Brexit Reaction

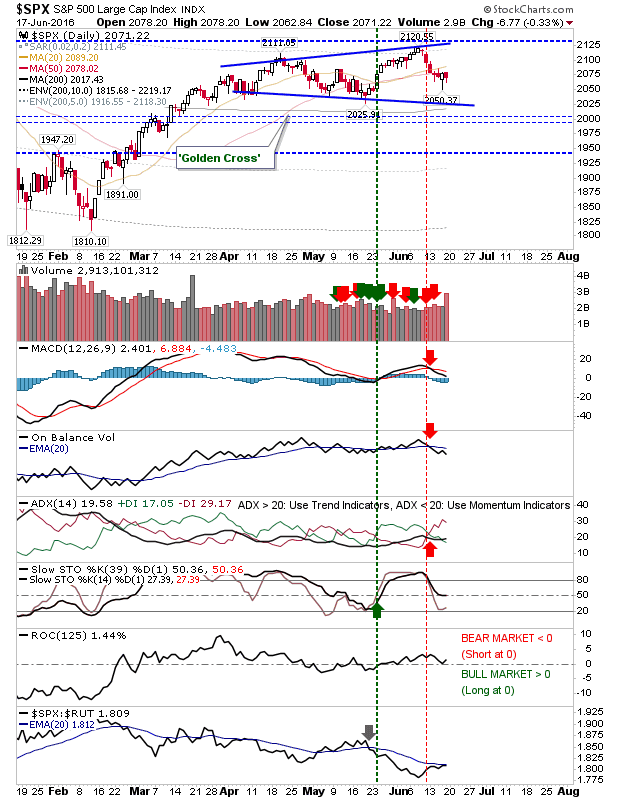

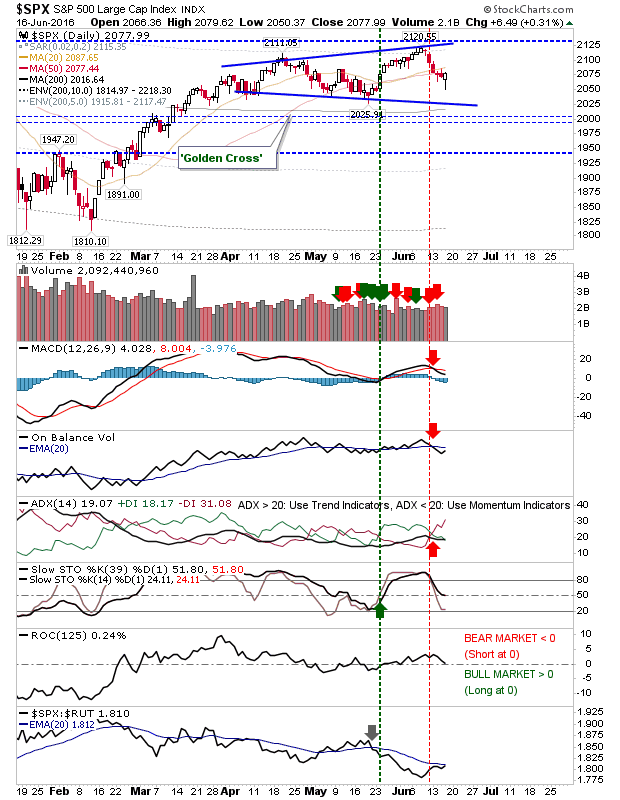

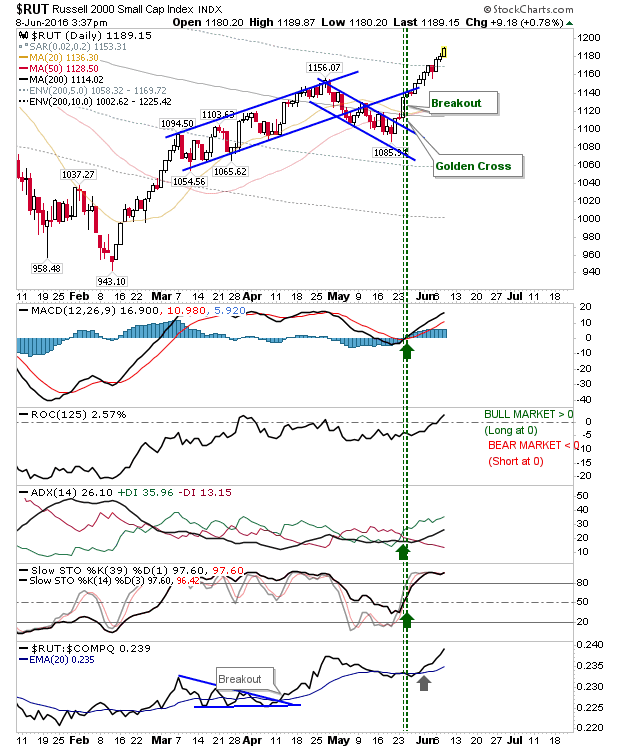

Typical, it always feels like markets make major moves while I'm away. So, in brief: [1] Markets (and more reliable forecast/betting markets) got the Brexit vote horribly wrong and it's going to be a long (long) time before market confidence returns: Broken Leave promises, broken Conservative and Labour parties, a leaderless British government, a half-in/half-out Brexit with article 50 still to be administered, the Scottish/Northern Ireland problem, an EU which will look to throw the UK under the bus etc etc. There are lots of questions to be answered before markets could consider breaking May highs (when markets had priced for a status quo vote). [2] What does this mean for Europe as a whole, or more pressing, the U.S. election? A Trump victory got a boost with the U.K. populist vote. Imagine how markets will react if Trump does win the November election... [3] The weekly charts had been consistent in forecasting long term weakness. I had highlighted this here if you...