Daily Market Commentary: Sellers Emerge

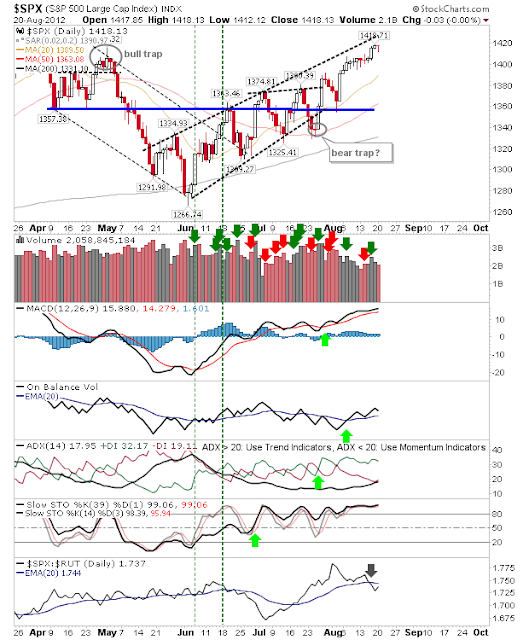

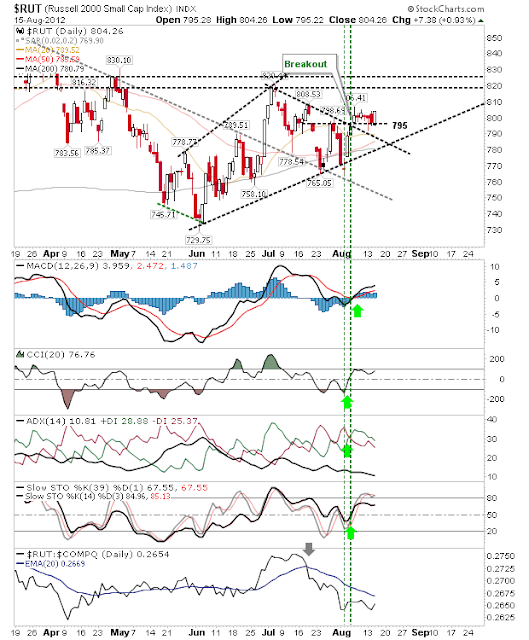

Today was a bit of a seller's tease. It was a clear win on the part of bears, but volume was light. Bernanke's comments tomorrow may inject the volume which was missing today. The most significant loss came in the semiconductor index. It had been loitering around 200-day MA / 396 support, both of which were lost today. It has fallen back to breakout support, which is a last line of defense before the 50-day MA. Technicals suggest there is more downside to come. Also hurting was the Russell 2000 as it reversed against resistance. However, it finished close to the 20-day MA with the 50-day MA and 795 support nearby. A further pullback - especially if it made it back to the angled trendline connecting the swing lows of June and July - could be an interesting long play for a push above 820. The Dow is offering one such trendline long play. The rising wedge is bearish, but if there is a bounce it should happen from Friday's open. But in the bearish cam...