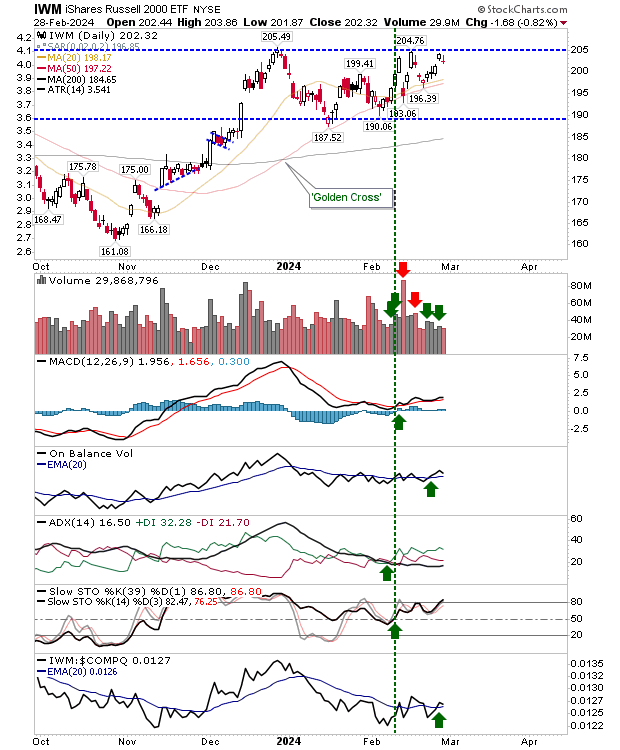

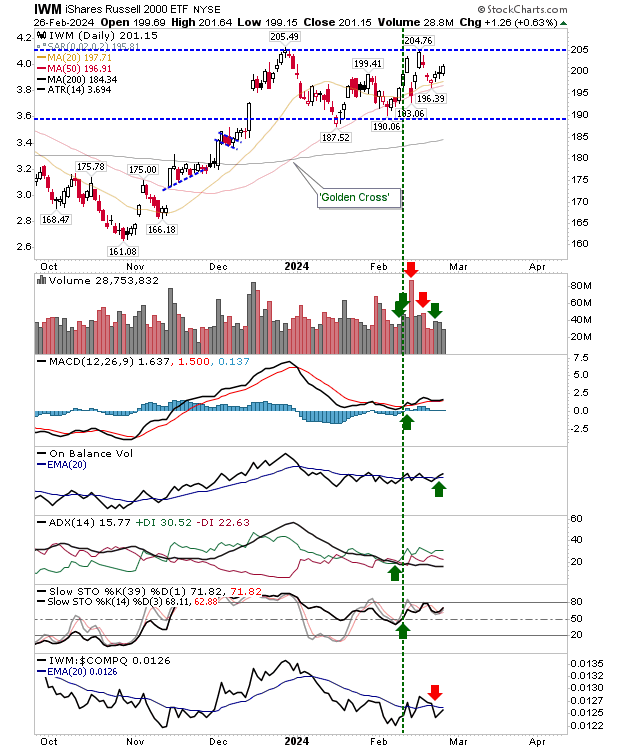

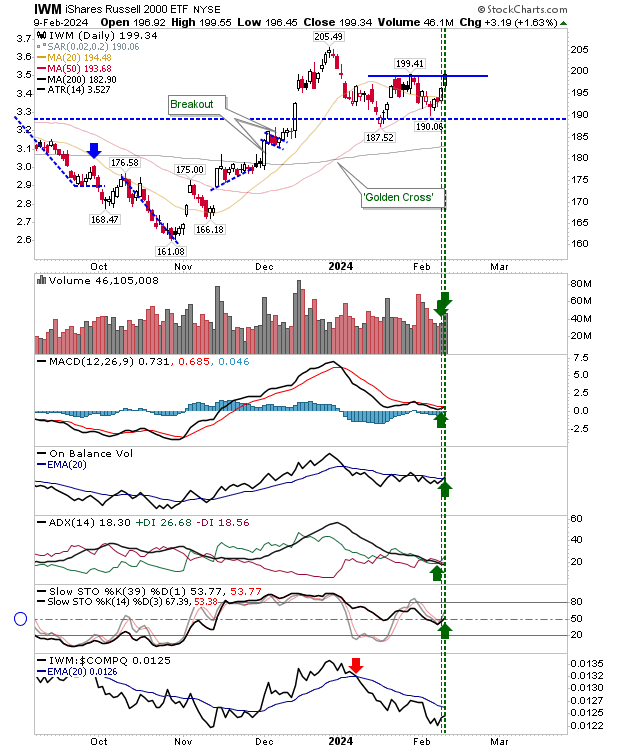

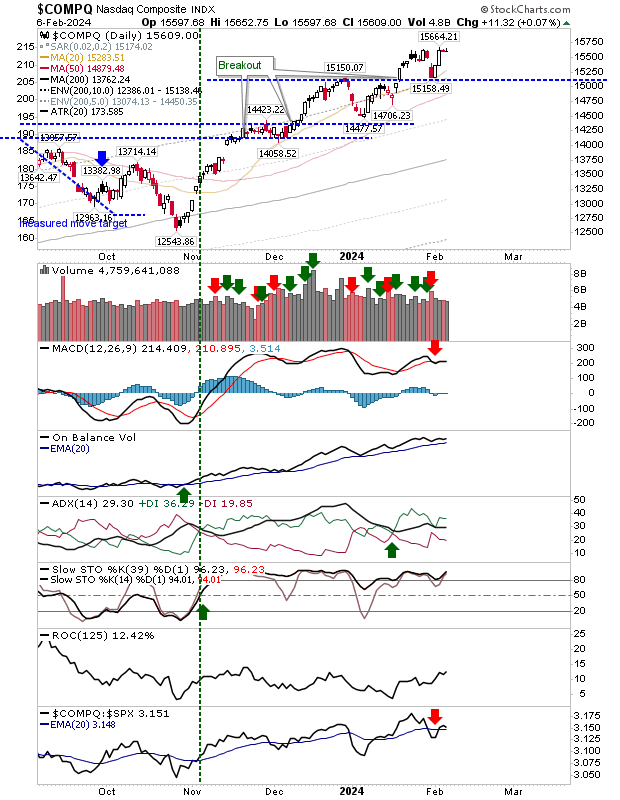

I wouldn't classify it as a "bull trap" as Monday's breakout in the Russell 2000 was an internal base breakout, but the drop back into this base places greater significance on support around $190. Technicals are net bullish, but On-Balance-Volume is flipping around its 20-day MA trigger line and ADX is also a little topsy turvy. The MACD might prove to be the bellwether here, and for now, there is a 'buy' trigger above the bullish zero line. The Nasdaq is recovering from its gap down, although there wasn't too much technical damage from this gap. Symmetry could be important here, and what happened in December could repeat here. If this proves true, the next breakout won't come until March. Technicals support this thesis. For the S&P, read the Nasdaq. Same setup, same potential outcome. The semicondcutor index has been performing relatively methodically, moving in step sequence through its bases. There are bearish diveregences ...