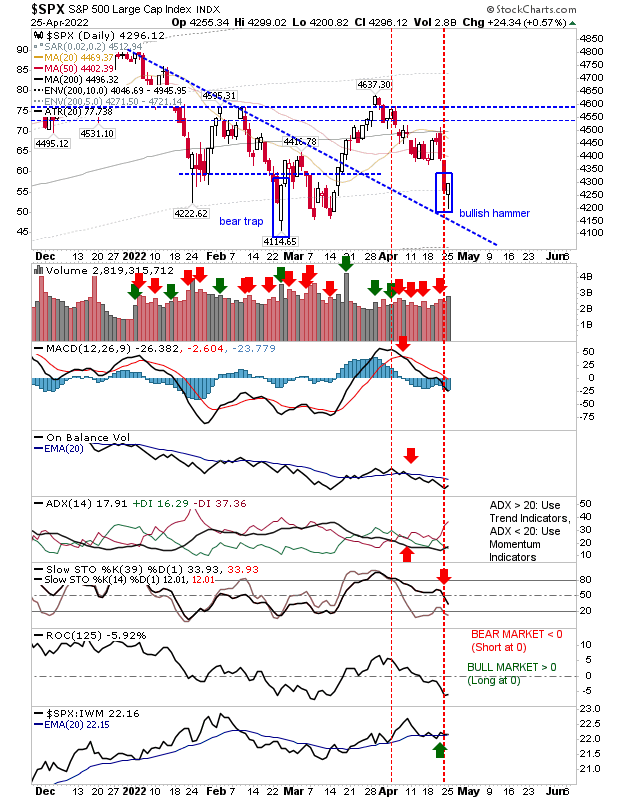

A last chance saloon for indices

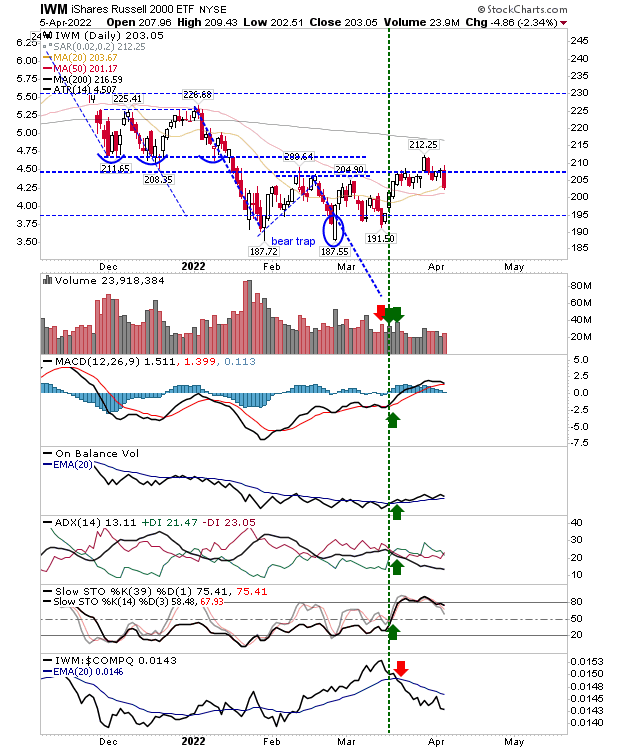

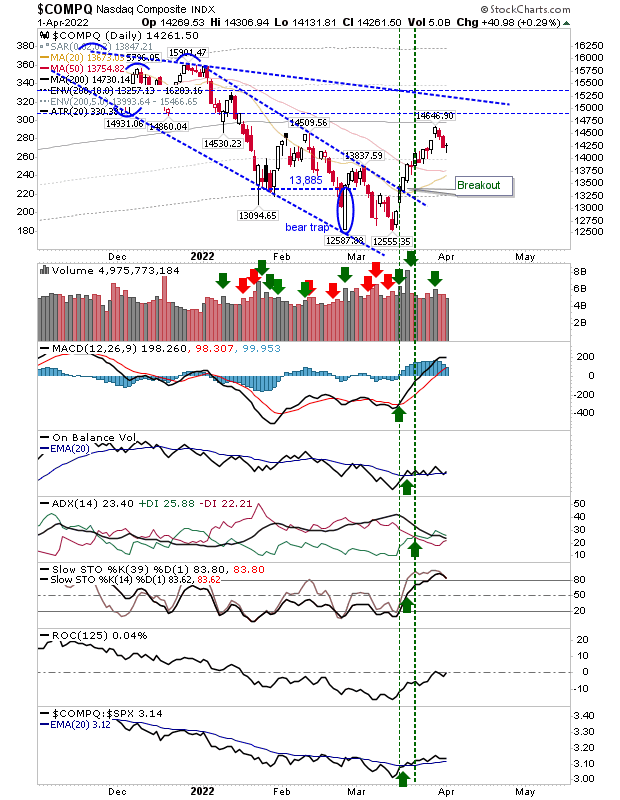

The Monday reversal wasn't enough to light a fire under bulls as sellers quickly returned to reverse all of that gain. Indices are now left with just the lows of February to hang on too, but even that is under pressure for the Russell 2000. The Russell 2000 had looked like it was going to lead a recovery when it broke out of its base in March, but the resulting 'bull trap' did what most 'bull traps' do and reversed all the way back to the lows of the base and then break support. Technicals are net bearish but momentum is at least oversold - although price crashes occur from an oversold condition. Because we have a test of support there is a buying opportunity, but keep the stop tight.