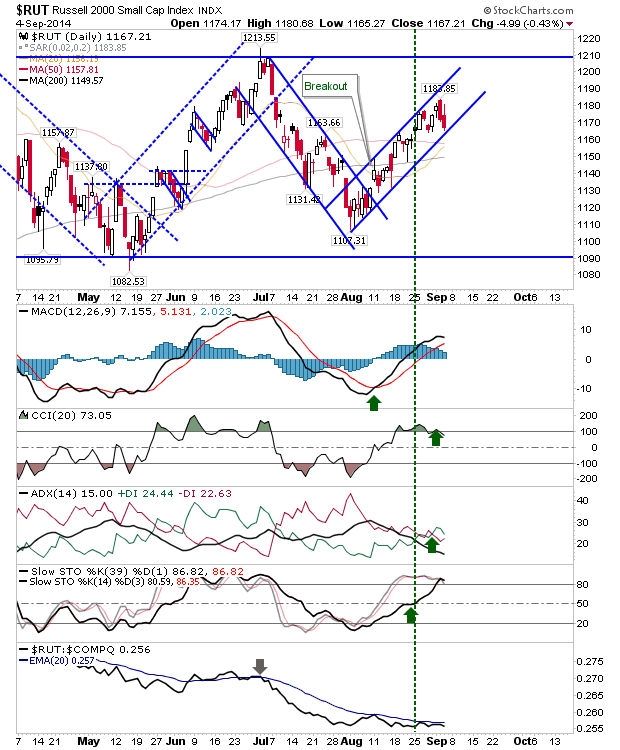

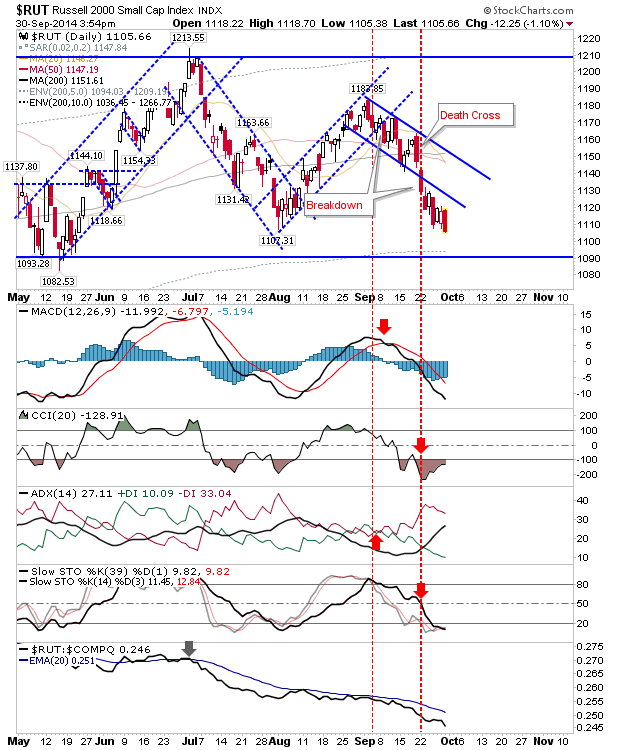

Small Caps take the brunt of selling

The aversion to risk continued with Small Caps edging a break below the July swing low on a loss of nearly 1.5%. However, the larger trading range is intact until 1,090 is lost. The 200-day MA is also nearby to lend support. As for today's action, more selling is favored for tomorrow, although action in other indices isn't pointing so bearish.