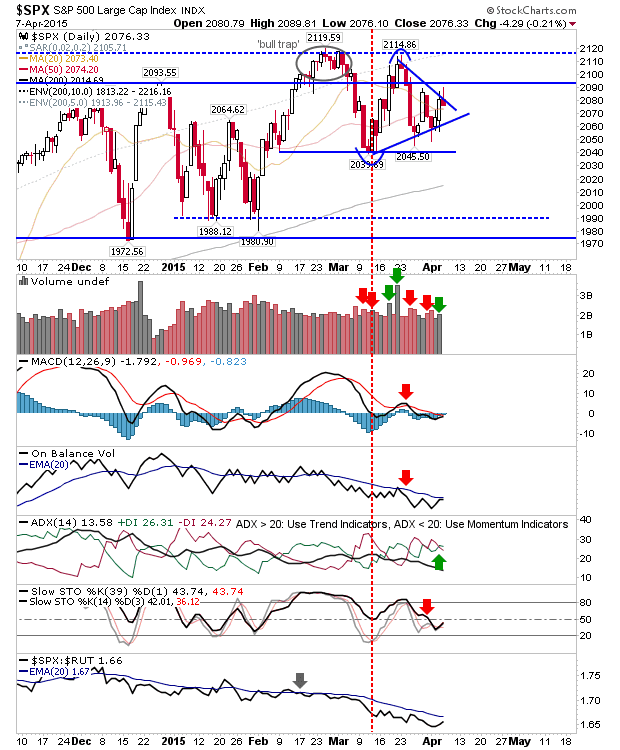

Declan Why is it traders like you and your ilk are uber- bullish in perpetuity? You write as if these indices have minds of there own, when in reality they are manipulated And propped up by primarily dealers trying to give the appearance of healthy indices... It never ends... The most hated bullshit market of all time.. Hi Peter, I don't think I'm uber bullish, more apathetic bullish. I would be happier to see this market take a dive so I could put my cash holdings to work instead of having them sit in the bank earning nothing! If you look at the end of every post I show two tables which highlight levels where markets typically find historic extremes. Based on where markets lie now, there is no extreme. So one has to work with what's gone before, and that's a 6-year bull cycle which hasn't show signs of slowing. People may think 6-years is a long time, and for many a bull rally that has gone before, it is. However, there was an 11-year gap from 1...