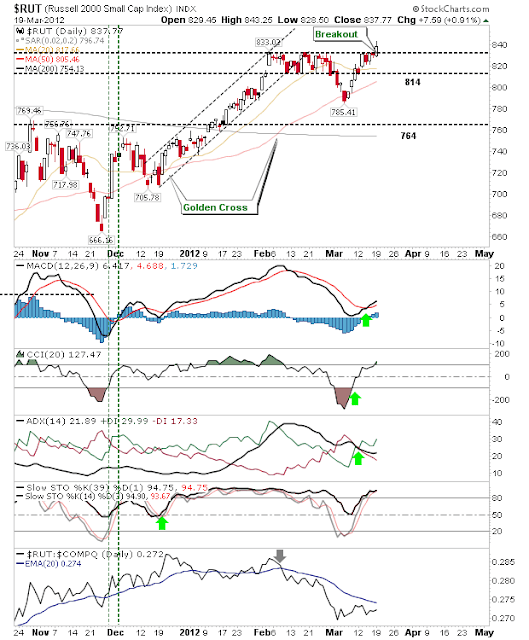

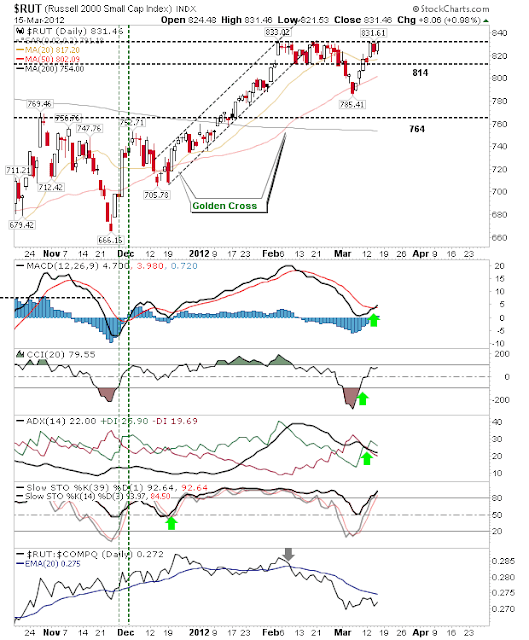

By lunchtime today it was looking like the day would belong to bears, but bulls were able to step up in afternoon trading - perhaps fearful of missing out on any more of this rally (given the rally maturity). But it wasn't all good news for bulls. The S&P was able to defend its 20-day MA, but not before on-balance-volume triggered a 'sell' to follow the earlier 'sell' trigger in the MACD. The Nasdaq followed the S&P with a 'sell' trigger in its on-balance-volume, although other technicals remain bullish. With the Percentage of Nasdaq Stocks above the 50-day MA trading at support once more; this offers a support 'buy'. But breadth support is offset by the potential 'bull trap' in Tech bellwether Semiconductor index. If bears aren't to be encouraged to go short there will need to be a rapid return above 440. Bulls can look to the 20-day MA as an area for stop placement Finally the Russell 2000 experienced a ...