Weekly Review of Stockcharts.com Publisher Charts

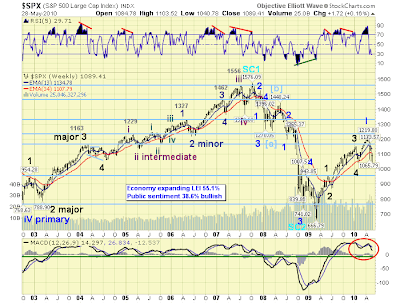

Another exciting week goes by; but has anyone the edge? Anthony V Caldaro of http://objectiveelliottwave.com / has checked this week; noting the bearish divergence in the MACD, but not changing any of his prior wave counts. Richard Lehman of TrendChannelMagic.com points towards a flat consolidation, but worries if the mild rally doesn't make it up to larger channel resistance c1,120 for the S&P. 5/28 --Even with Thursday's huge advance, the week's action shows flatter short term upchannels than were first indicated. There are still a couple of different angles possible, but they are relatively flat and may alllow more weakness early next week before rising again. If the Dow is going to get to 10,500 and the SPX to 1120, it will now take longer at this angle (i.e. most of next week). If the indexes reverse before even reaching the upper green channel lines, it will be rather negative, as it may suggest that the green channel is accelerating downward. S...