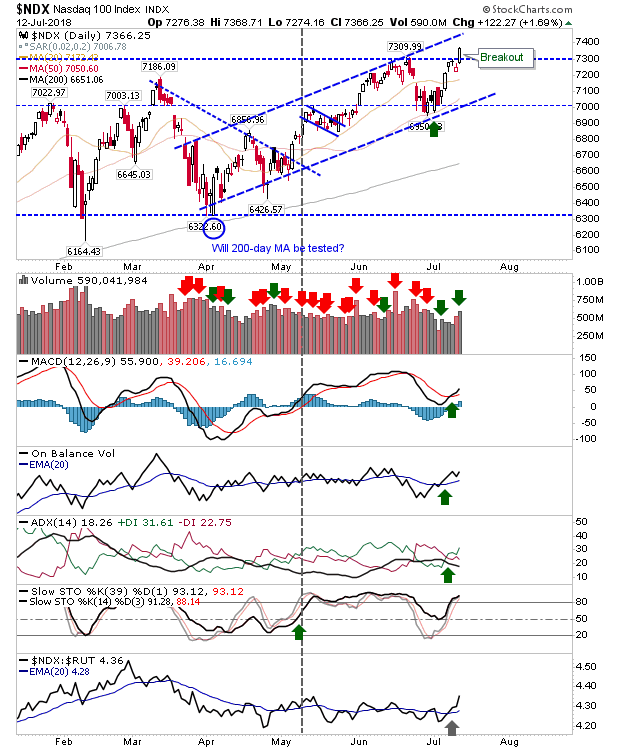

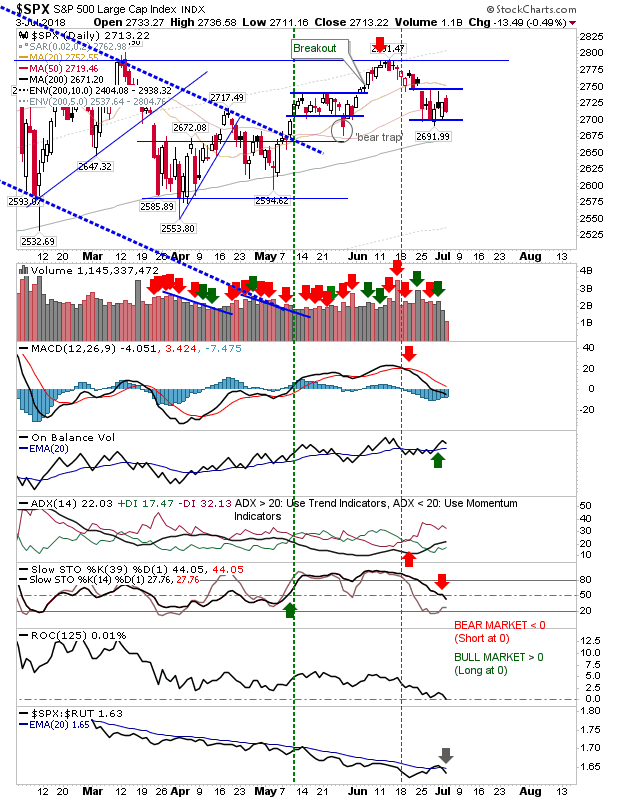

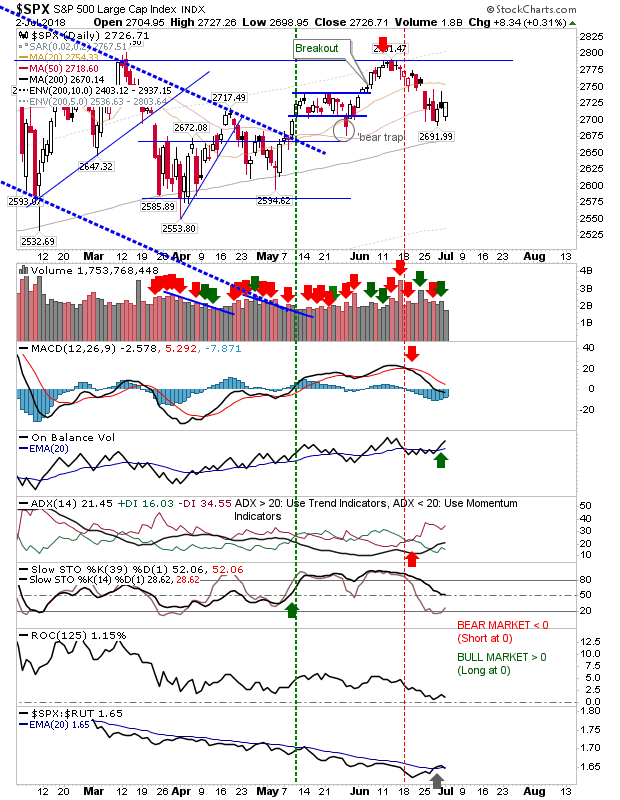

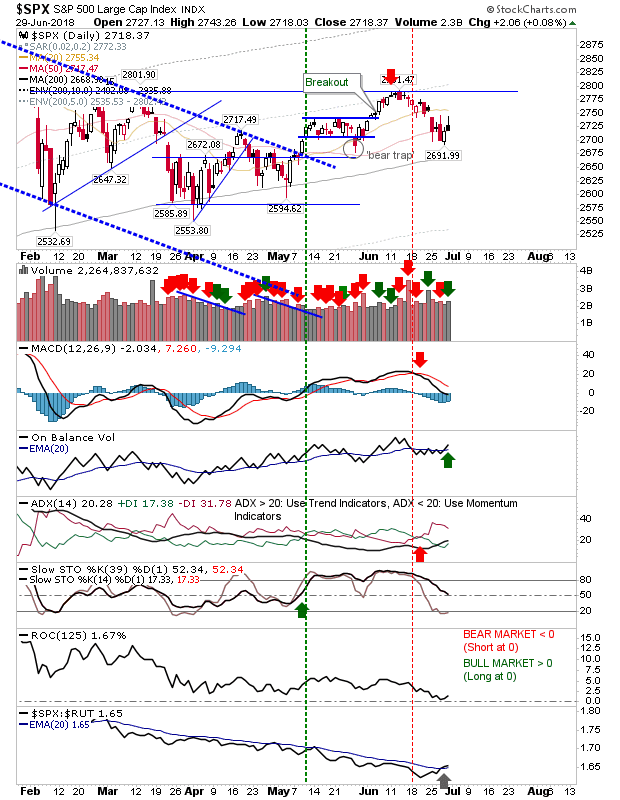

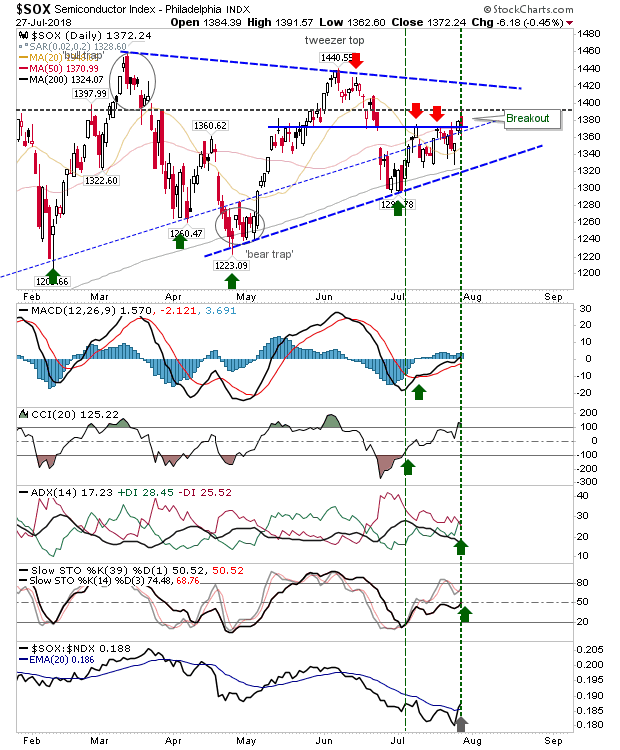

Semiconductors Index Breakout but Dow at Channel Resistance as Small Caps Breakdown

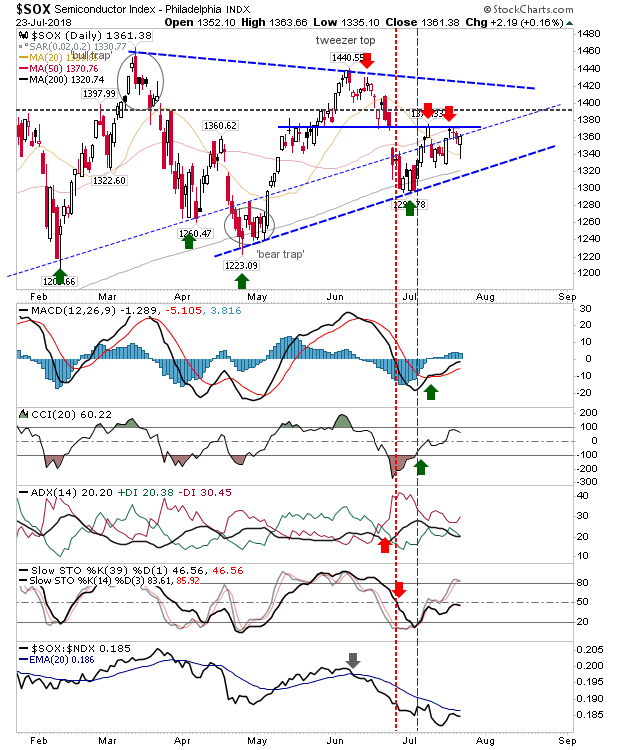

Lots of divergences in play across the markets. Start with the positives, the Semiconductor Index edged above resistance in what looks like breakout. It lost ground Friday which suggests it may still require a redrawing of resistance if this is some form of rising channel. However, in the near term, this looks like a genuine breakout and look for a move to triangle resistance.