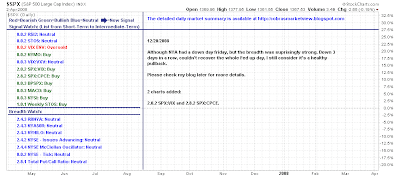

After months of struggle the Dow and S&P were able to push through their 50-day MAs following the Fed announcement on rates . The Nasdaq and Russell 2000 finished right on their 50-day MAs, closing shy of an actual break. With the exception of the NYSE, yesterdays gains didn't turn associated index stochastics overbought, preserving some leeway for further gains. McLellan Oscillator bullish Although the TICK is overbought Will the market view the Fed rate cut in a more negative light? Has the Fed shot its last bolt? How markets behave around their 50-day MAs will be telling. I still think there is more juice to this rally as breadth indicators, while neutral, are nowhere near overbought - even by (new) bear market standards. Get the Fallond Newsletter Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts and stock charts website