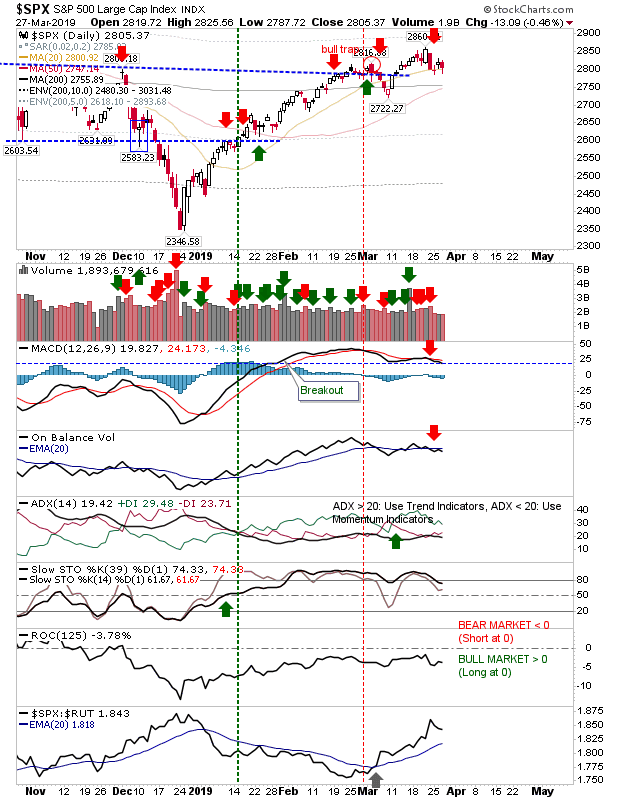

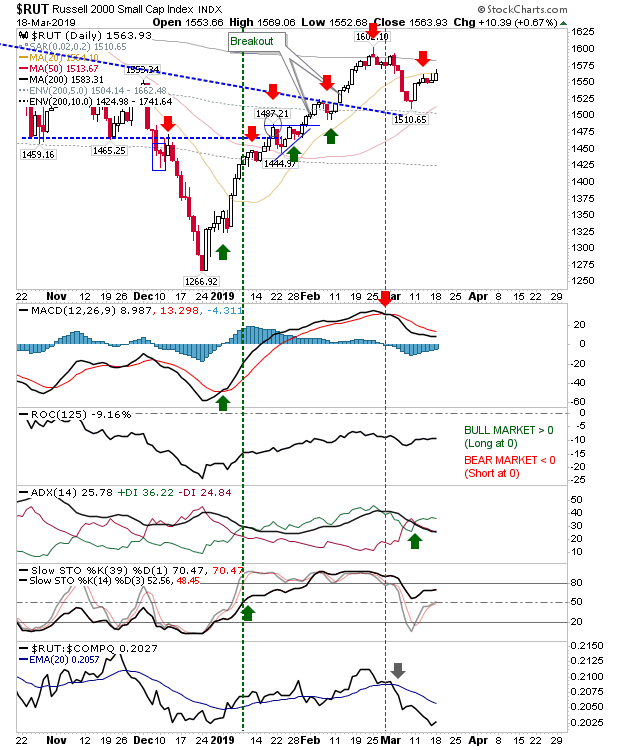

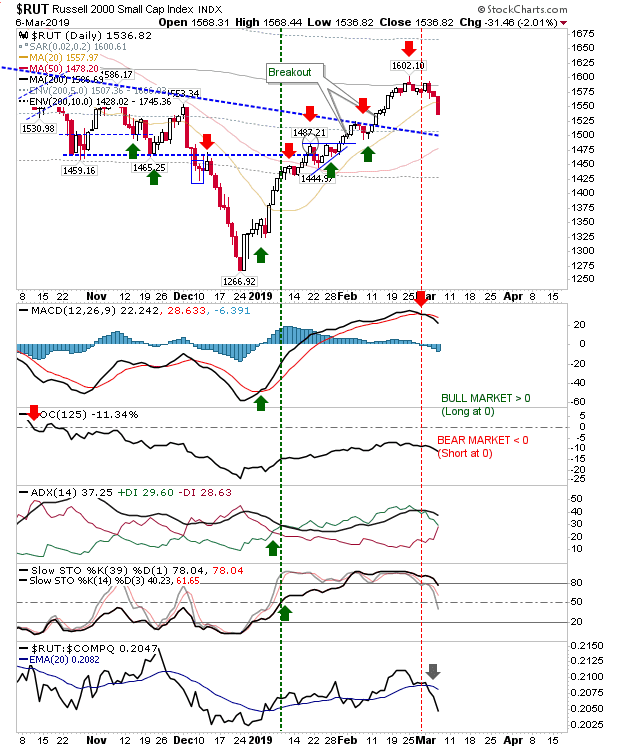

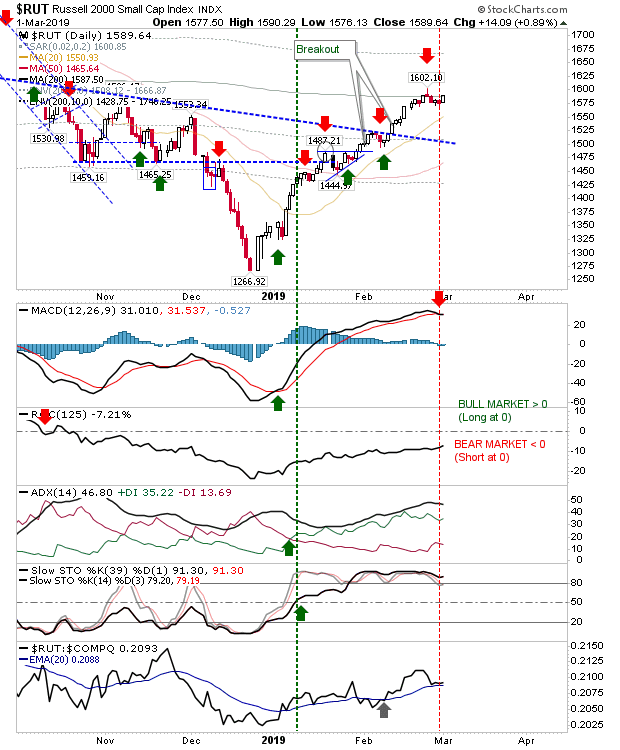

Large Caps recover as Small Caps run into resistance at 20-day MA

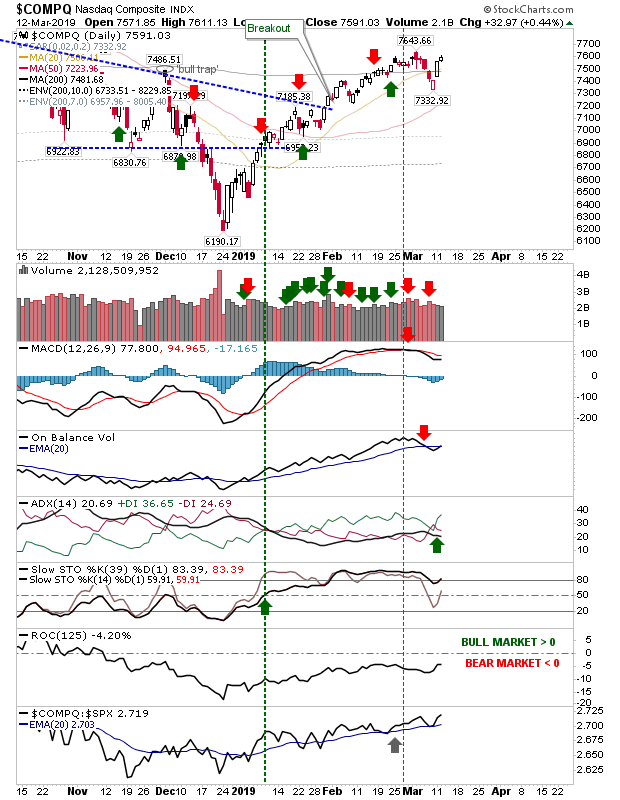

Friday offered Large Caps a little boost which helped generate a breakout in the Dow Jones Index. Small Caps were not as lucky as the 20-day MA turned into resistance. The Nasdaq bounced off its 20-day MA in what looks to be favoring the bullish picture. Large Caps, led by the Dow Jones Index, broke from the consolidation pattern. Volume rose in accumulation and the MACD is on the verge of a new 'buy' trigger above the bullish zero line.