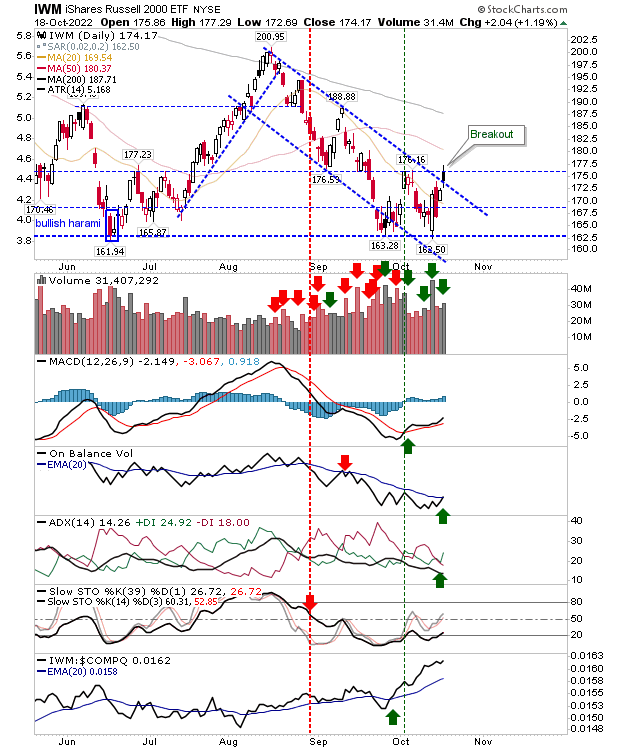

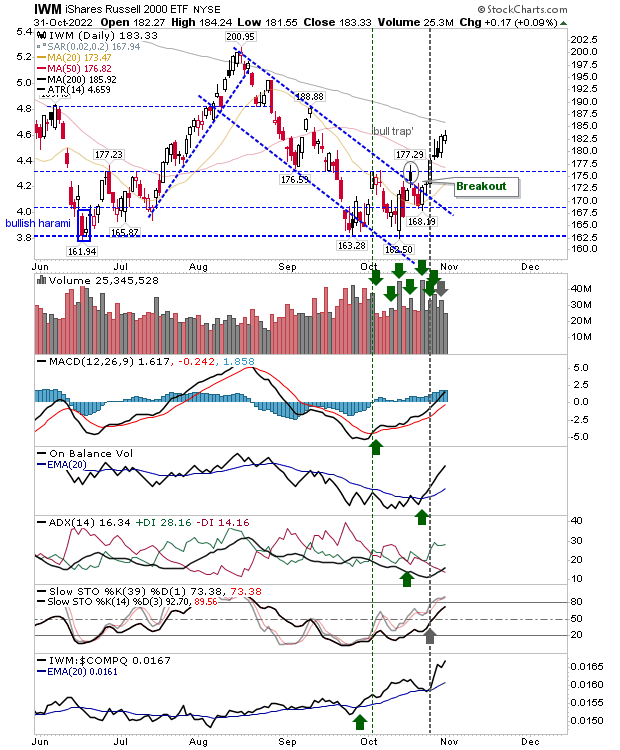

Russell 2000 gets closer to 200-day MA as Friday's gains hold

After Friday's strong finish there was the potential for bears to stew over the weekend and attack on Monday, and although sellers were able to do some damage - they weren't able to do more than they did at the open. Given that, the Russell 2000 was able to protect itself from the sellers and managed to make a modest gain as it looks ready to challenge its 200-day MA, perhaps as soon as tomorrow. Technicals are net bullish and relative performance has accelerated in the latter part of the month to its peers.