Being "Right" but still losing...

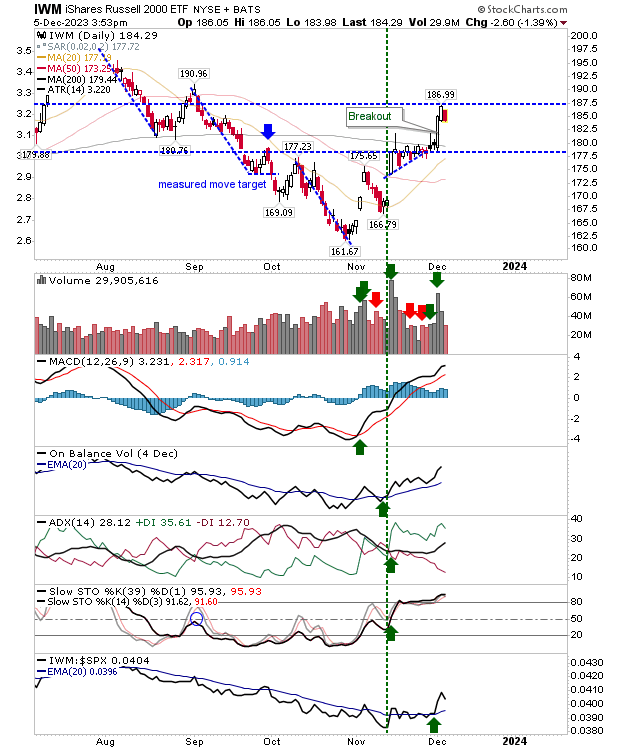

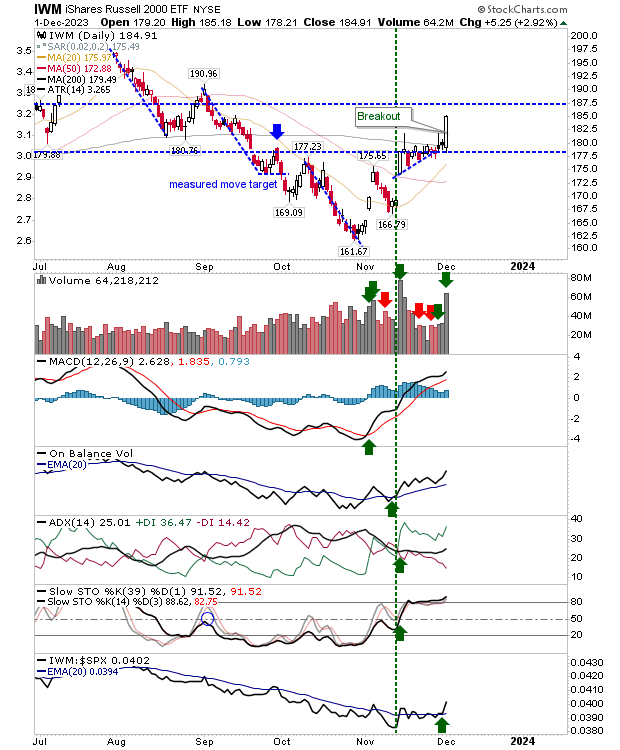

I'm trying the Topstep Trader Combine as a sampler to day trading and it's an interesting setup with minimal outlay costs to get started. I'm not a huge fan of their platform UI but everything else has been pretty good so far. Today was one of those days where I waiting (and waiting) for the profit taking to kick in, but by the time sellers made their appearance I had reached my loss limit for the day and so that, was that. You can see all of my whipsaw trades here. For the record, I only work off price action, looking at support/resistance and tells like rapid stop take outs, usually a good sign for a reversal.