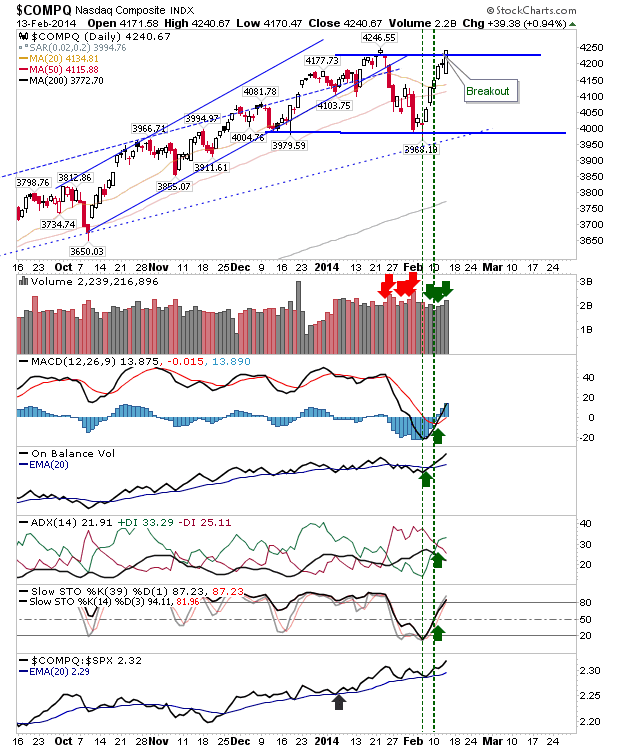

Daily Market Commentary: Nasdaq Breadth Strengthens

Very little change in the markets, but there was a net bullish turn in technicals for Nasdaq breadth metrics. The Nasdaq Summation Index is in a clear advance and is on course to reach an overbought state. This breadth metric is a good confirmation signal for swings in the parent index, and it's suggesting more upside. For the Nasdaq Summation Index to reach an overbought state, it would take another couple weeks of gains in the Nasdaq.