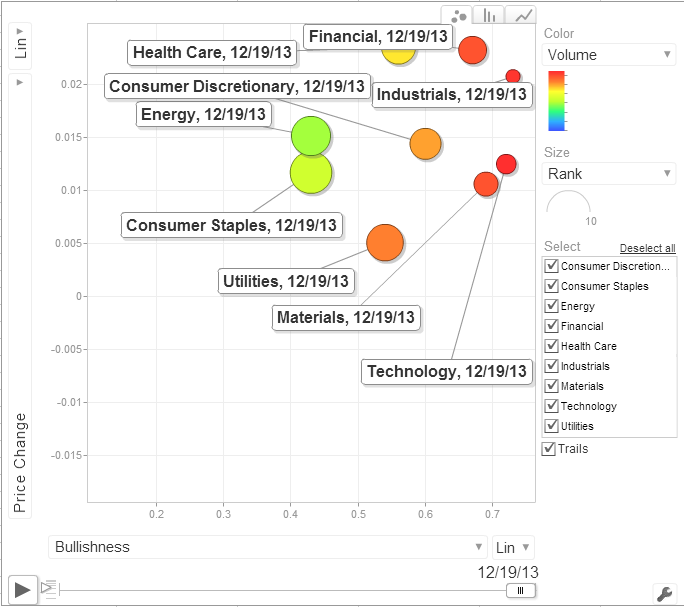

Market Sentiment: Sector Breadth Divided

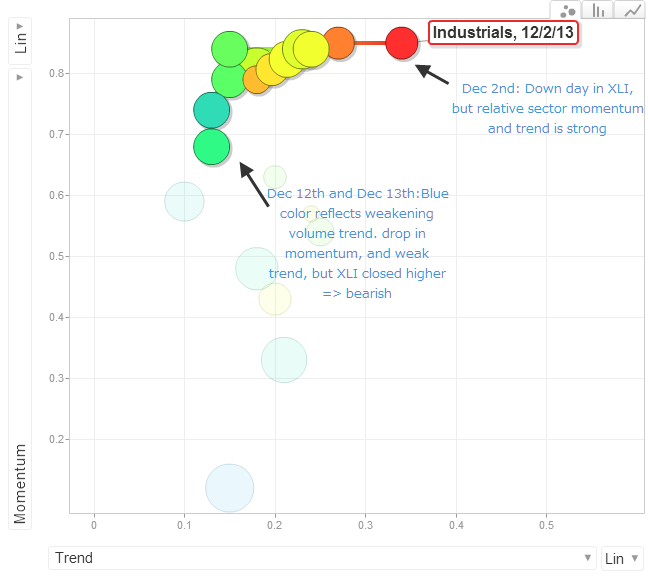

Well, after last week's possible short suggestion on Industrials , one has to go back to the drawing board. Friday's snapshot covered the prior two days, which offered largest price gains for Financials and Health Care, but it's Industrials which are the most bullish (x-axis), and experiencing the strongest accumulation (red color intensity for volume). The other two sectors showing good volume hot zones on strong bullishness are Technology and Materials.