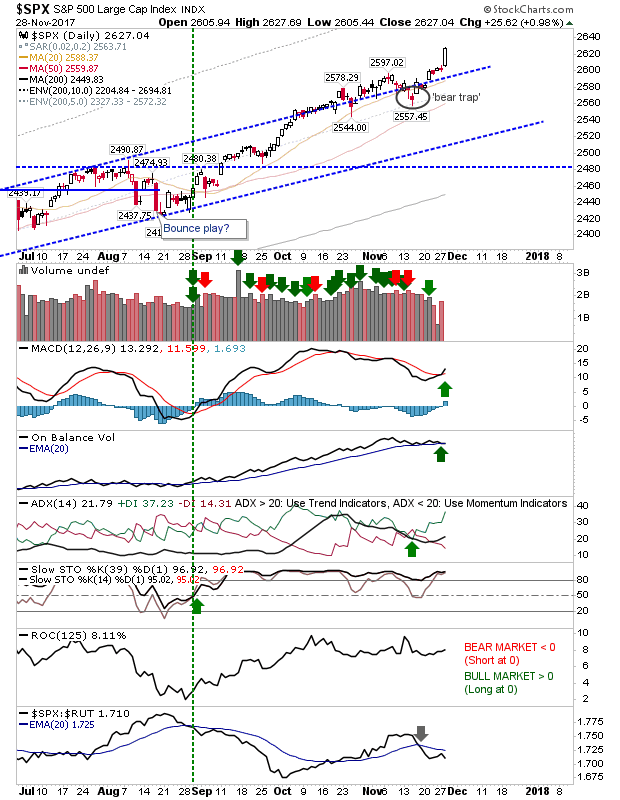

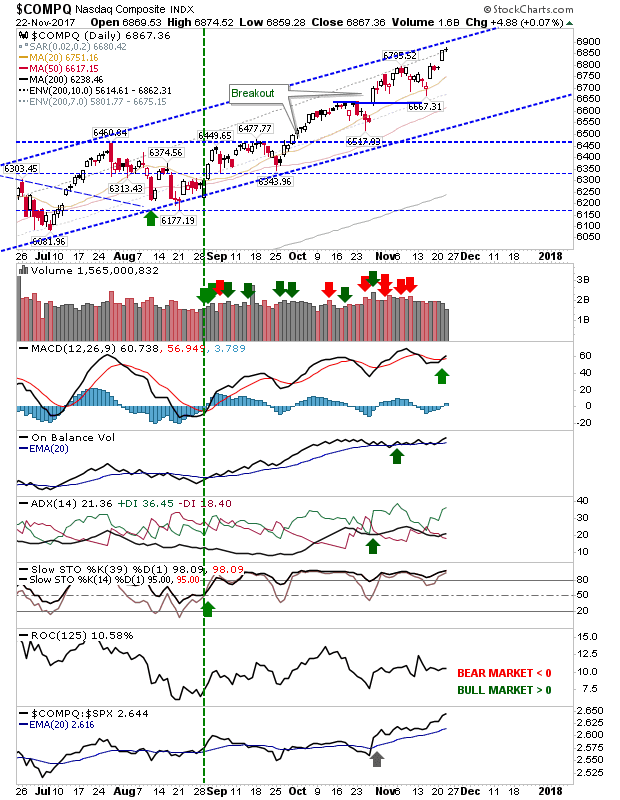

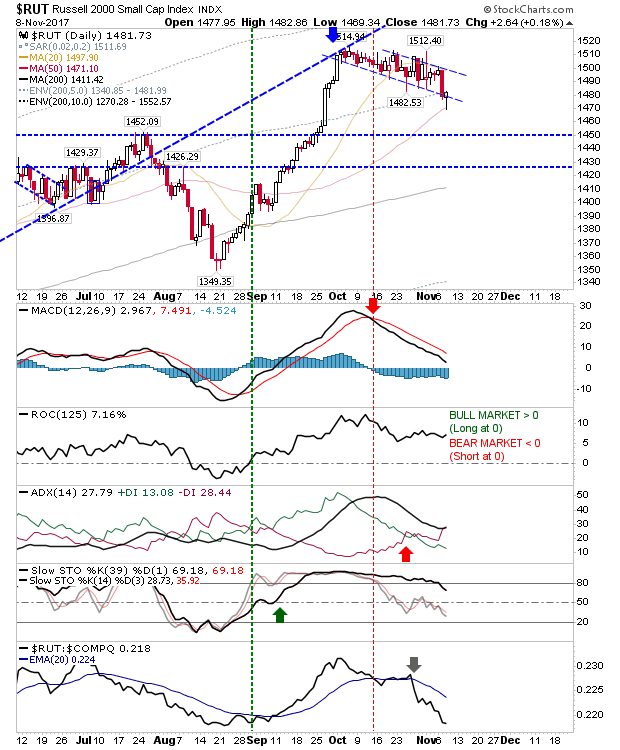

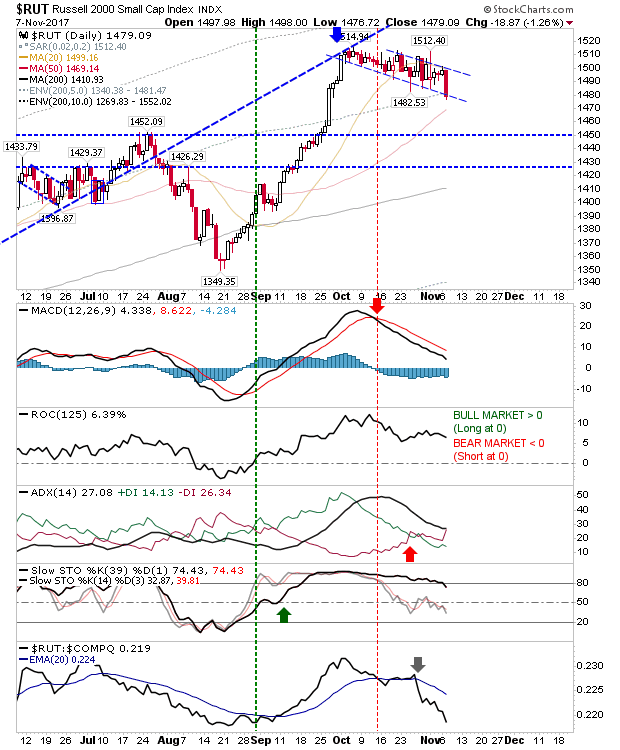

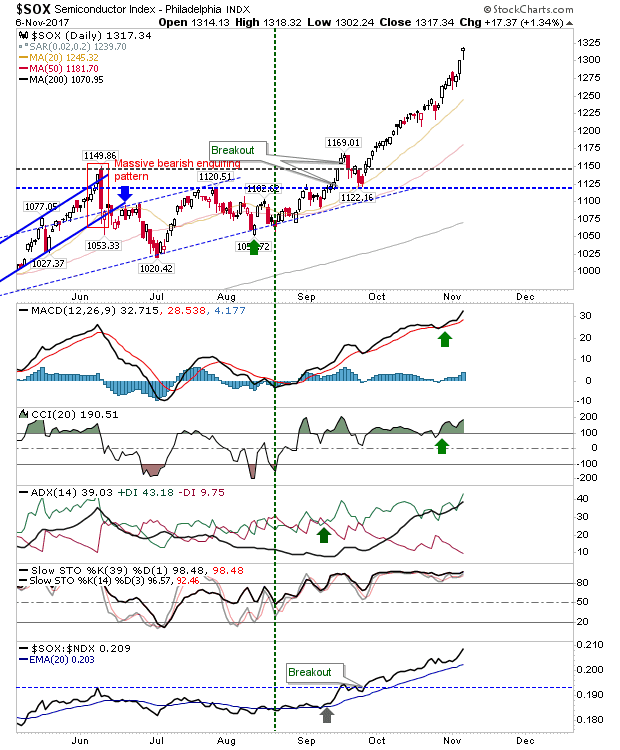

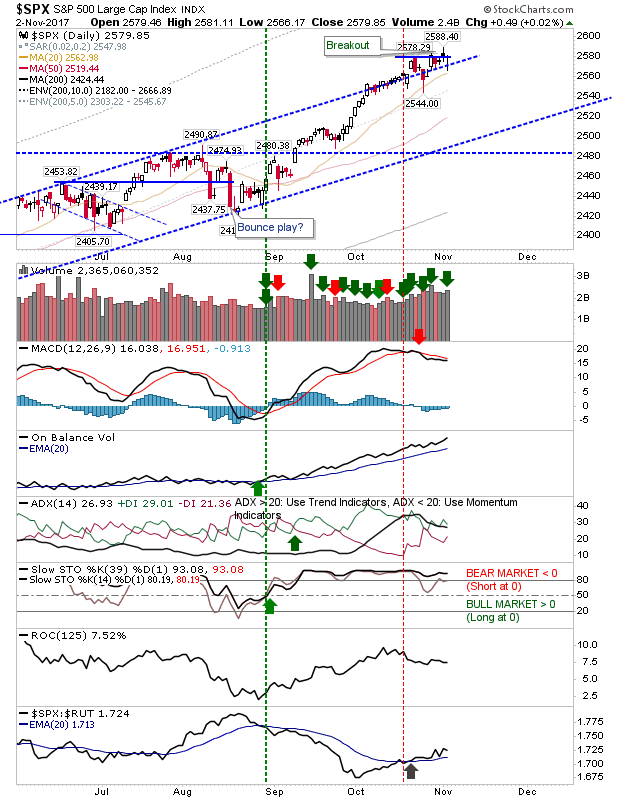

Profit Taking Sweeps Tech While Large Caps Gain

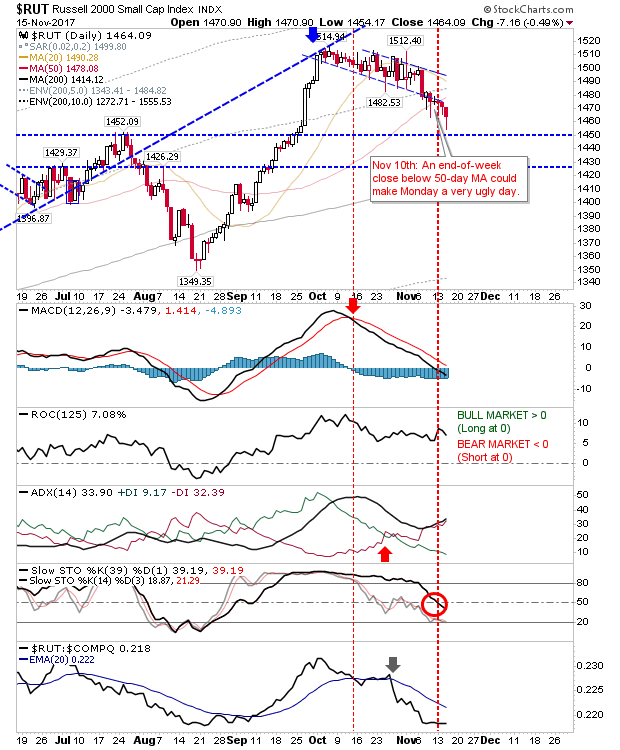

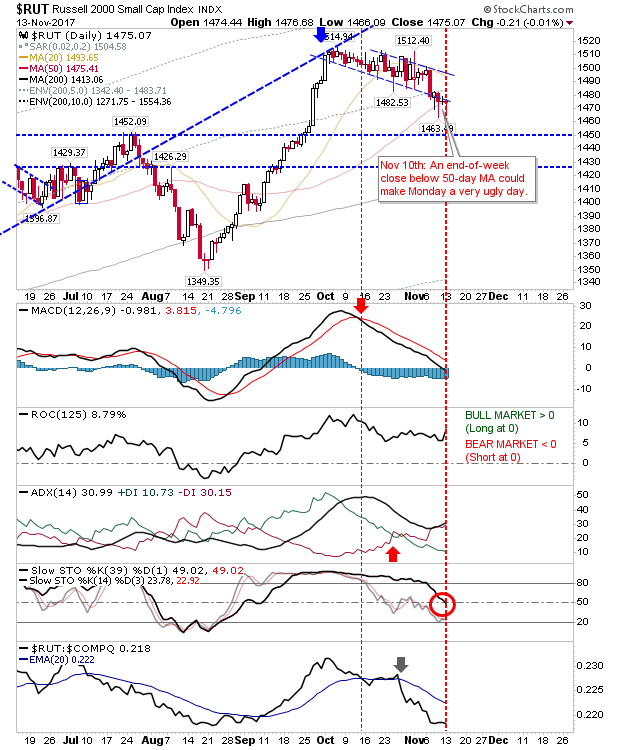

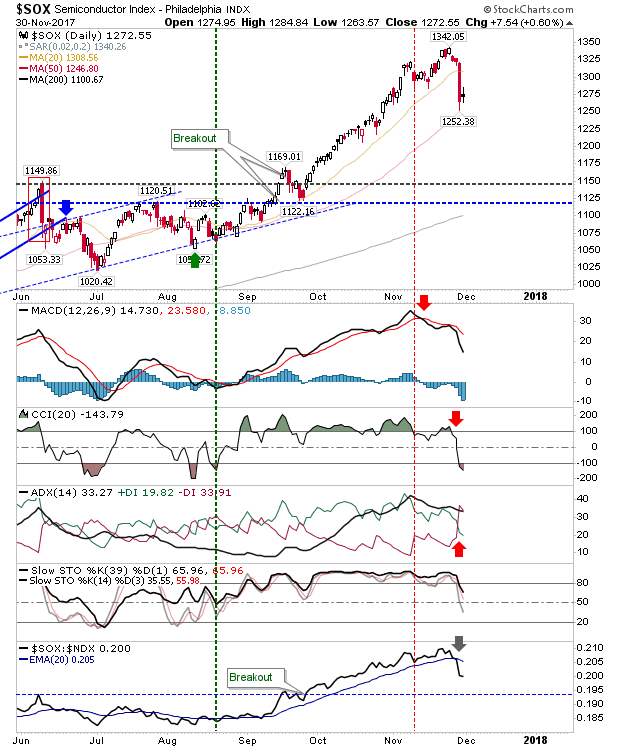

There was a clear shift in market behaviour as Large Caps enjoyed the fruit of renewed buying as Tech indices (Semiconductors mostly) felt the heat of profit taking. After weeks of tight gains in the Semiconductor Index it was an easy turn for profit takers to come in and push the market down; in the absence of logical support it was going to be a hard task to pinpoint where potential depend may lurk outside of 1,150. The 50-day MA may provide one such escape but there isn't a whole lot to suggest it may play as support.