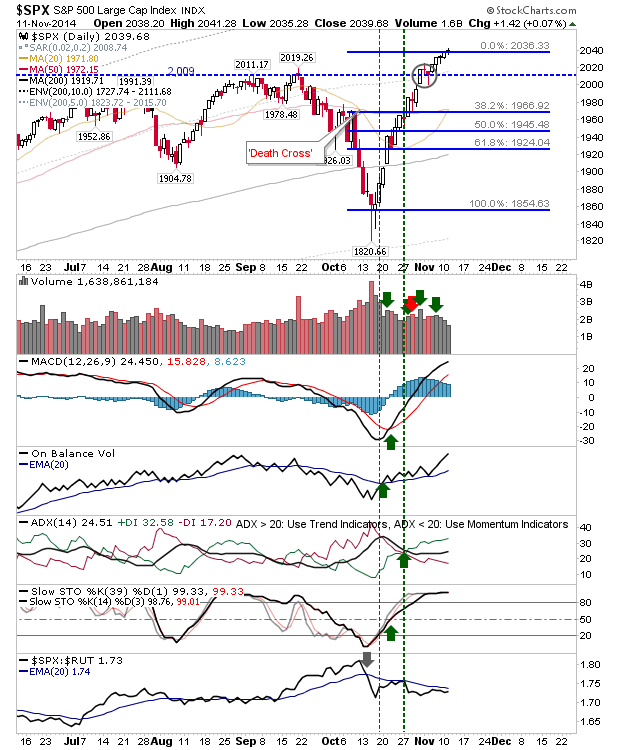

Bullish monetary policy rumblings from China and Europe had kick started a bright opening for markets, but the feel good factor gradually wore off as the day lengthened, and in the end, the day felt oddly bearish. The S&P closed with a bearish inverse hammer, which could turn into a bearish shooting star if there is a gap down on Monday. Volume climbed to register technical accumulation, but this could mark significant overhead supply if sellers come back tomorrow. I have widened the Fib levels for the next decline. Note, pending MACD trigger 'sell,' although other technicals are in good shape.