F-day

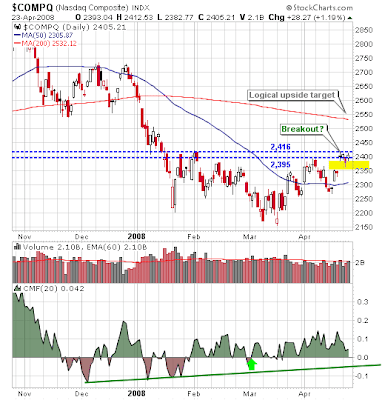

How will the market react to whatever the Fed decides to do? Because of the tight trading for the past few days the expectation will be for a sizable move one way or the other. The 200-day MAs are a logical upside target, with the 20-day and 50-day MAs lurking below. Markets have effectively traded sideways since the January bottom and it would be good for this pattern to be put to rest. The best action for the bulls comes from the Transport index (even with all the woes in the airlines). The ADX confirms a bull trend and the "Golden Cross" between the 200-day and 50-day MAs shows a long-term bullish shift. Given this, I suspect we will see higher prices over the coming weeks even if the Fed 'disappoints'. Points [1] and [2] on the chart mark likely retracement points (based on Fibonacci and support) for a negative reaction to the Fed. Get the Fallond Newsletter