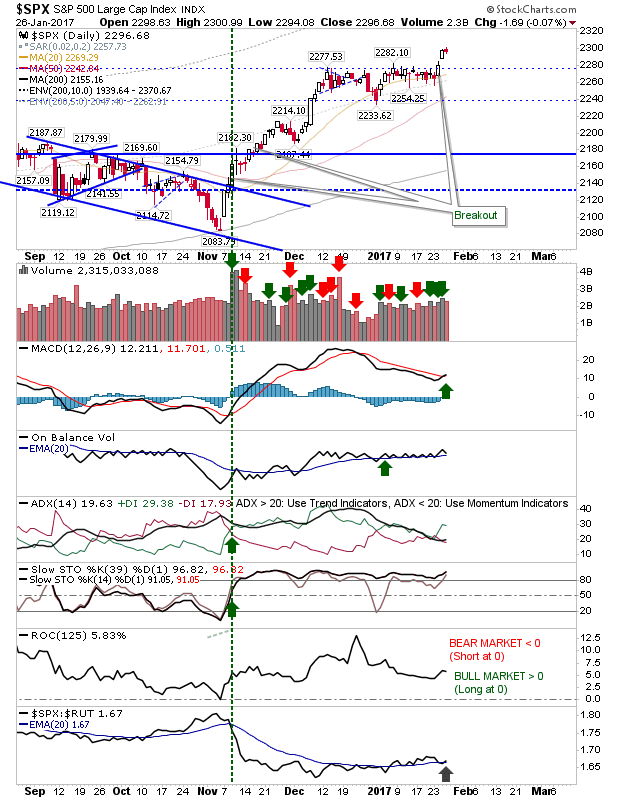

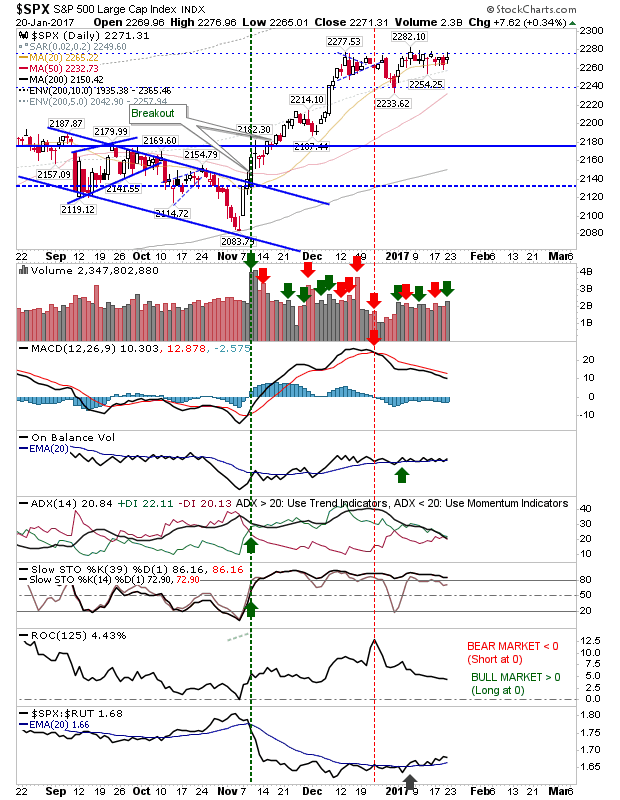

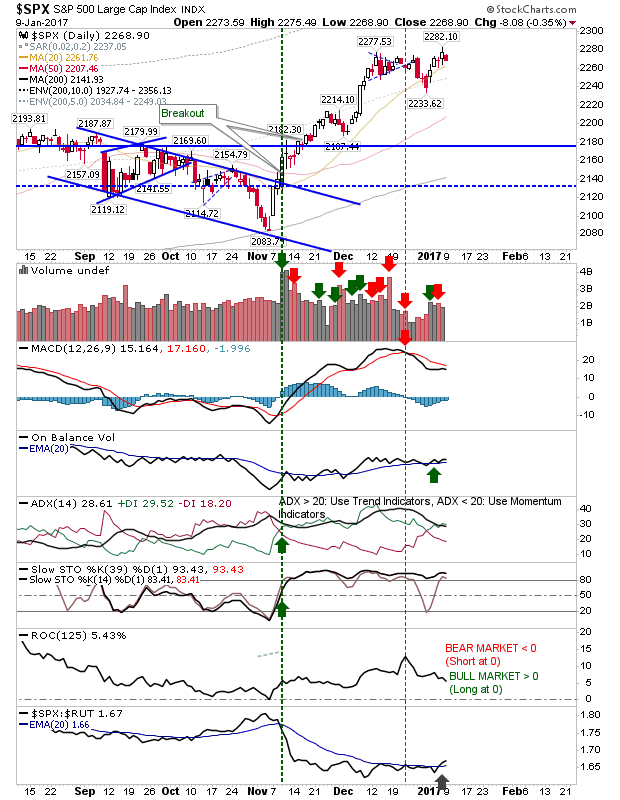

