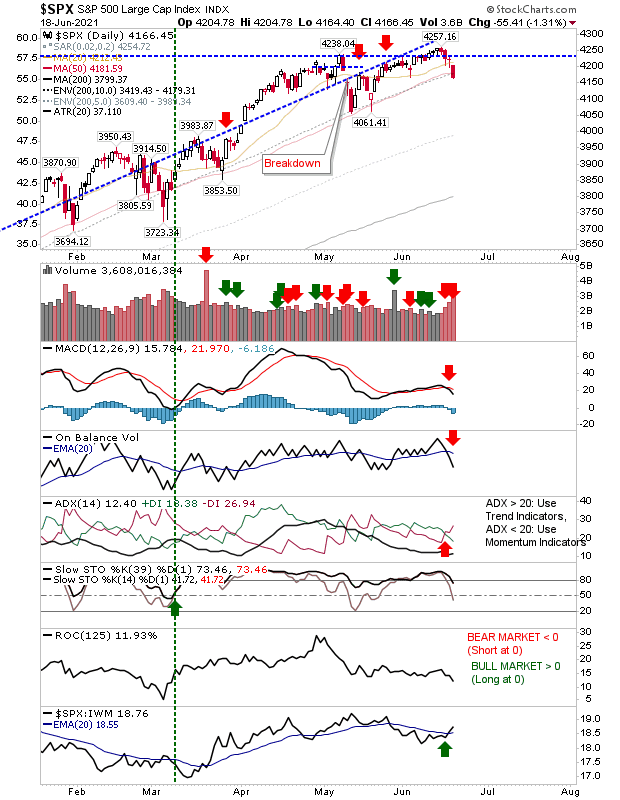

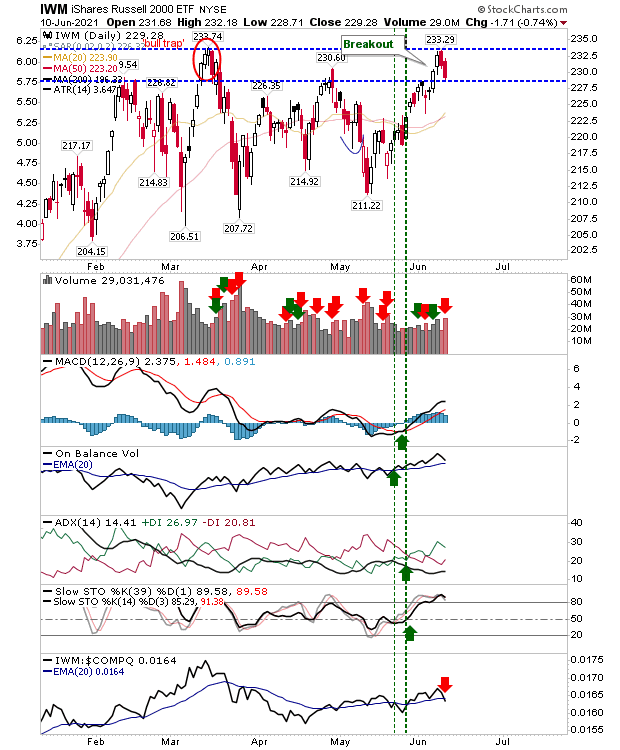

We are seeing more definition in the trend direction for some indices, but even with Friday's losses, a more likely outcome for the weeks ahead is sideways trading with May lows a potential support anchor for this. The S&P undercut its 50-day MA on Friday's close on higher volume, although options expiration will have weighed on the volume. May's swing low is next, which if held would mark a new level of support for my suggested trading range.