Quick Update: Bulls Need This Rally To Work

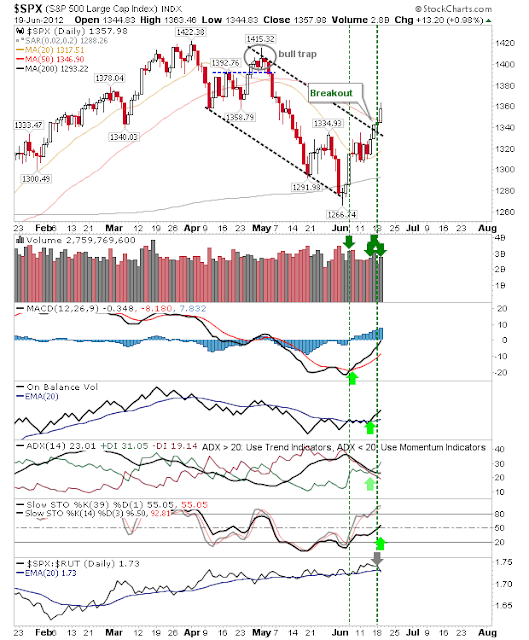

It's an important time for bulls to work their magic. Markets are still vulnerable and Blain over at StocktradingToGo has a chart for the S&P which neatly shows the challenges bulls have to overcome if something more dramatic to the downside isn't going to emerge. I have repeated the key elements here. In effect, for the S&P, bulls have to hold rising channel support and comfortably clear 1,360 if it's going to offer sideline money the confidence to step in and buy. Today has offered a good start, but there is still more to do. Have a great weekend! --- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboa...