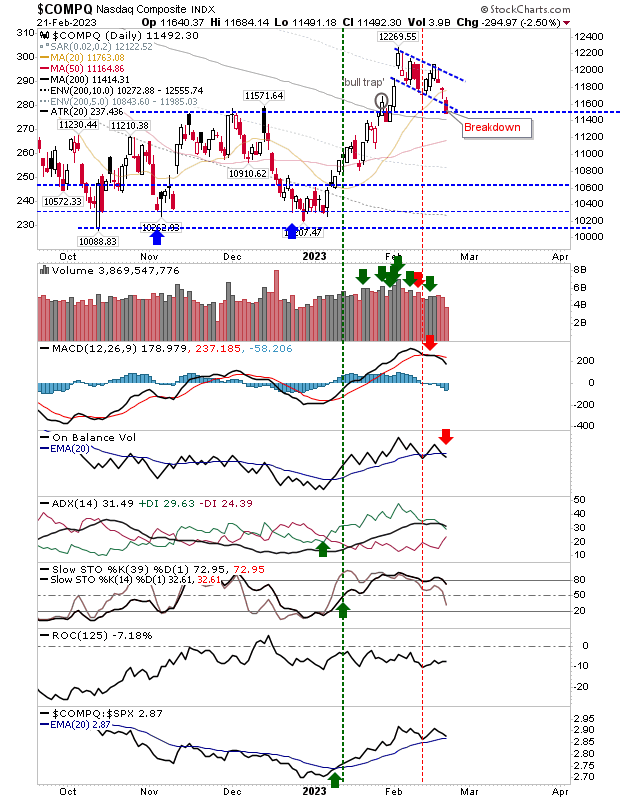

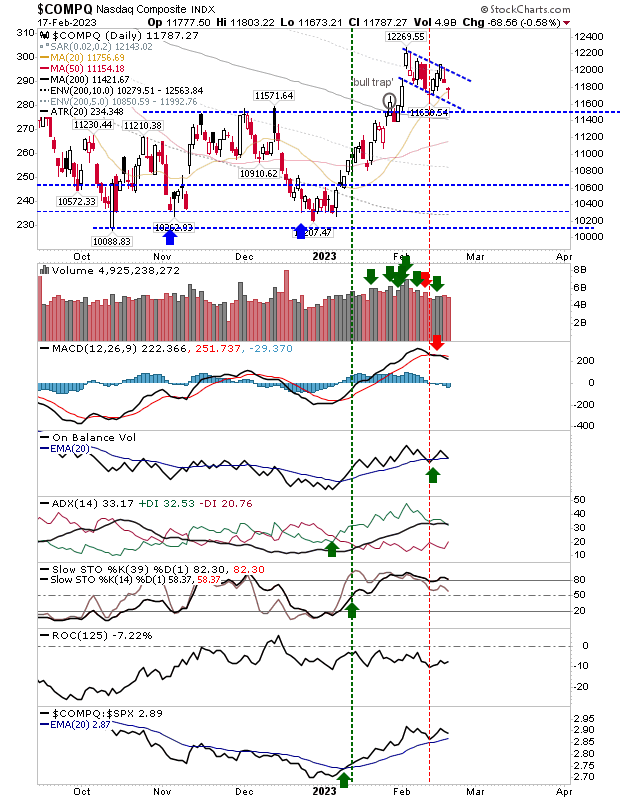

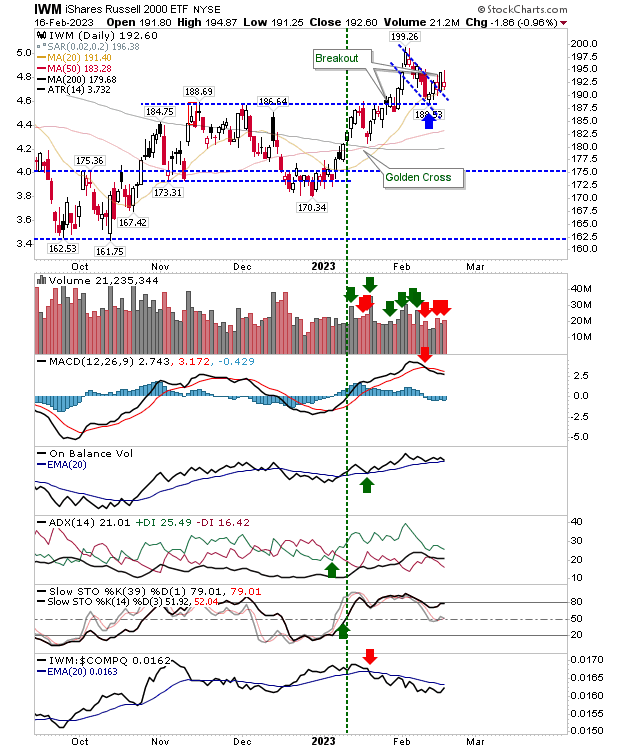

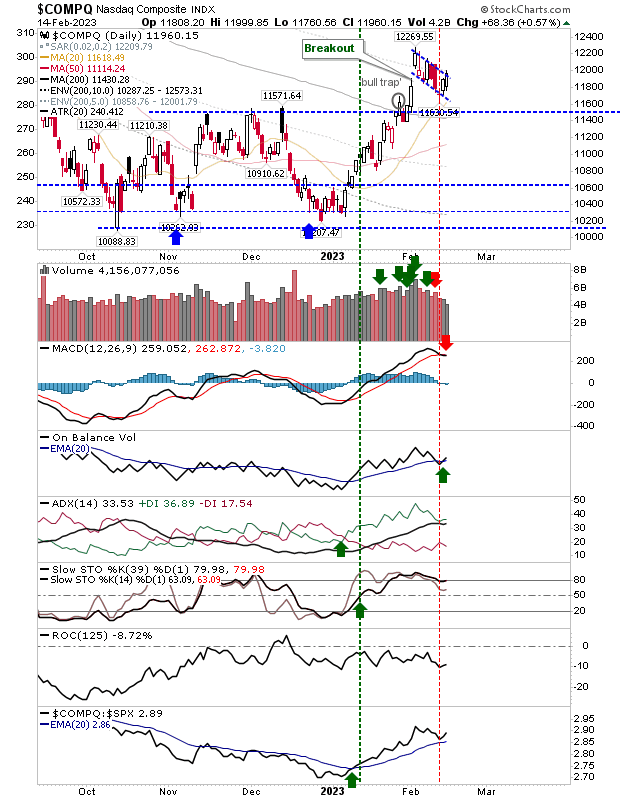

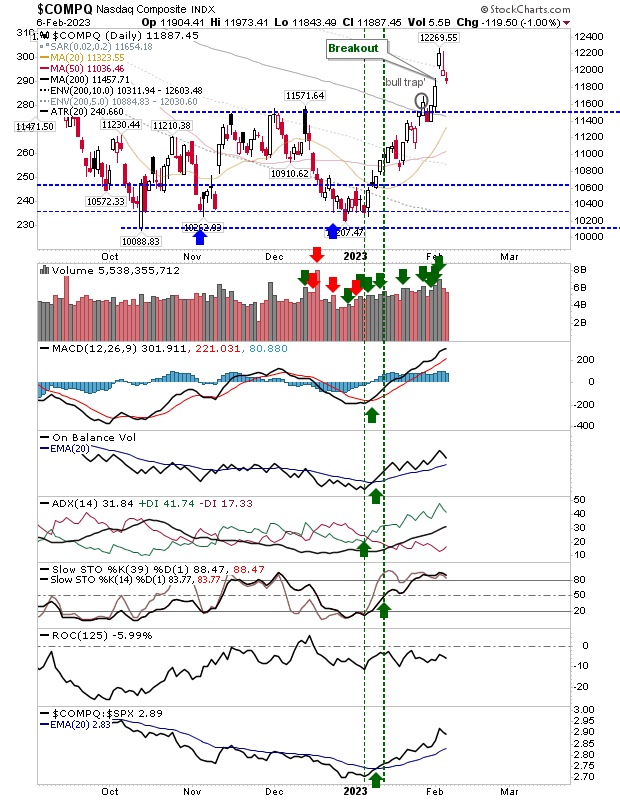

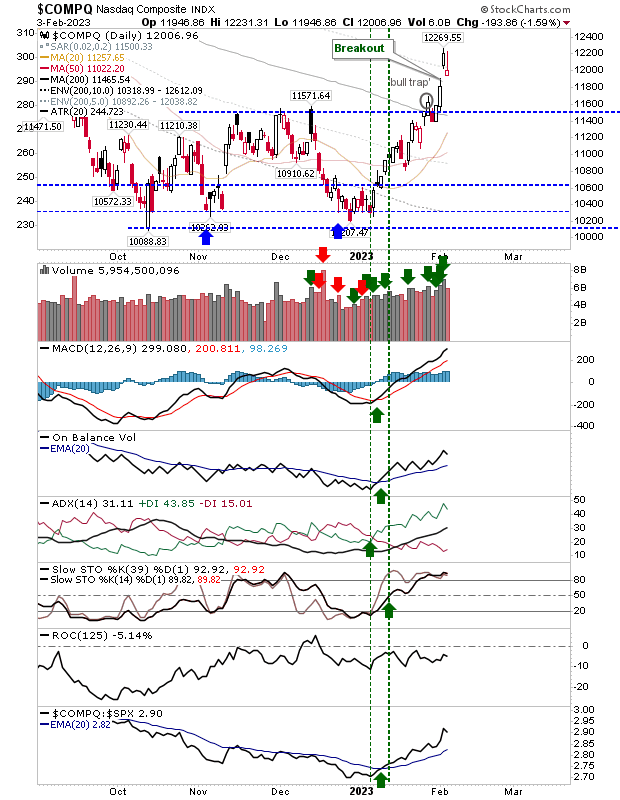

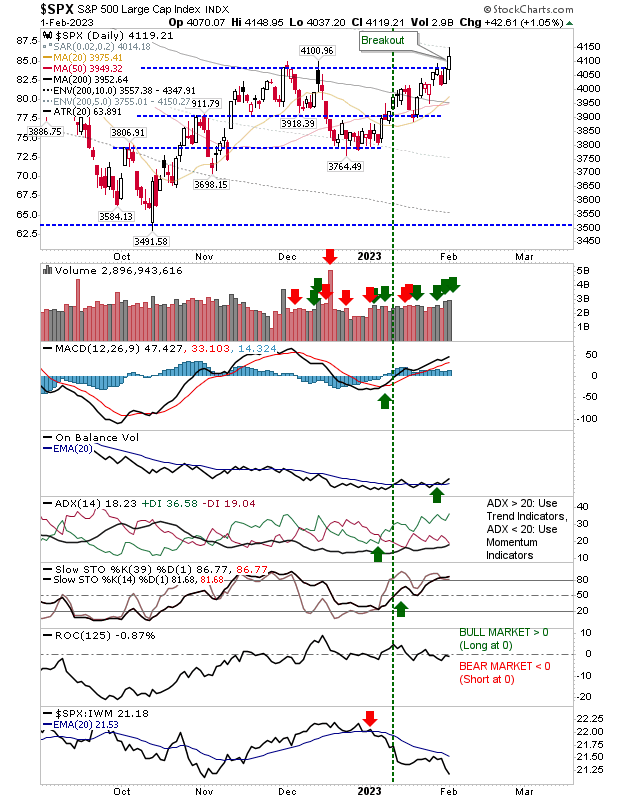

Eesh, today's bearish candlesticks are a problem

I don't like seeing 'black' candlesticks as they reflect a failure of opening strength, and today was one of those days. 'Black' candlesticks are more of a problem at the end of the rally than at the start, but if we see a gap down tomorrow there won't be much support to lean on. The S&P and Nasdaq might yet see another test of the 200-day MA tomorrow. However, if there is a close above today's high, the bearishness of the 'black' candlesticks is negated.