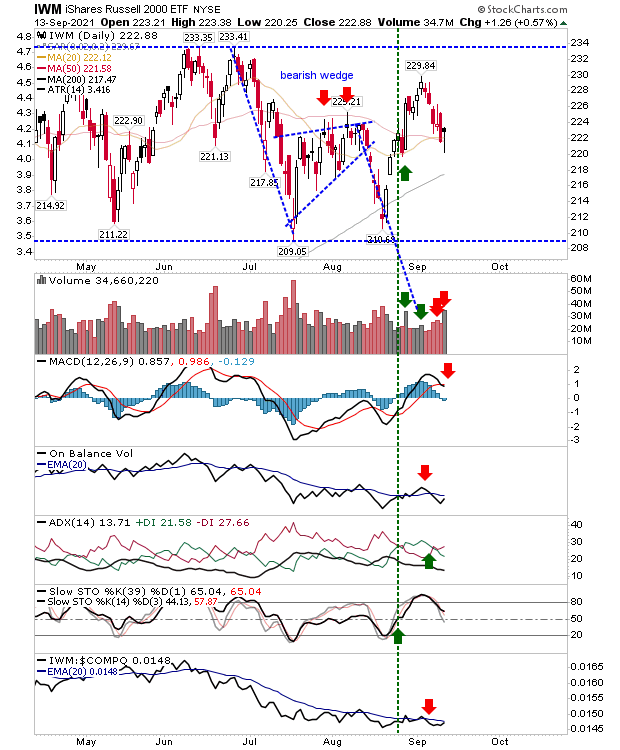

S&P pushes lower as Russell 2000 tags 200-day MA for a third time in two months

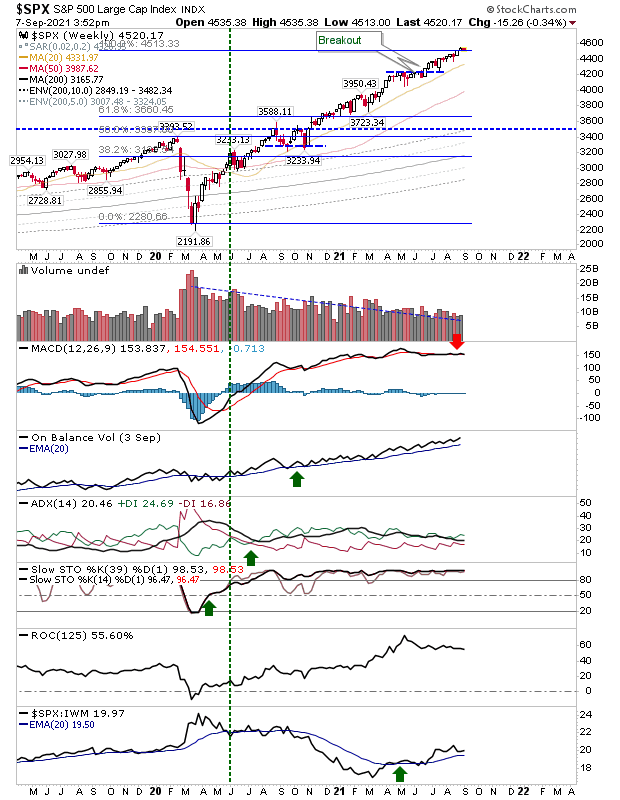

The S&P followed through on its continuation pattern by delivering a solid red candlestick lower. Those big red candlesticks have also come with bearish distribution. Next stop is the 200-day MA on net bearish technicals.