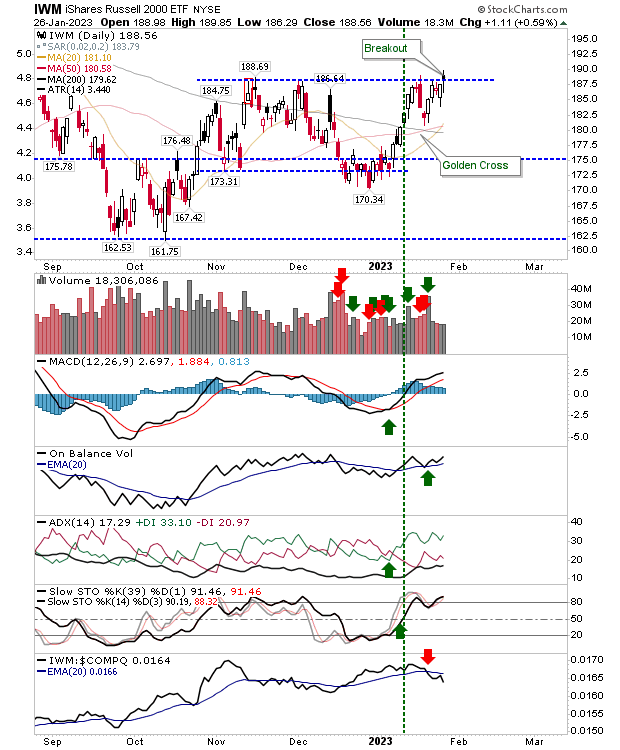

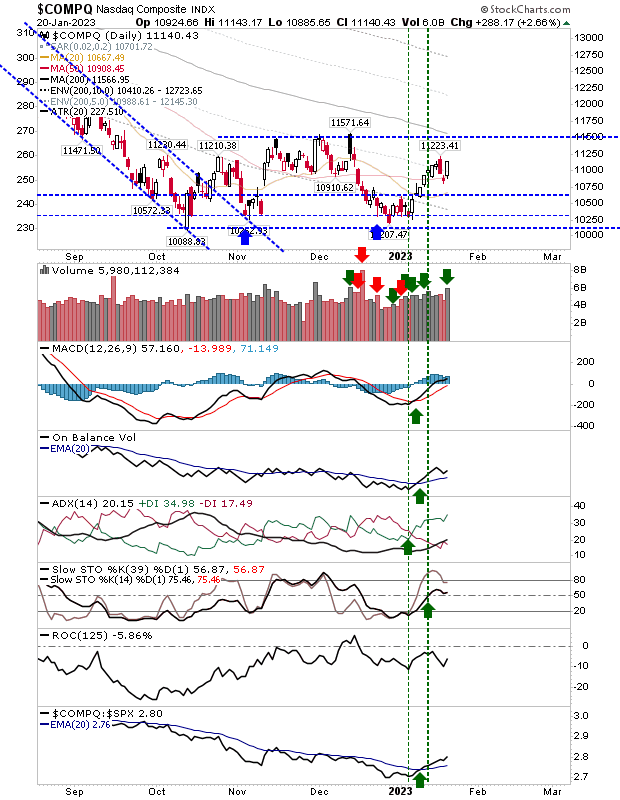

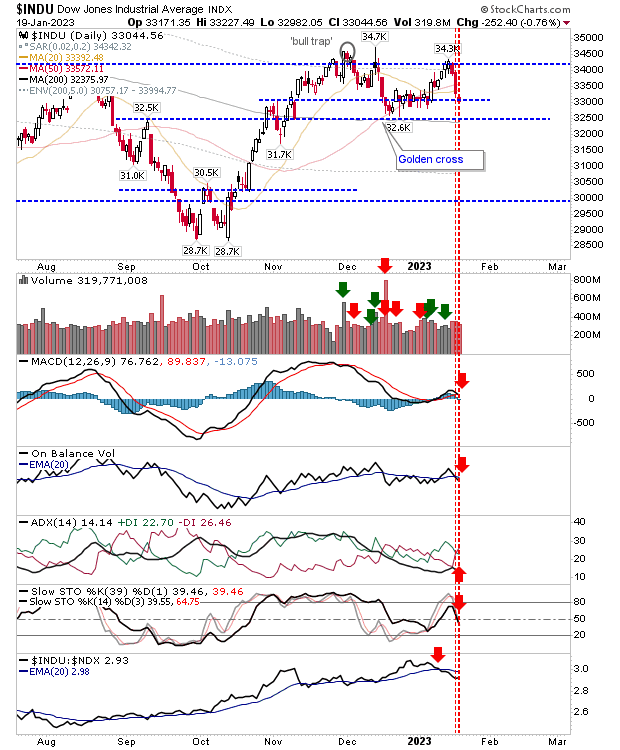

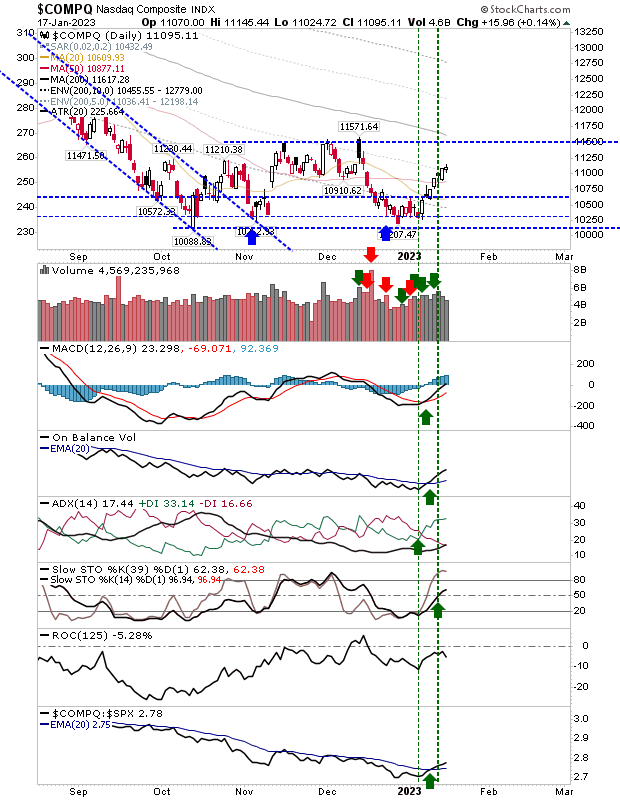

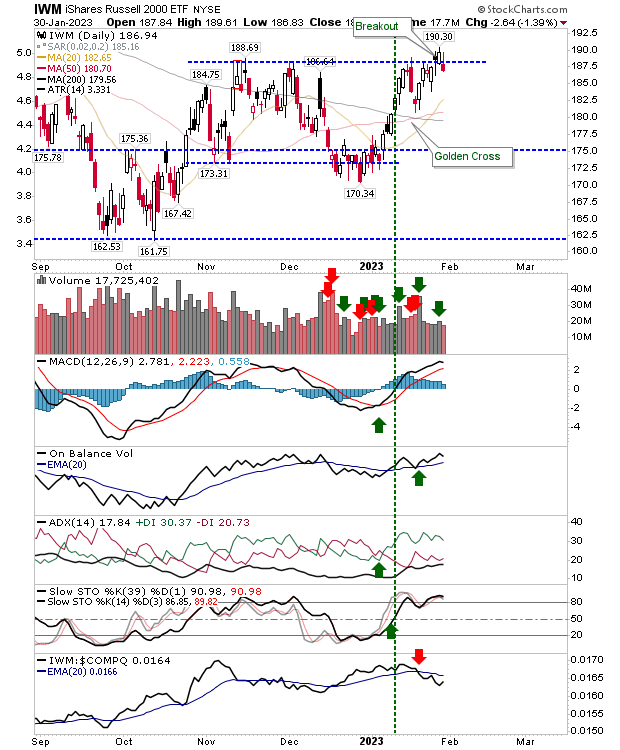

'Bull traps' threaten Nasdaq and Russell 2000

What goes up may come down, or at least, the nascent breakouts in the Nasdaq and Russell 2000 now find themselves on the wrong side of support. It hasn't been a total collapse, selling volume was down on Friday's buying, and the potential for a recovery is quite high. But for this to happen, sellers can't be allowed to build up any momentum. As things stand, the Nasdaq and Russell 2000 now find themselves back inside the prior consolidation. The Russell 2000 is underpeforming the Nasdaq, so it's the most vulnerable to further selling. Even if the 'bull trap' is confirmed, I would still look for the potential of the 20-day MA to play as support.