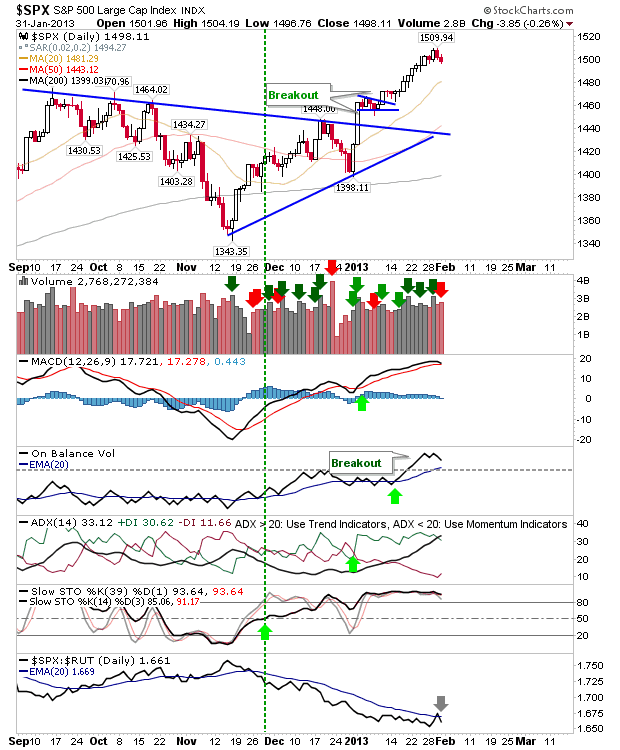

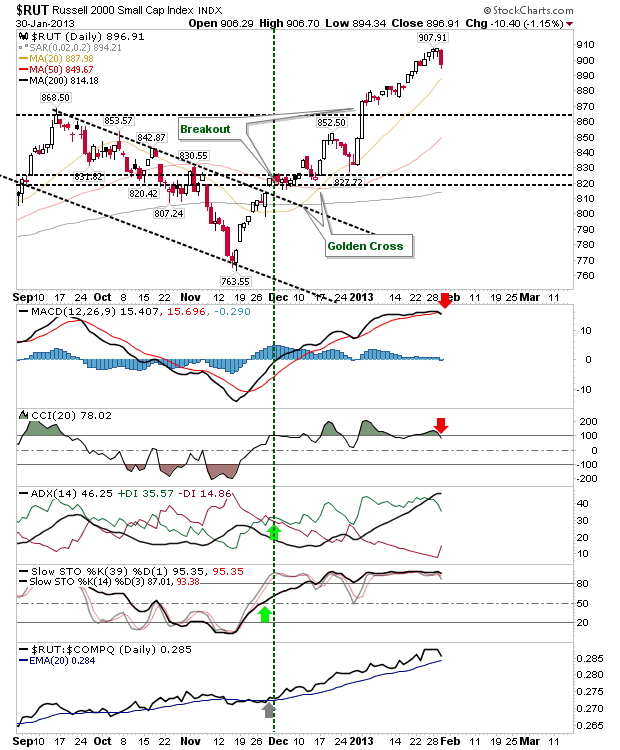

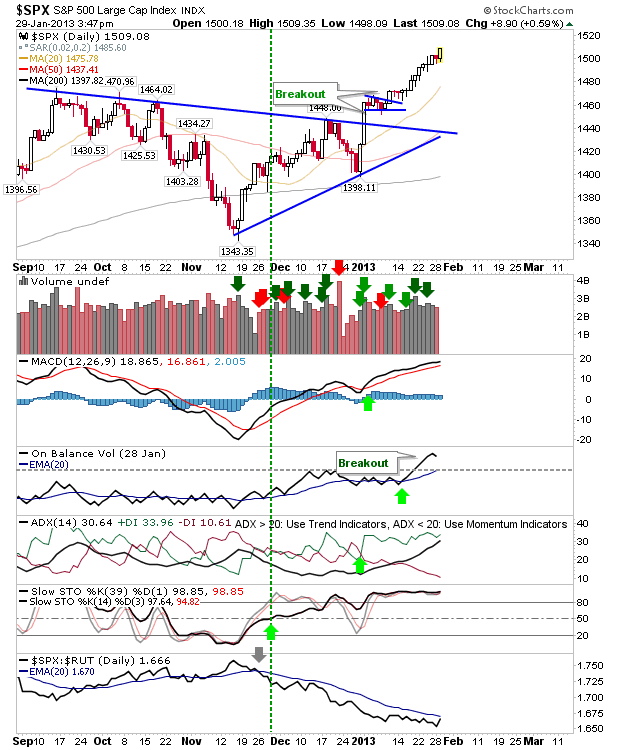

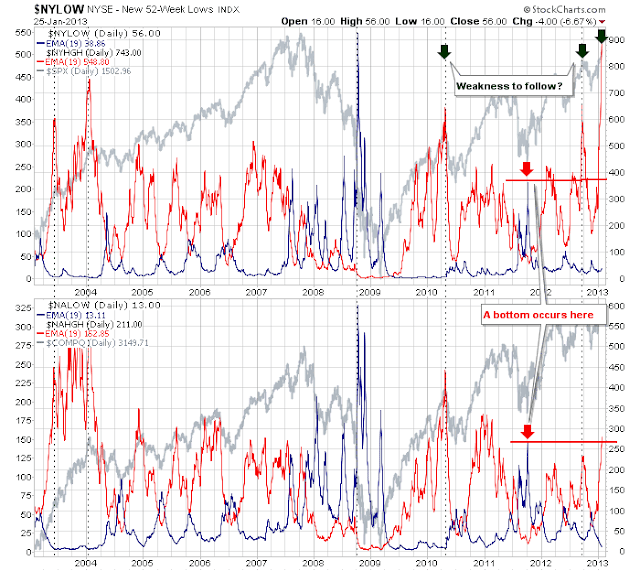

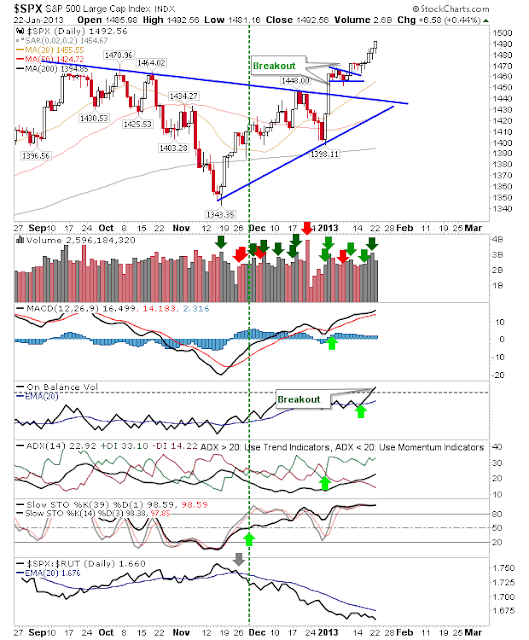

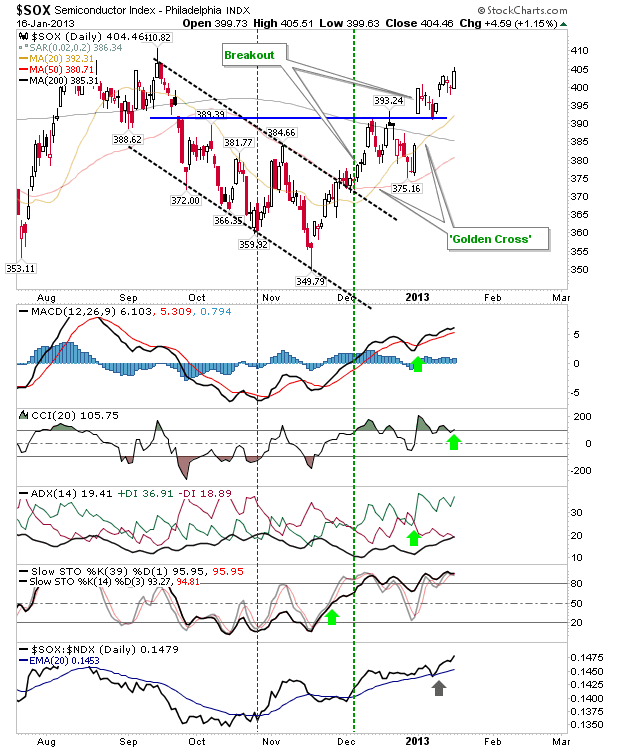

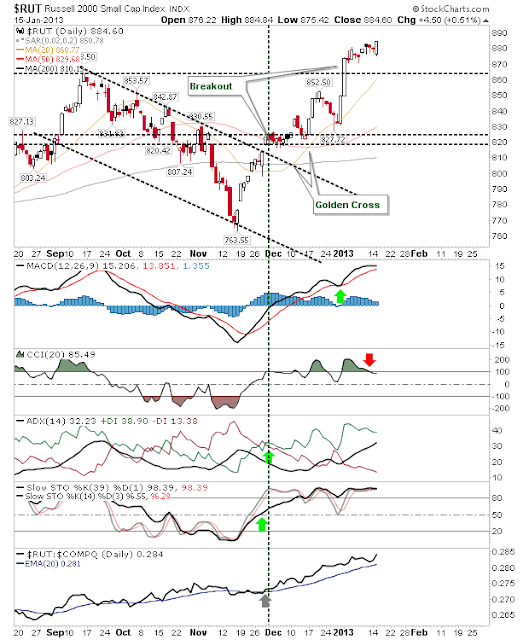

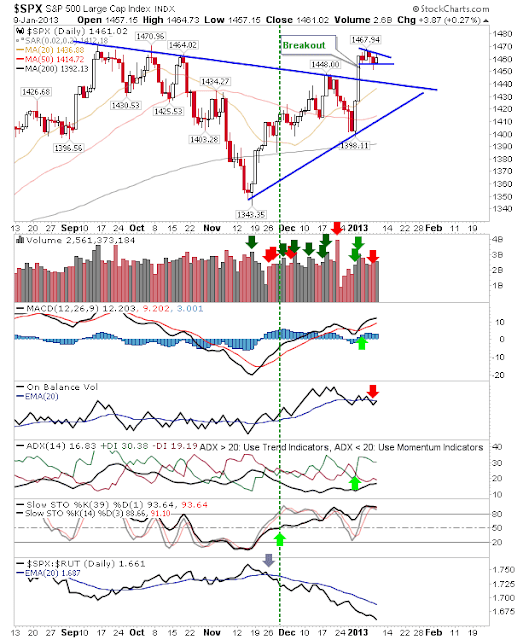

While recent action has focused on Small Caps, it has been the semiconductor index which has quietly advanced in recent days. Today was a solid day for the semiconductor index, gaining over 1% as it fast approaches September's high. The gain is also good news for the Nasdaq and Nasdaq 100, given how the rally in the Russell 2000 has stalled somewhat. For example, the Nasdaq 100 is holding on to its breakout gap. The 20-day MA is also fast approaching and in a position to lend support. However, On-Balance-Volume is still trending lower in a path of distribution, but a few days of heavy volume buying could reverse this trend. The Nasdaq also has a consolidation to break from and a breakout gap to defend. Unlike the Nasdaq 100, it enjoyed a 'Golden Cross' between 200-day MA and 50-day MA, an important long term bullish trigger. The S&P spent another day preparing to break higher, but so far it hasn't done it, despite a higher volume accumulation day. ...