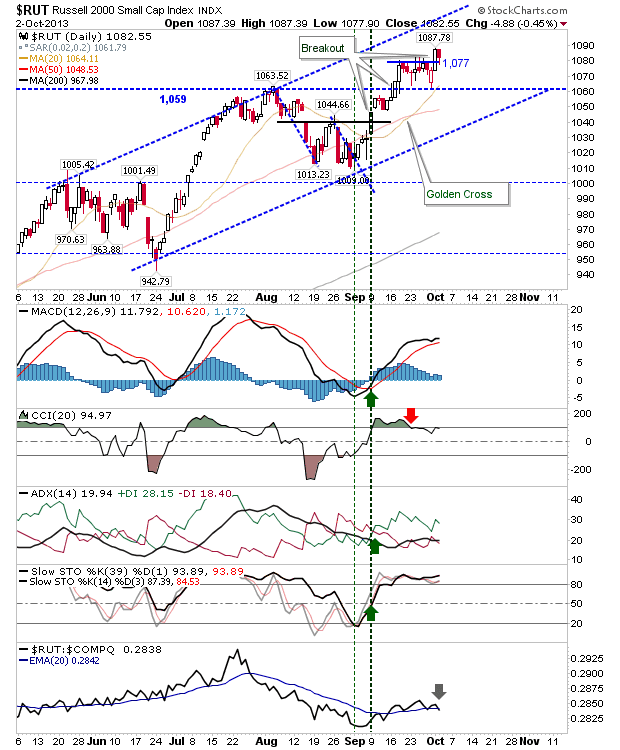

Daily Market Commentary: Bearish Engulfing Pattern in Russell 2000

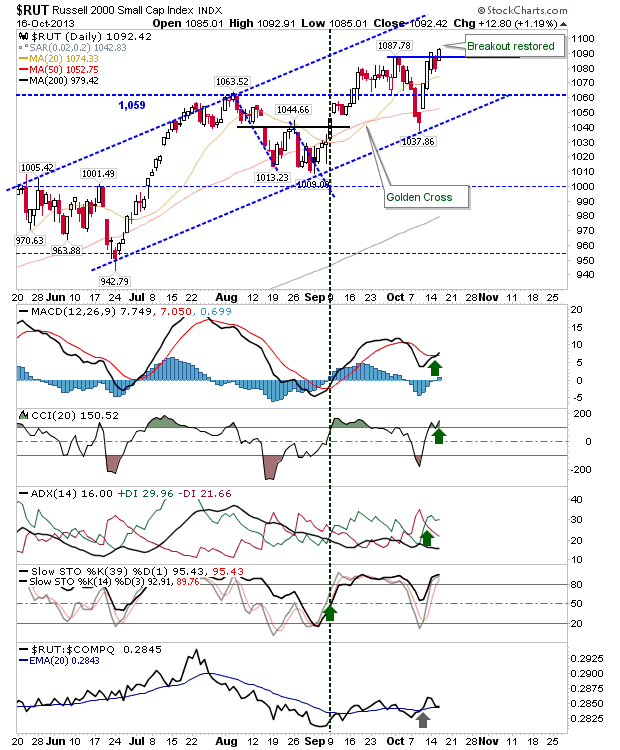

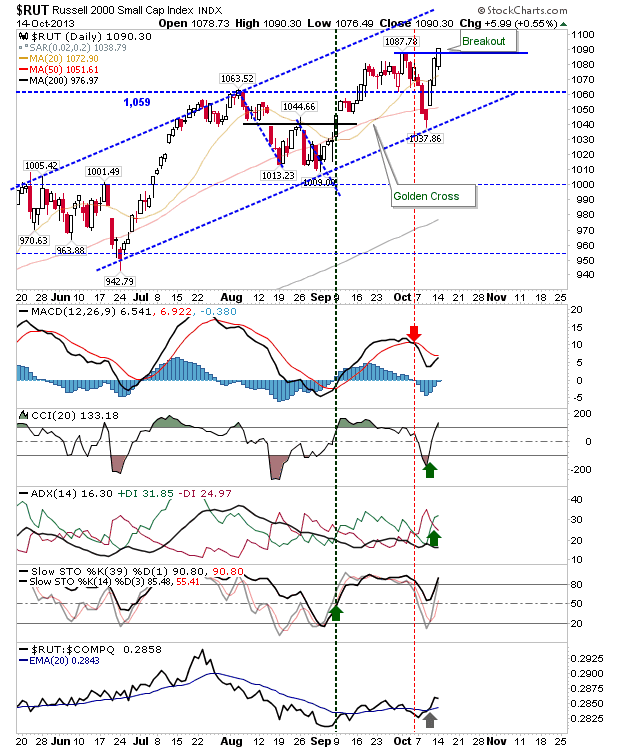

Small Caps took the biggest hit from sellers with a substantial bearish engulfing pattern (at least, relative to the last couple of weeks). The rally didn't make it to channel resistance, so it will be interesting to see how it does when it makes it back to its 20-day MA.