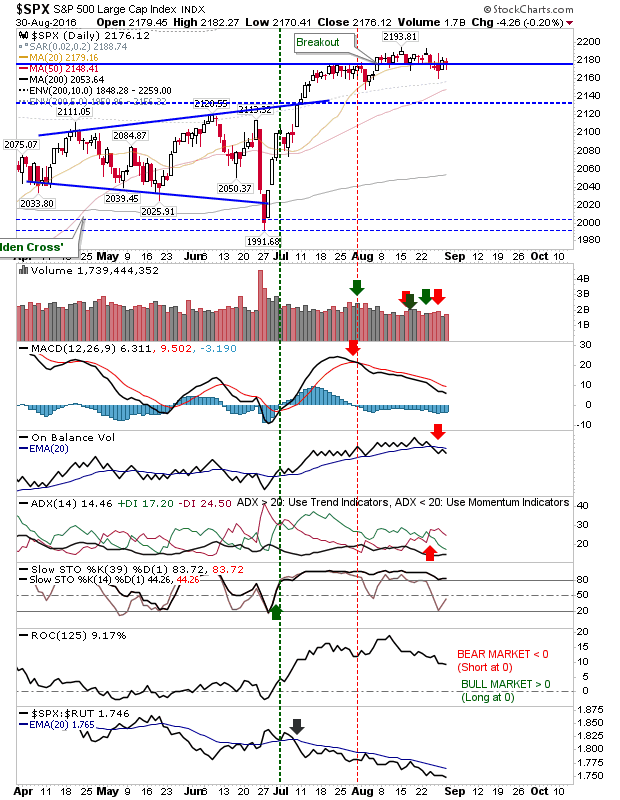

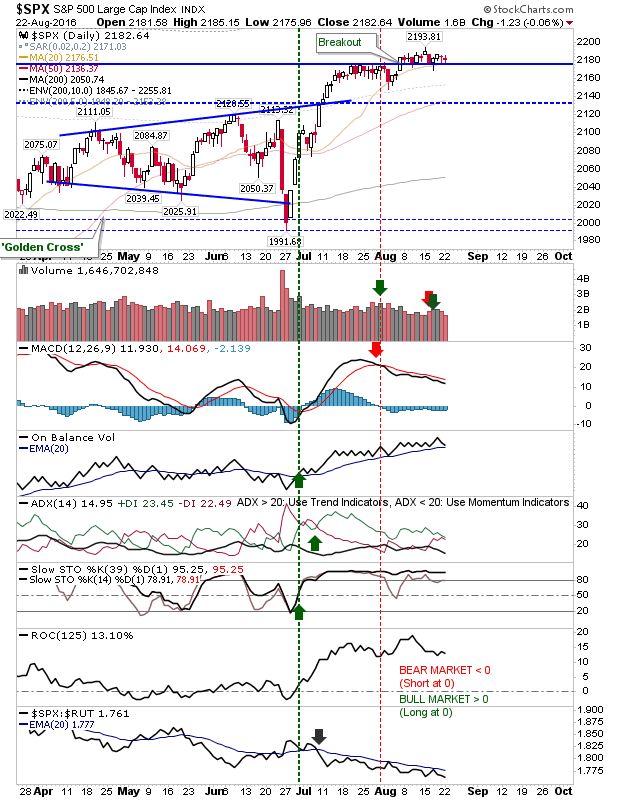

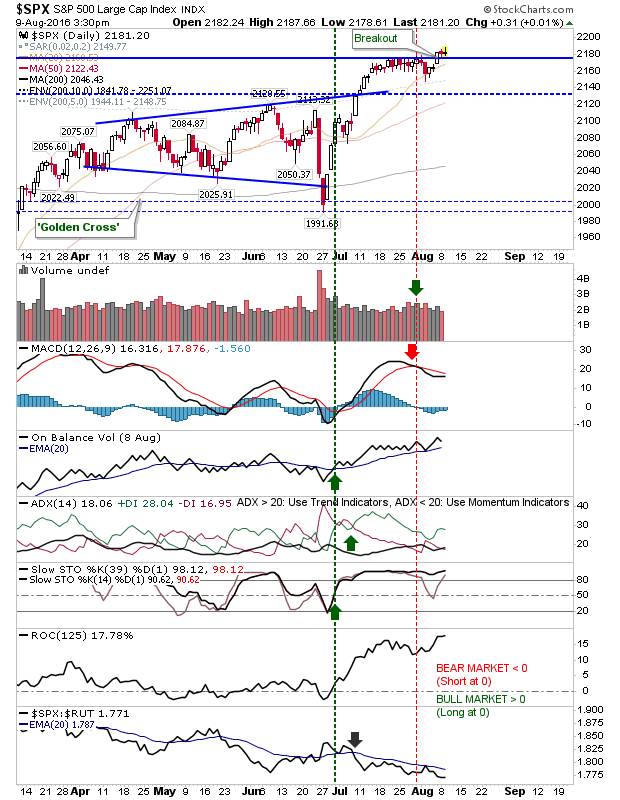

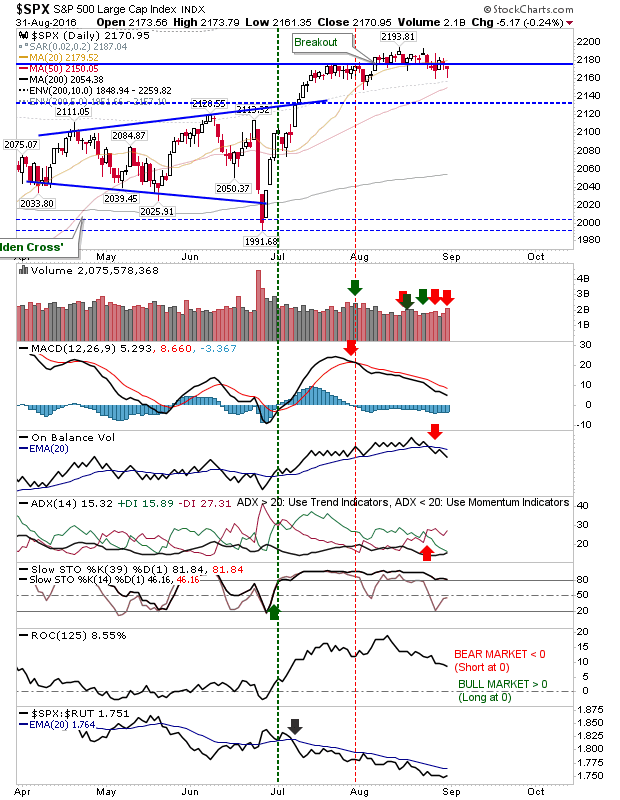

Buyers Step In Late

Sellers had looked to press in early trading, but buyers were again there to bid markets higher as they approached last week's spike lows. The net result leaves things as they were with Friday's jobs data the next opportunity to move the needle. The S&P may look to tag the 50-day MA if sellers get another swing on this. If buyers are able to continue with today's afternoon action then a tag of 2,200 should be feasible as part of this rally.