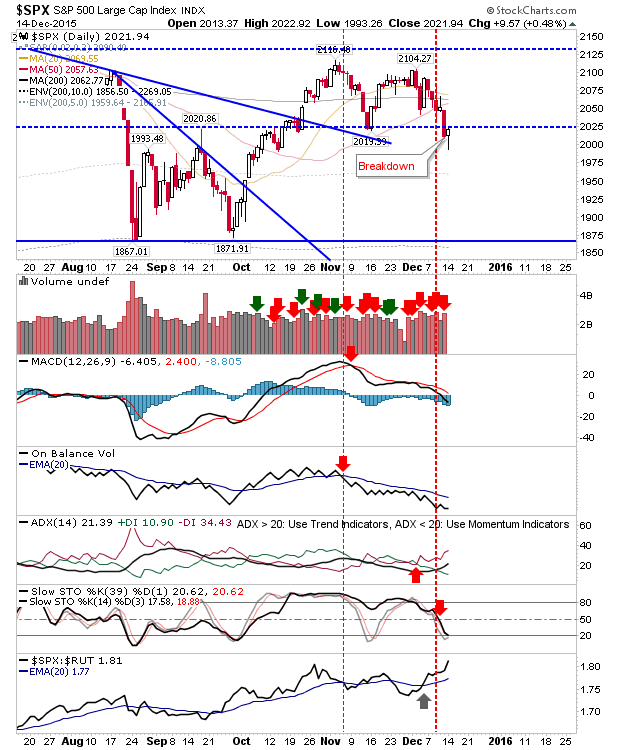

Big Volume Distribution

Things will be cooling down a little heading into the Christmas break, but Friday offered bears a huge boost with significant distribution and technical reversals. Few indices escaped the selling. The Nasdaq lost rising support, and undercut its 200-day MA in a ,move to set to challenge the swing lows of November and December. The 4,900 level is a critical level for the trading range as a loss of this would open up for a retest of the August/October swing lows.