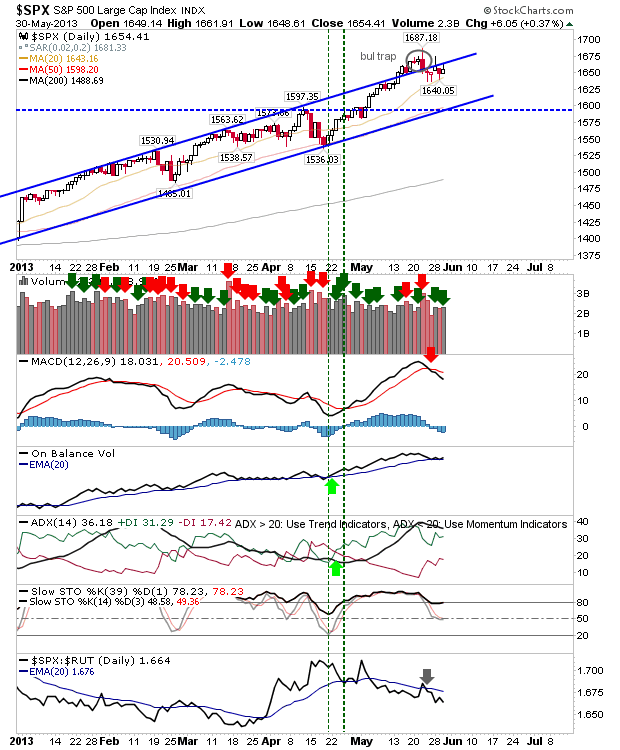

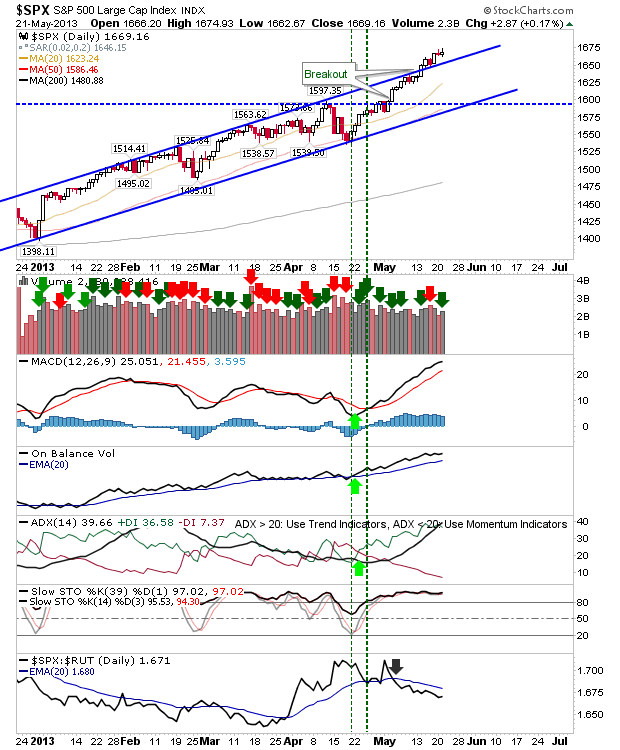

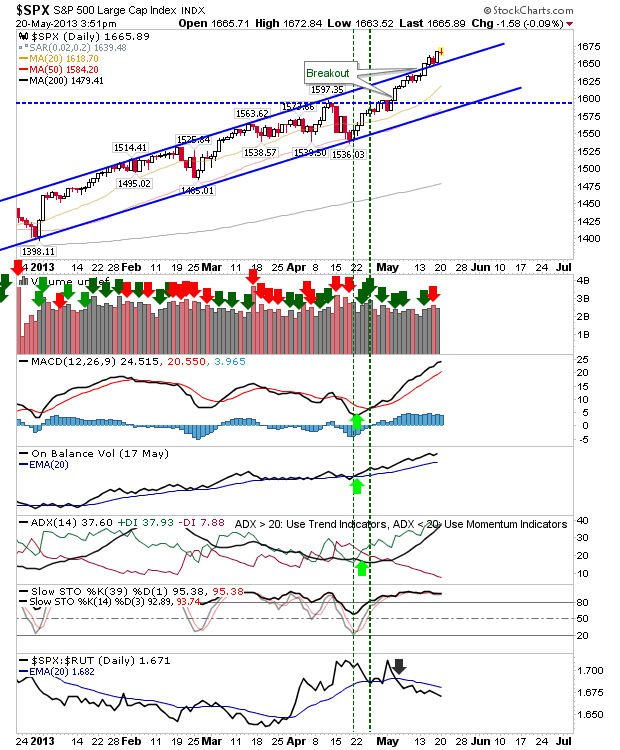

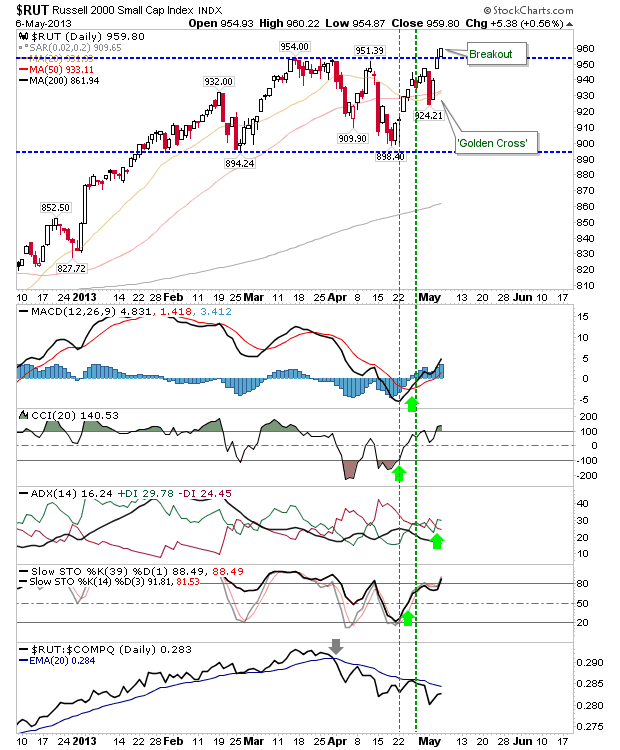

A worrying sell off in Small Cap stocks overshadowed the selling in other indices. The Russell 2000 experienced over a 2% sell off, cutting below 20-day and 50-day MAs in the process. However, the February and April swing lows likely mark the boundary of a trading range. This lessens the significance of today's selling, although you still don't want to see it! The selling did result in a bear trigger in the ADX and increased the relative loss against other indices; this has been particularly ugly against the Nasdaq. Despite a trading range in the Russell 2000, the big relative swing against Small Caps is undermining the April rally. Without participation of Small Caps, the broader rally will struggle for long term traction. What would add to the misery is if the breakouts in the Tech averages would fail (and they are close to it).