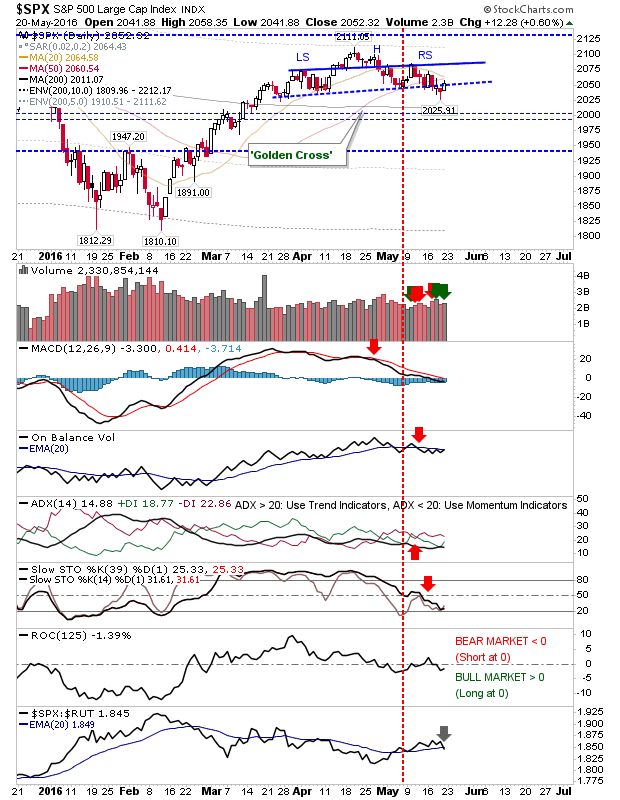

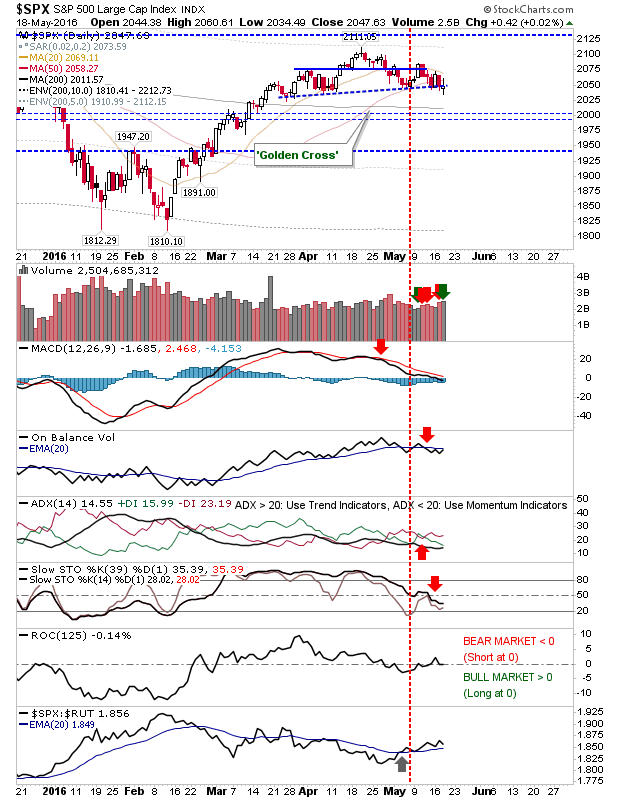

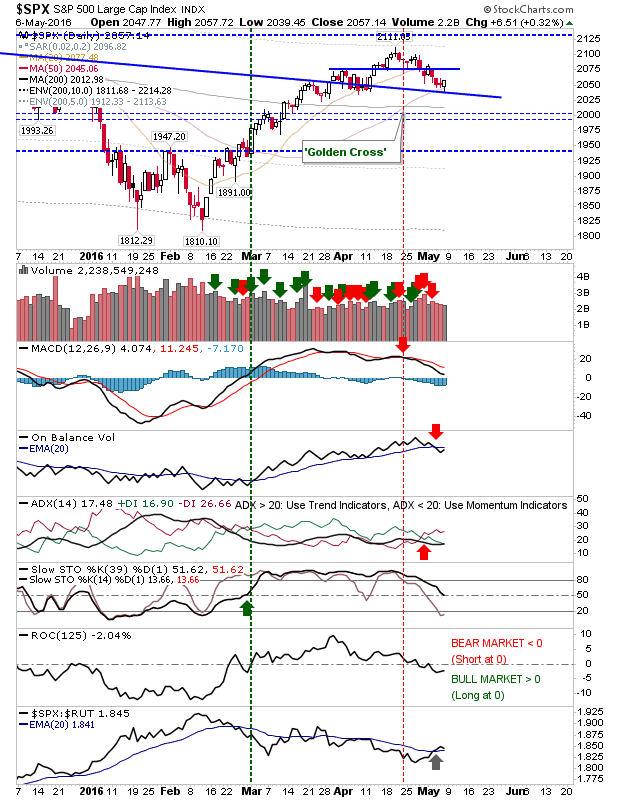

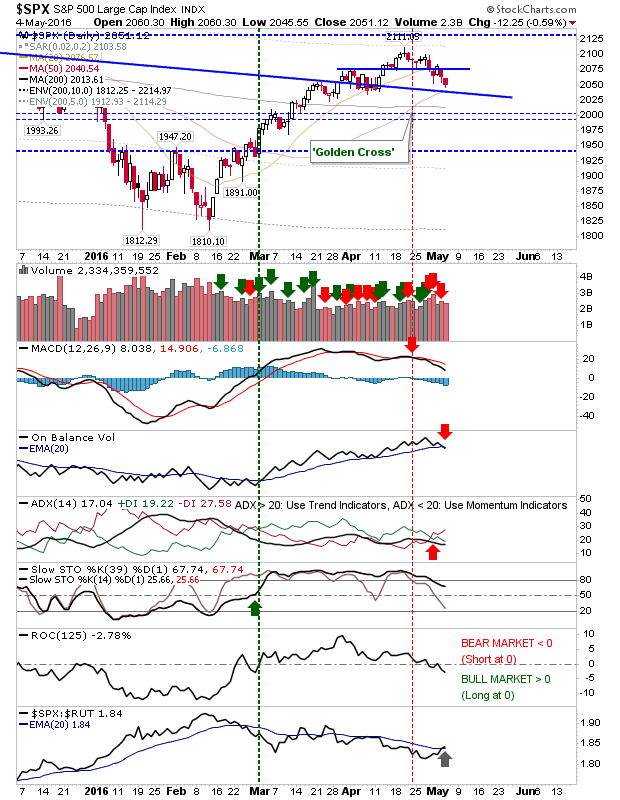

Pause in Advance

With indices knocking on the door of new highs for 2016 it was of new surprise to see some profit taking. The S&P has struggled when it gets to 2,100, but each run at this resistance level weakens its importance as resistance. I have left the marker for the head-and-shoulder reversal, but a close above 2,111 will negate it.