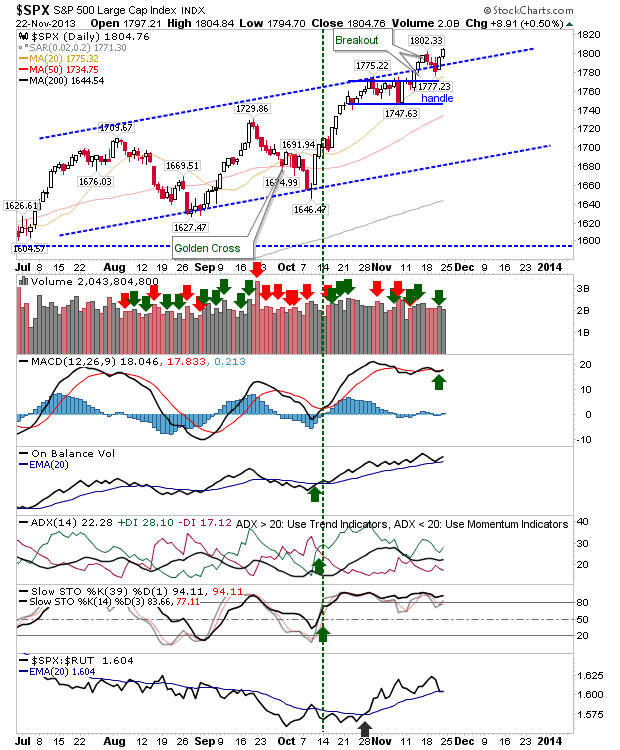

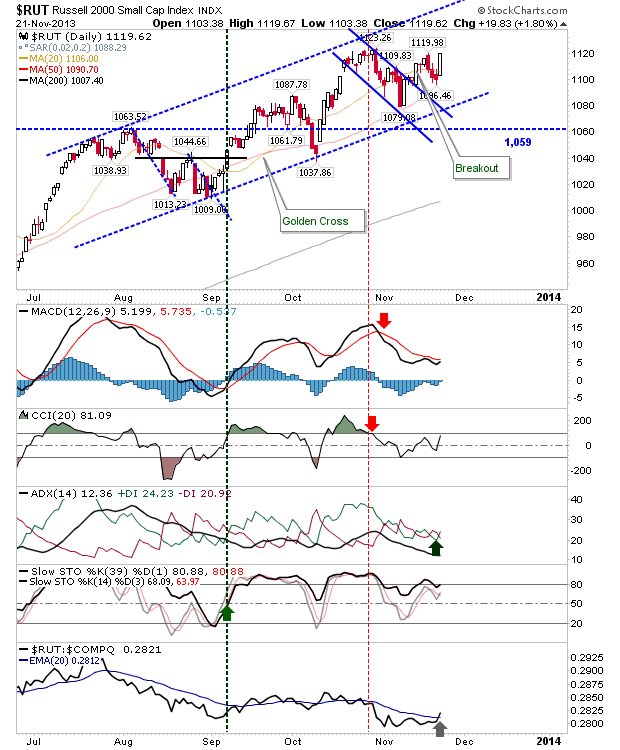

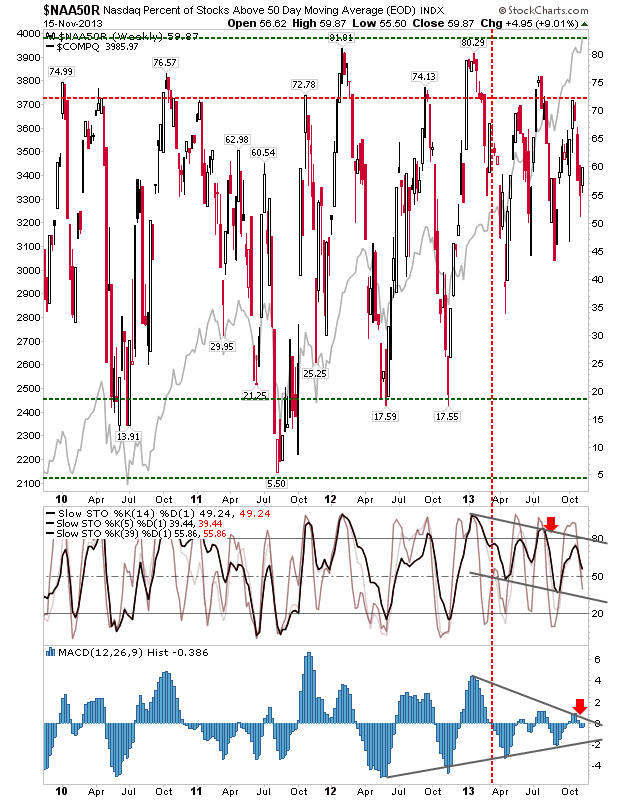

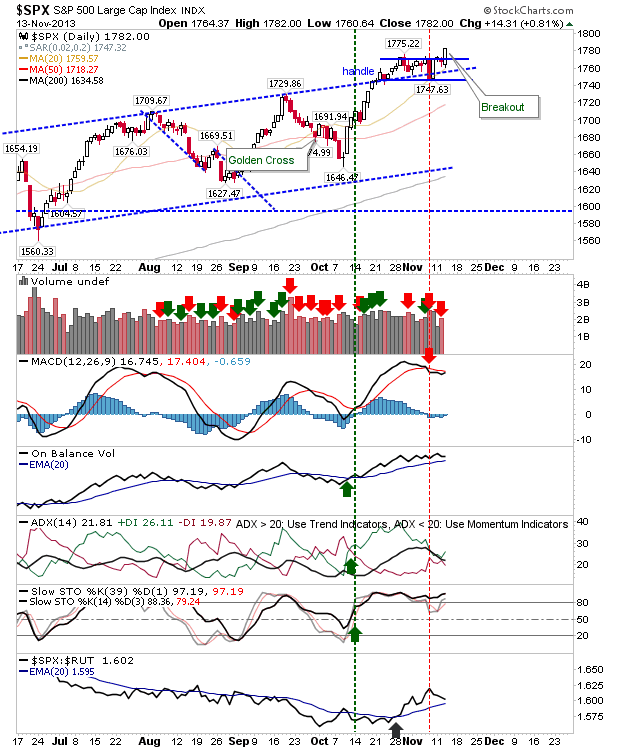

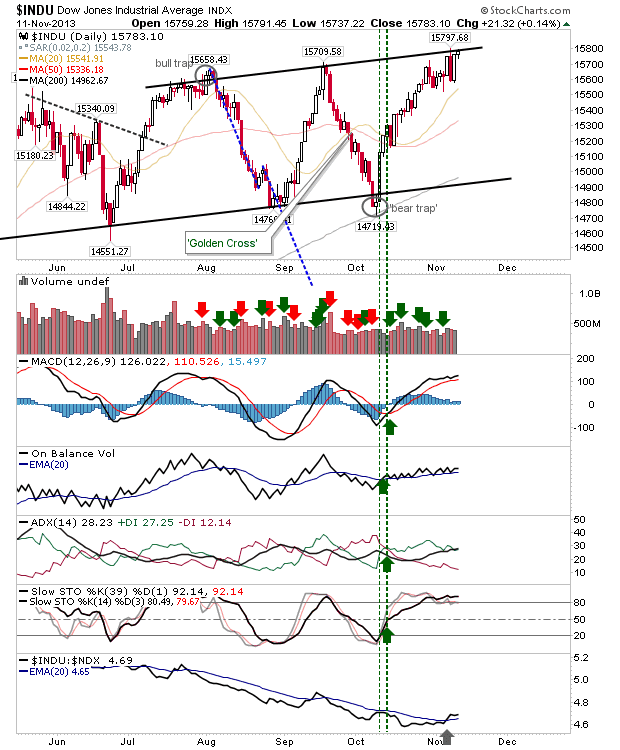

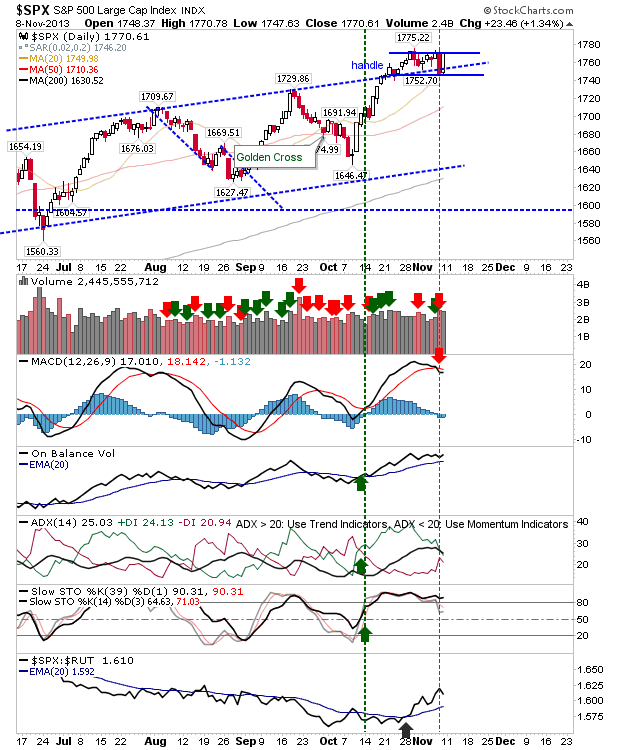

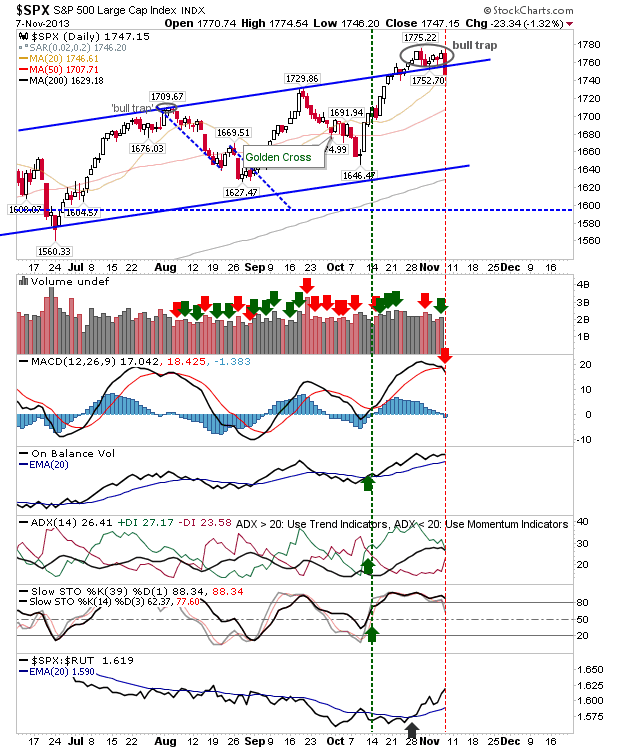

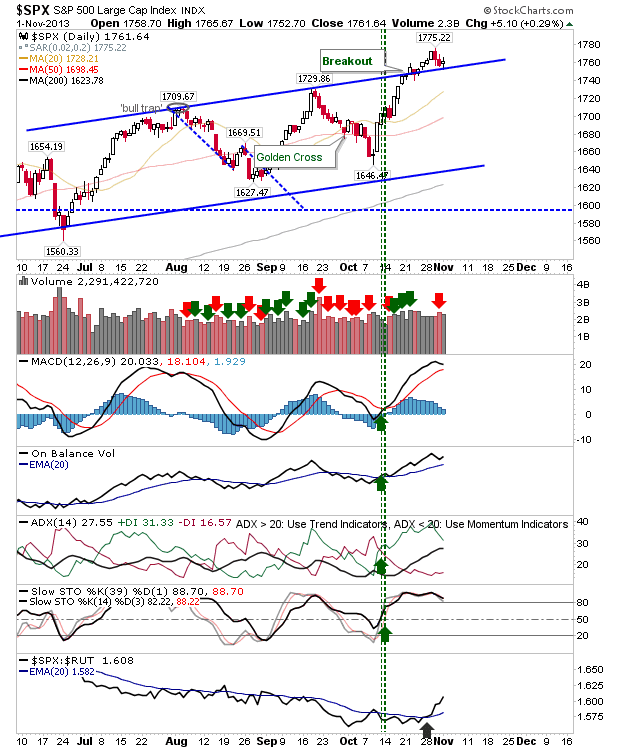

If one was to only look at Daily Charts, all looks well: new highs, technicals net bullish, decent volumes. Looking at the Weekly Charts offers similar optimism: well maintained trends dating back to 2011, sustainable (i.e. non parabolic) ascents, firm technicals. The only thing indicating a wobble are breadth metrics. The change in breadth metrics isn't outright bearish, and in itself may offer indices the basis for another big leg up, but the divergence to price is unusual. It has expressed itself more in supporting technicals of breadth metrics, rather than the breadth metrics themselves. For example, the Percentage of Nasdaq Stocks above the 50-day MA peaked in late 2012 at 80%, but has struggled through 2013 to make a sustained move above 70%. It currently lies at 60%, which for a market pushing new all-time highs, is not particularly healthy. In addition, the MACD histogram is narrowing into a coil and the trend for intermediate stochastics [39,1] points to a...