Daily Market Commentary: Volume Selling Fails To Break Channels

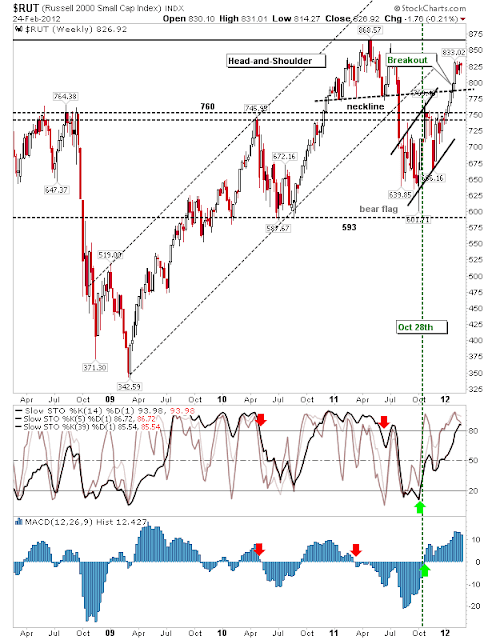

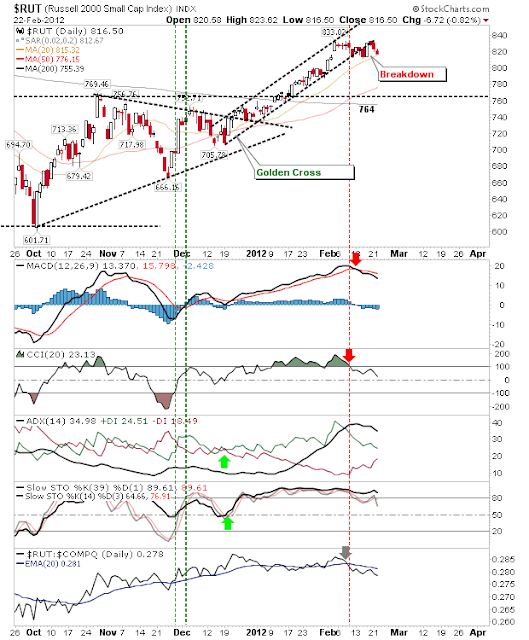

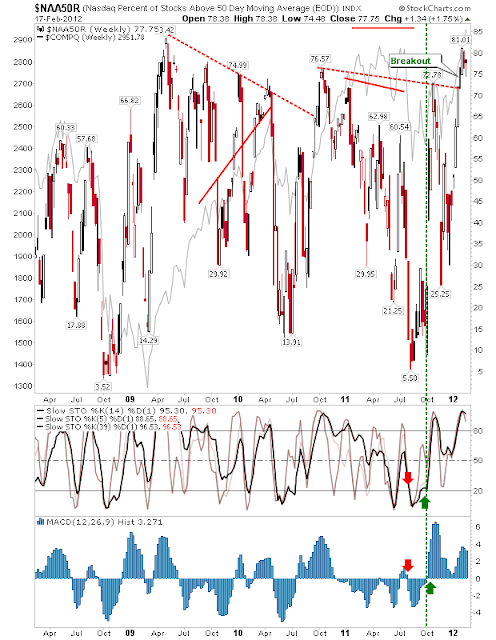

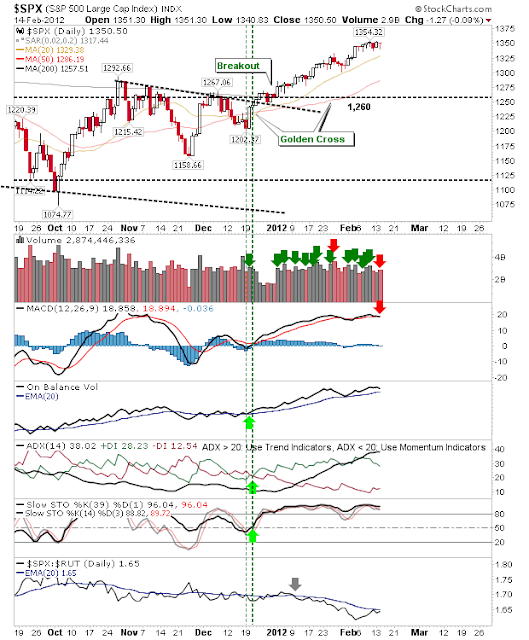

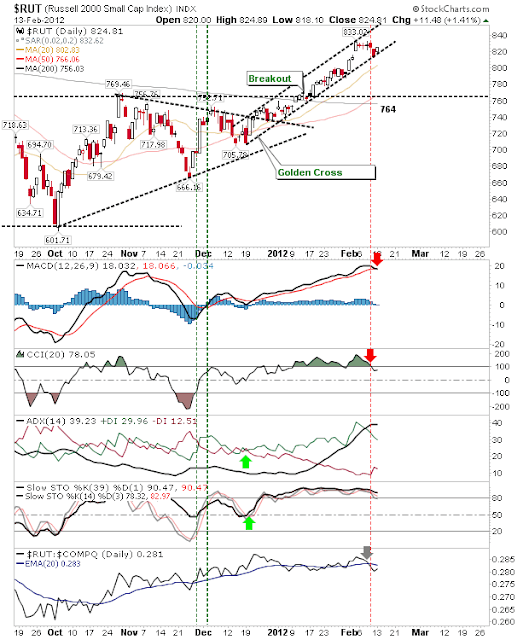

It has been a while since markets experienced a significant distribution day, but today was one such day. Luckily the heavier volume selling wasn't accompanied with a big point loss, and prices remained inside tight rising channels for many of the key indices. But there was an exception. The Russell 2000 is the index under the most selling pressure and today's action didn't help. Small Cap selling saw a loss of the 20-day MA with additional pressure on range support. The net result is a significant dent in buyers' confidence. Should losses continue tomorrow (leading to a confirmed break of the February trading range) the next support level is the 50-day MA down at 786. Note the expansion in relative weakness to Tech ...and Large Cap sectors The Nasdaq is looking vulnerable, but it has the benefit of expanding relative strength and robust technical health. So while a second day of selling may see channel support broken, it may have enough to attract buyers...