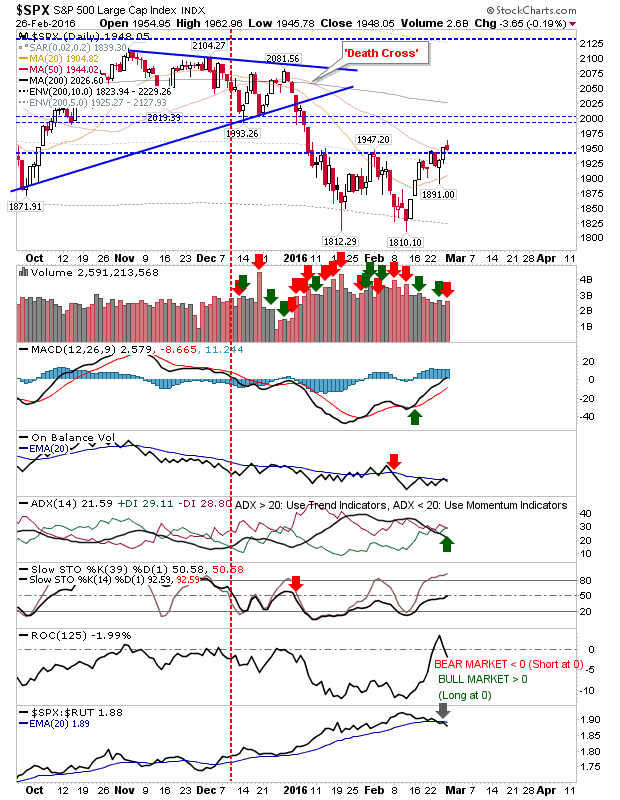

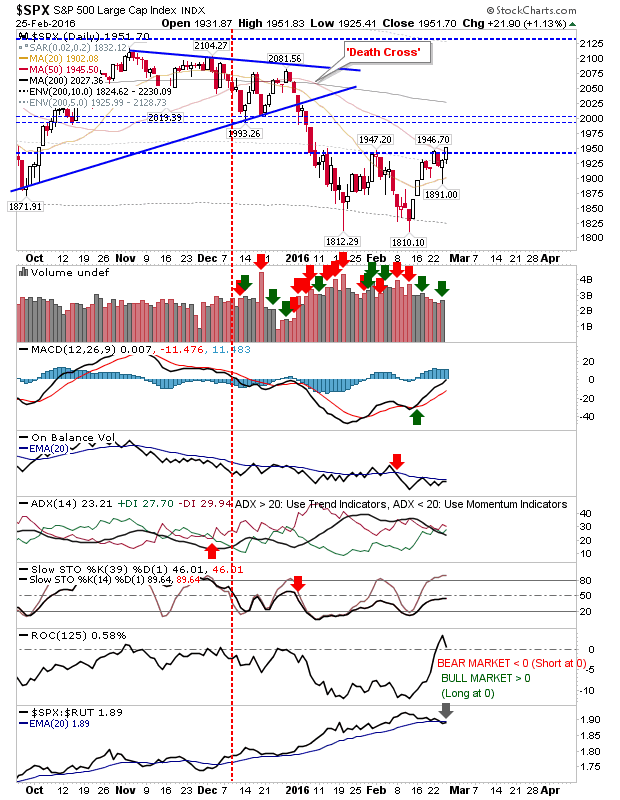

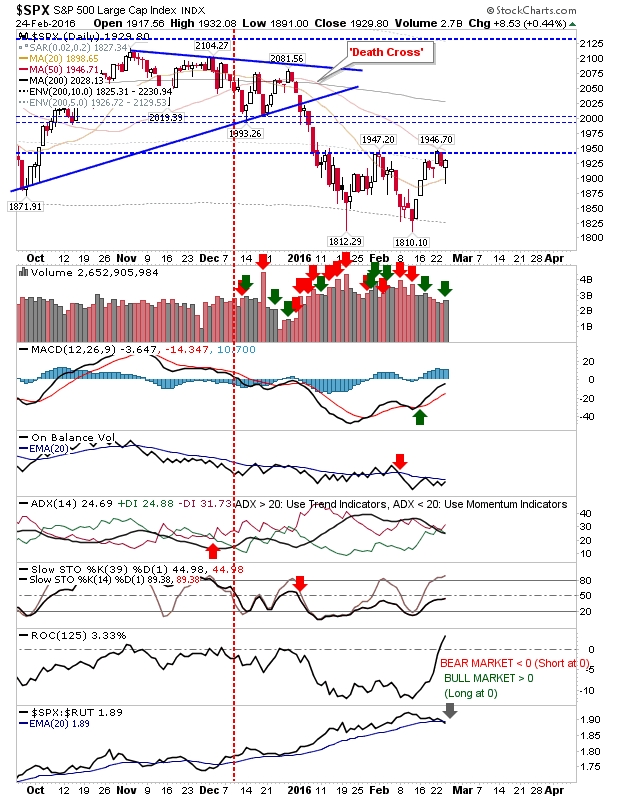

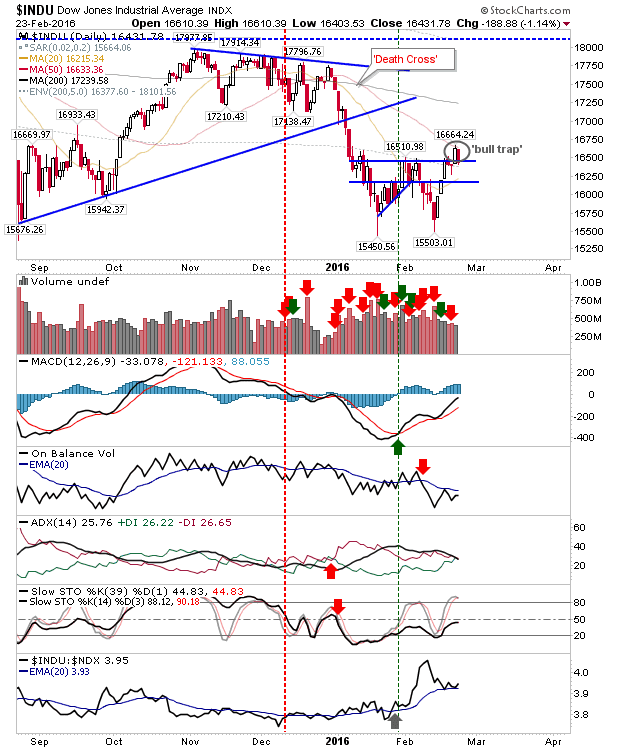

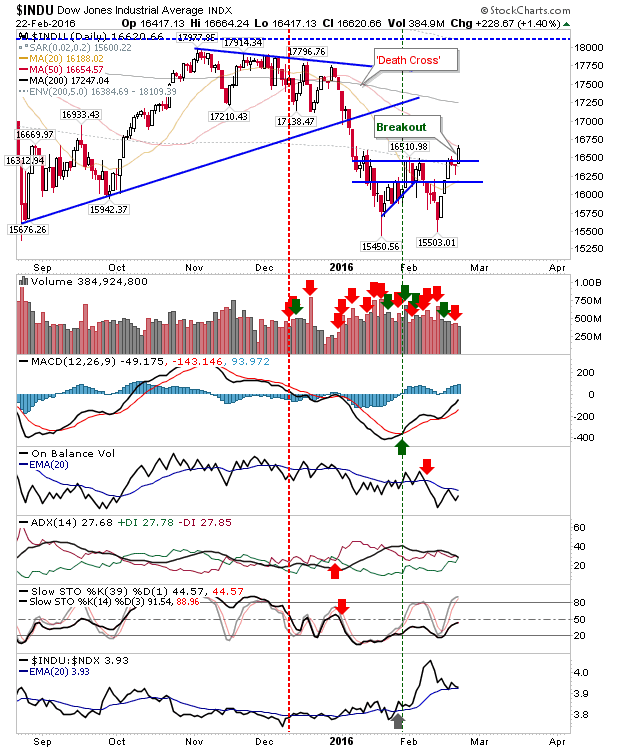

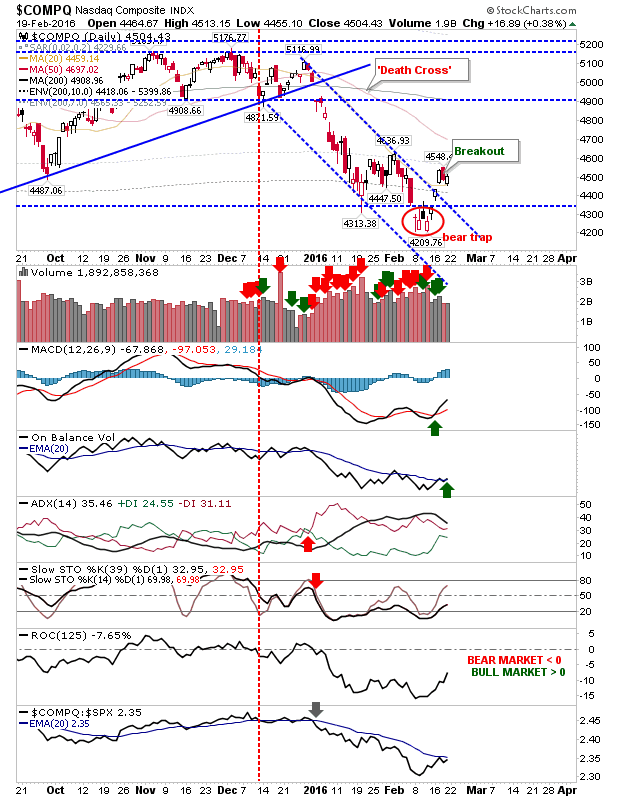

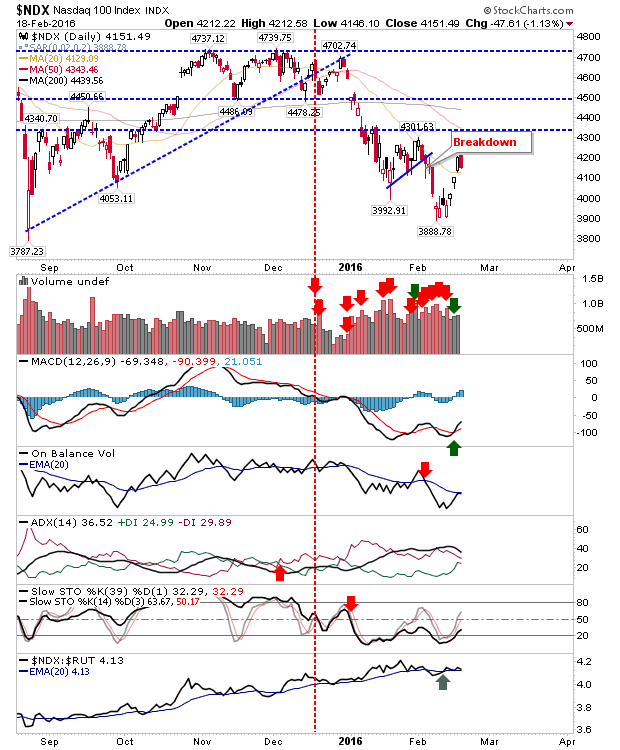

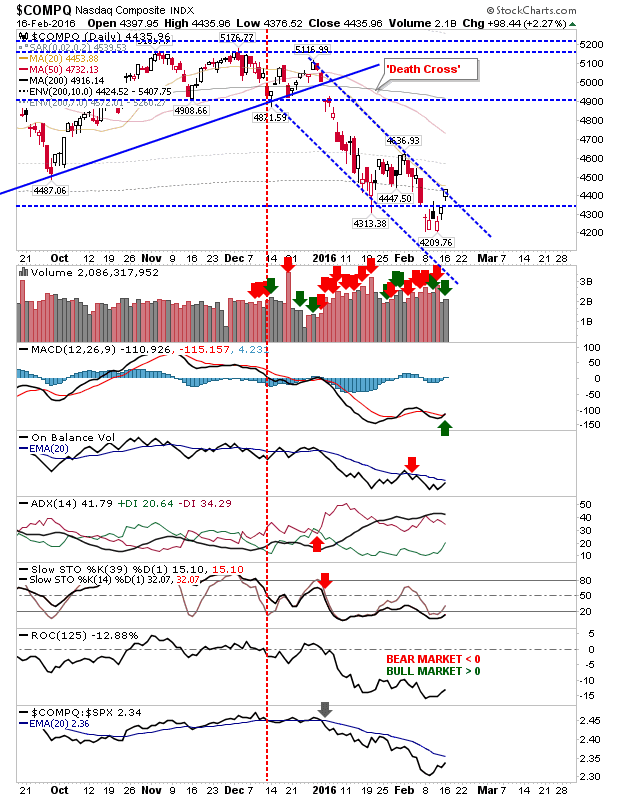

