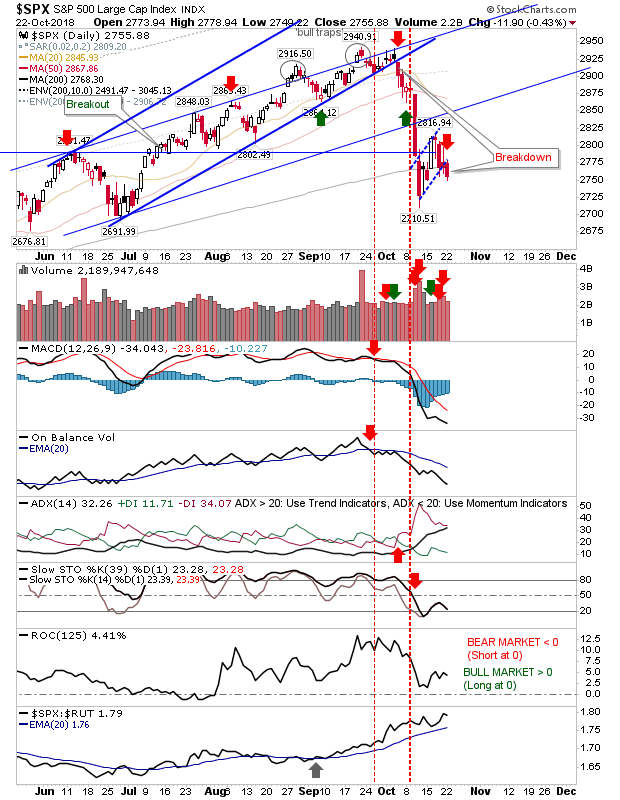

Rallies Run Into Channel Resistance

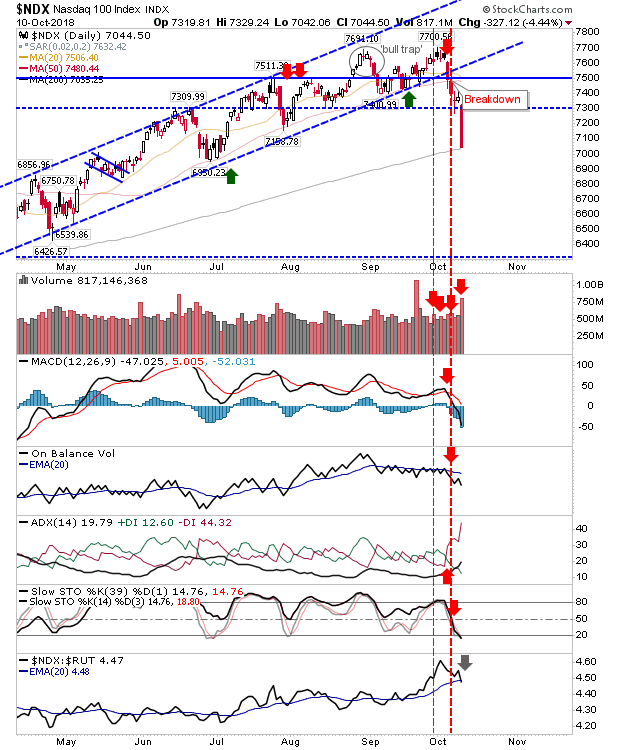

The initial bounces off spike lows have encountered their first major test of supply with pushes into newly drawn channel resistance. All indices are mapping this price action. First up is the S&P. Today's action finished with a spike high bang on channel resistance. Technicals are negative with the exception of relative performance, which has been tracking higher since September. Shorts may look to attack here and are likely expected to do so - if they don't emerge then we can think about Fibonacci retracements of the entire September-October move.