Stock Market Commentary: Gap Down But No Follow Through

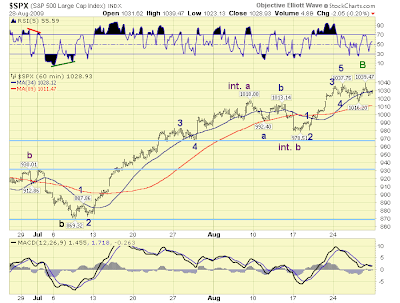

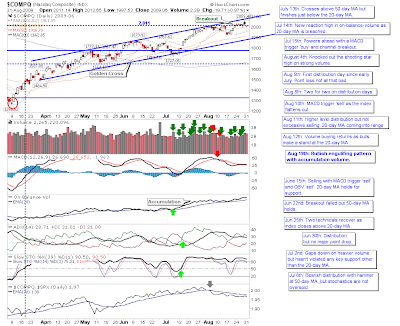

It could have been a lot worse but in the end there was little change for many of the indices. The Nasdaq finished above 2,000 on no technical change and light volume; it's going to need more than a break of the 50-day MA to crack this The Dow is trading between upper channel resistance and its 20-day MA below. Plenty of room down to support. The biggest change came in small caps; relative strength shifted away from speculative and tech issues to 'safer' large cap stocks. There were also bearish 'sell' triggers from the MACD and CCI. Note how the Russell 2000 has so far failed to get anywhere close to its upper channel line. However, the 20-day MA remains as support. The semiconductor index is another index struggling to make it to its upper channel, but at least it scored a MACD trigger 'buy' The week has started badly, but how will it end? Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts , stock charts , watchlist, multi-curr...