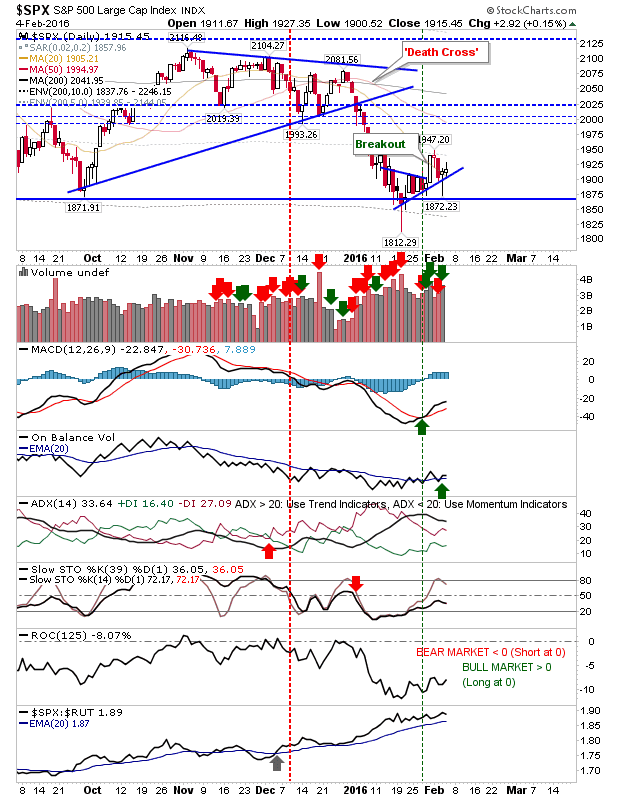

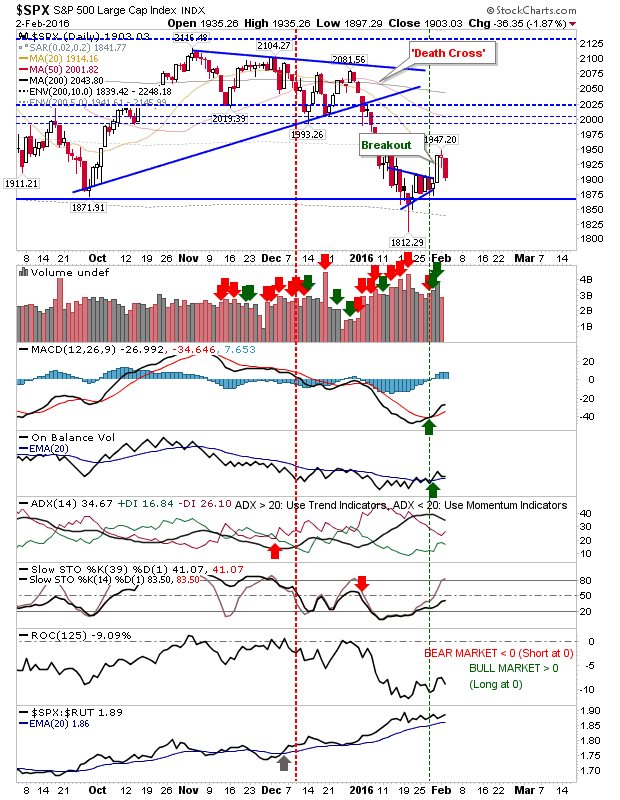

A third solid day of bullish action has built up the potential for market double bottoms. Selling from here will be treated as a pullback rather than a drop into the abyss. For the S&P, volume picked up to register as accumulation. A test of 1,940 will be interesting - watch for this tomorrow. On-Balance-Volume is close to a 'buy' trigger, to support the earlier signal in the MACD. The Nasdaq broke resistance of the declining channel. A push to the 50-day MA at 4,722 is the next target. The push below 4,350 left a 'bear trap', so any weakness will want to hold on to former resistance, turned support at 4,350. On-Balance-Volume marks the breakout with a 'buy' trigger. The Russell 2000 was not the same high flyer as Large Caps, which was a little disappointing, but the index was able to push itself back inside the prior consolidation. The Dow might be the index to confirm a double bottom. It closed today right on the neckline. Watch for ...