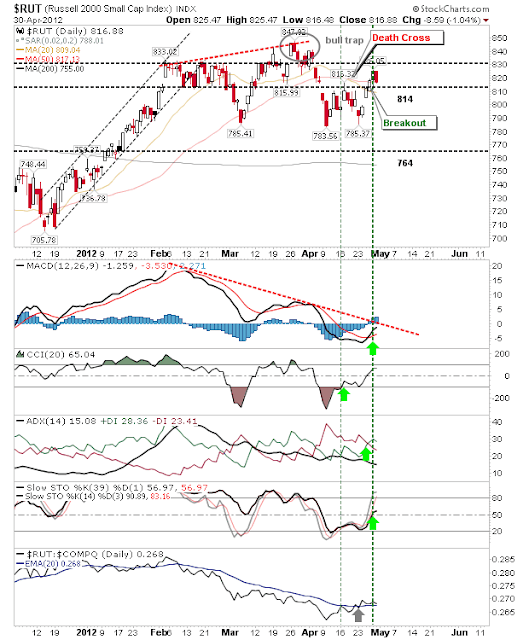

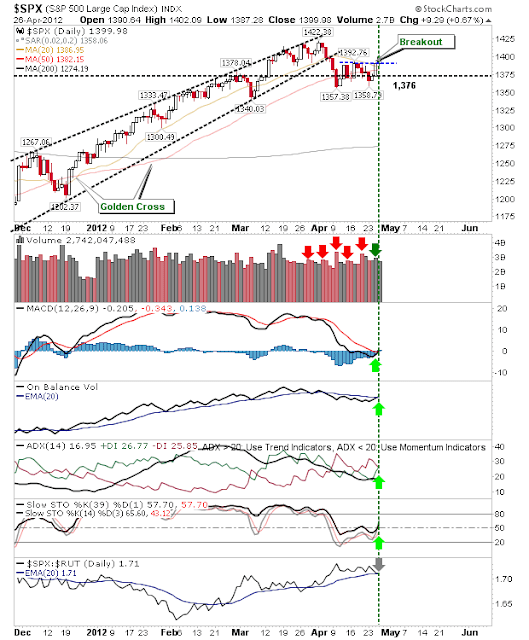

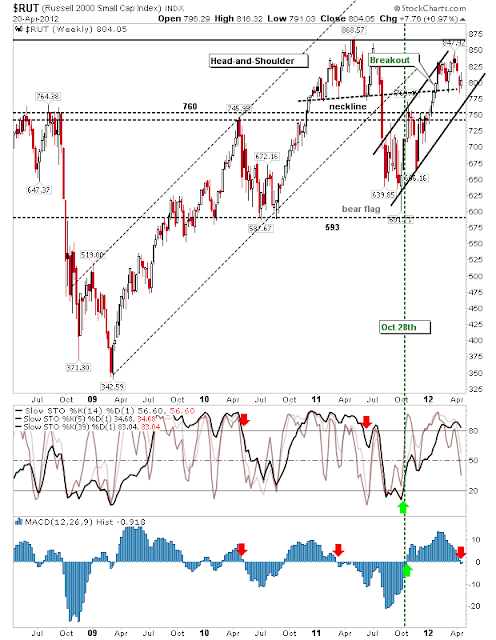

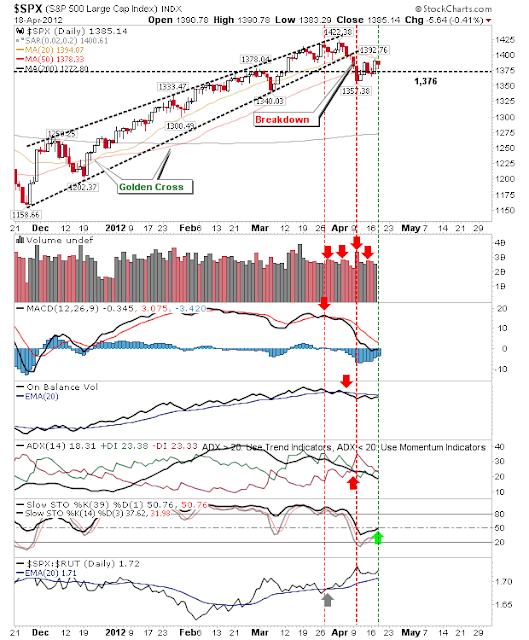

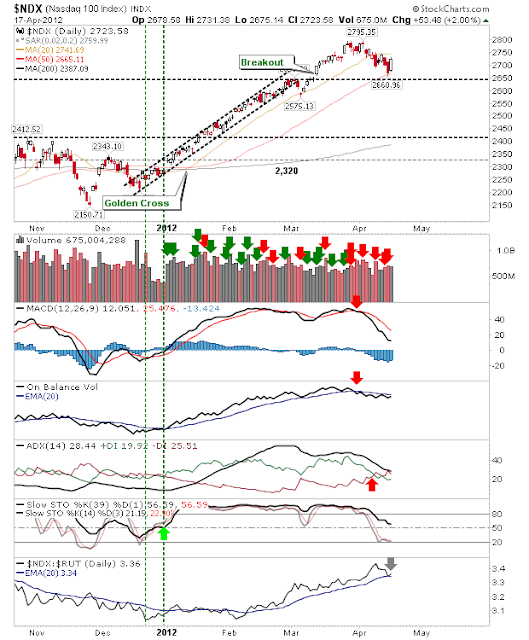

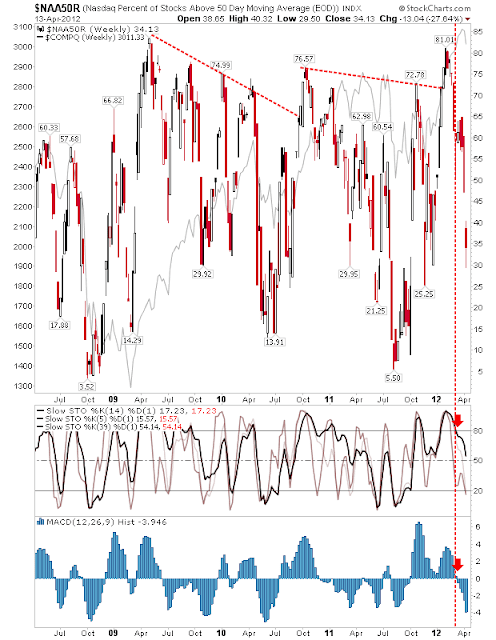

It has taken the best part of a month for markets to record an accumulation day, but today was one such day. Volume, while higher, was only marginally so; making it a relatively quiet day for anyone not trading Apple (AAPL). Despite the gain it was a tough market to trade given the bulk of the gains occurred pre-market. The S&P pushed far enough off its 50-day MA to close above its 20-day MA. It's nicely poised to challenge the 1,422 high and to push some of its negative technicals into positive territory. The Nasdaq was able to regain 3,000 support and finish above its 50-day MA, but it was left below its 20-day MA which may offer shorts something for Thursday. Technicals are weak, but not oversold. The Russell 2000 is also poised to challenge its March 'bull trap', although it still has to break above overhead 20-day and 50-day MAs. Tomorrow offers a good opportunity for some upside follow through on today's accumulation. Markets at or just...