Stock Market Commentary: Further Gains

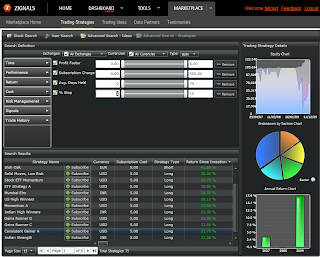

This will likely be the last post for 2009 as Christmas fast approaches. Markets added to yesterday's gains although large caps continued to struggle; maybe the S&P pushed a modest breakout? But volume was less than yesterday: Of sentiment indicators, the percentage of Nasdaq stocks above the 50-day MA gained upward momentum but it still is someway from September highs: Looks like markets want to maintain bullish momentum into the end-of-year. Unless something dramatic happens during the intervening period I don't expect much reaction until January. Have a great rest of 2009! Dr. Declan Fallon, Senior Market Technician, Zignals.com . November 2009 has seen a significant upgrade and is on course to becoming the eBay of finance with our new Beta MarketPlace and a new rich internet application for finance, the Zignals Dashboard . Zignals now has new fundamental stock alerts , stock charts for Indian, Australian, Frankfurt and soon Canadian stocks, tabbed stock list watchli...