Daily Market Commentary: Higher Volume Buying

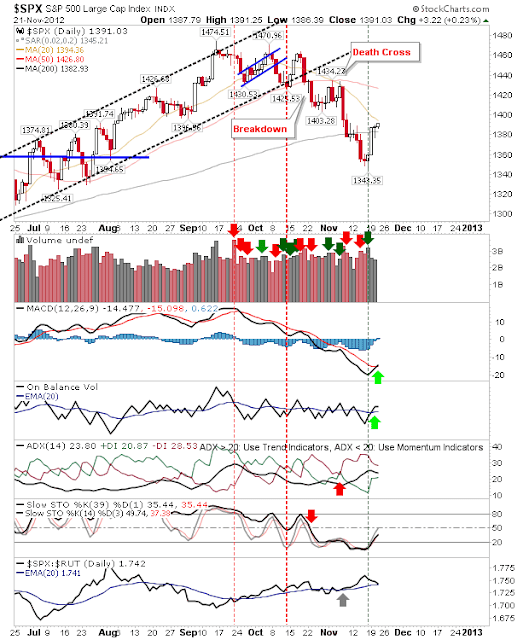

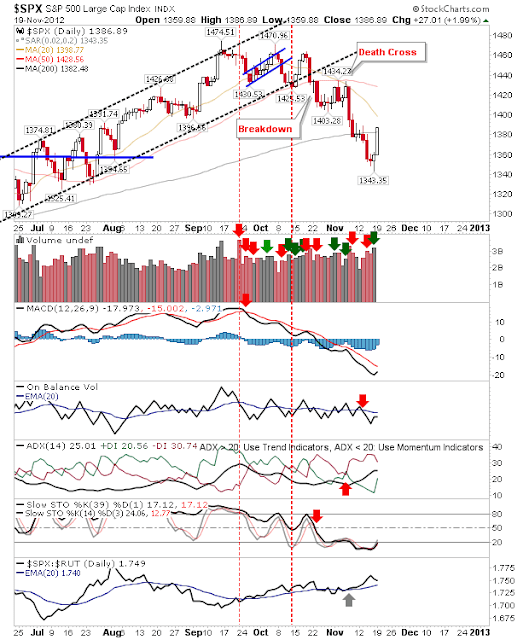

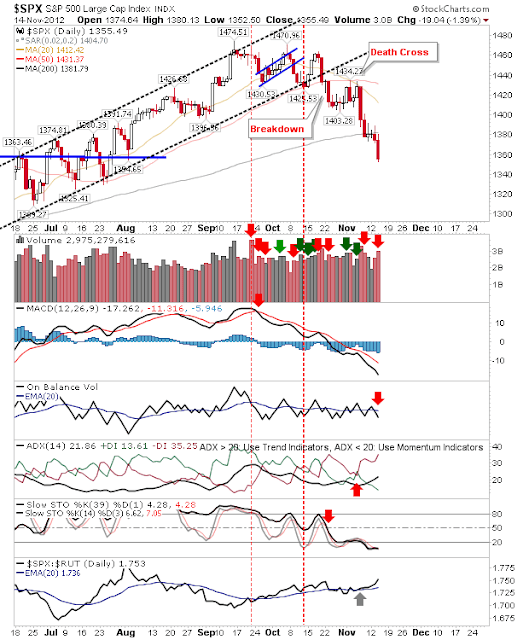

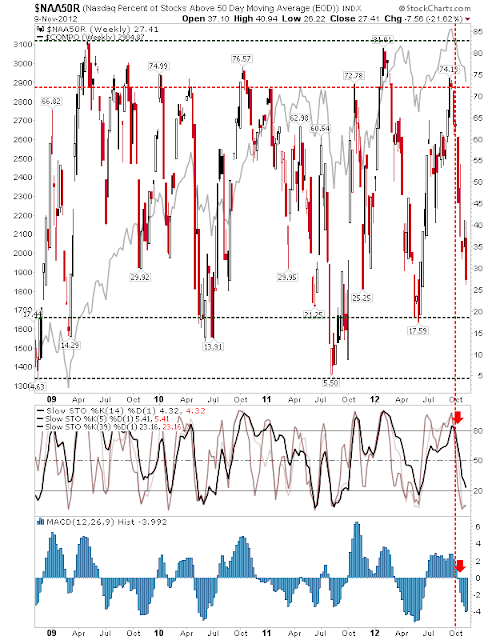

It was another good day for indices. Volume climbed in a confirmed accumulation day, following through on yesterday's recovery. This keeps the November rally intact, and nicely sets up the 'Santa Rally'. The Russell 2000 managed an upside breakout from its channel. This coincided with a close above the 50-day MA. Technicals also improved, with the Directional Movement Index the only indicator to fall shy of a bullish turn. Small Caps are outperforming the Tech indices. The Nasdaq continued its advance, but it didn't make it to its 50-day MA. The S&P finished just shy of its 50-day MA, but given action in the Russell 2000, it should have enough buying juice to see an upside break. However, relative strength continued to weaken against the Small Cap index. Tomorrow might not be the day, but this rally looks good to see a push above respective 50-day MAs. The 'Santa Rally' is in play. --- Follow Me on Twitter Dr. Declan Fallon is t...