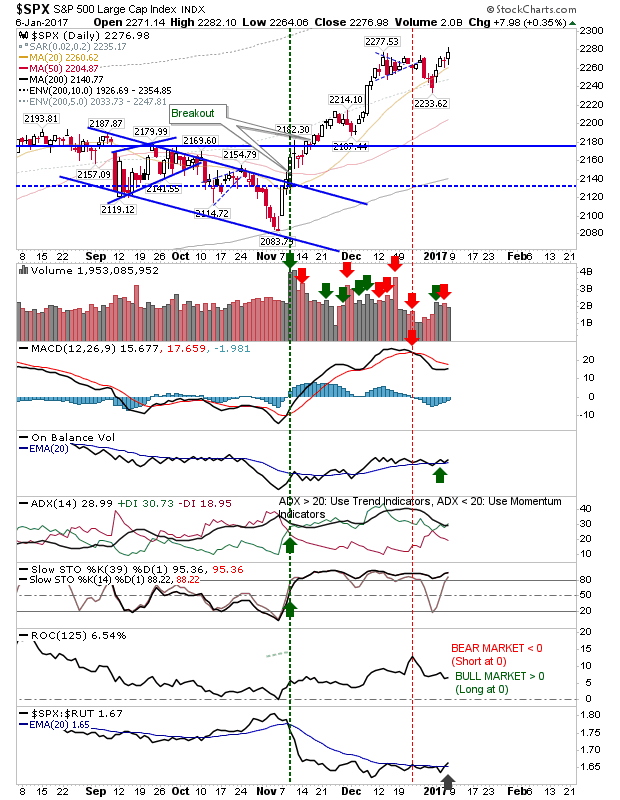

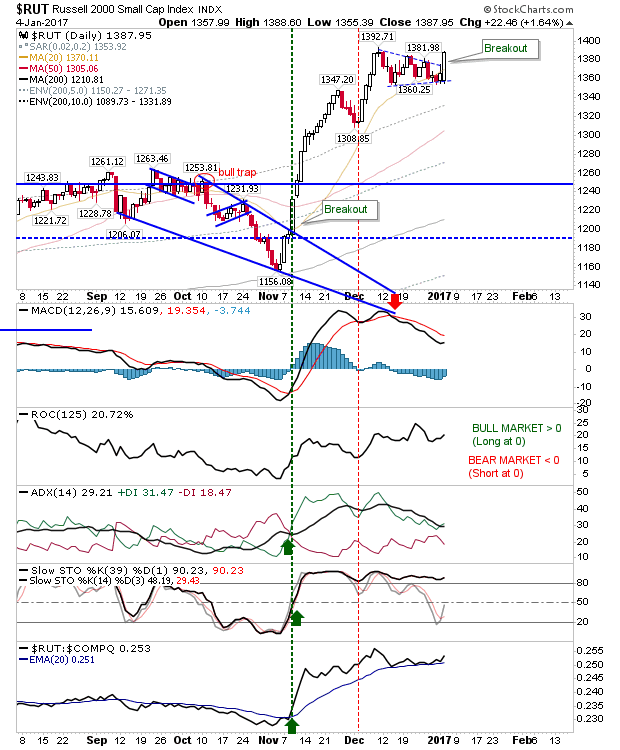

Markets Sell Off But Recover Into Close

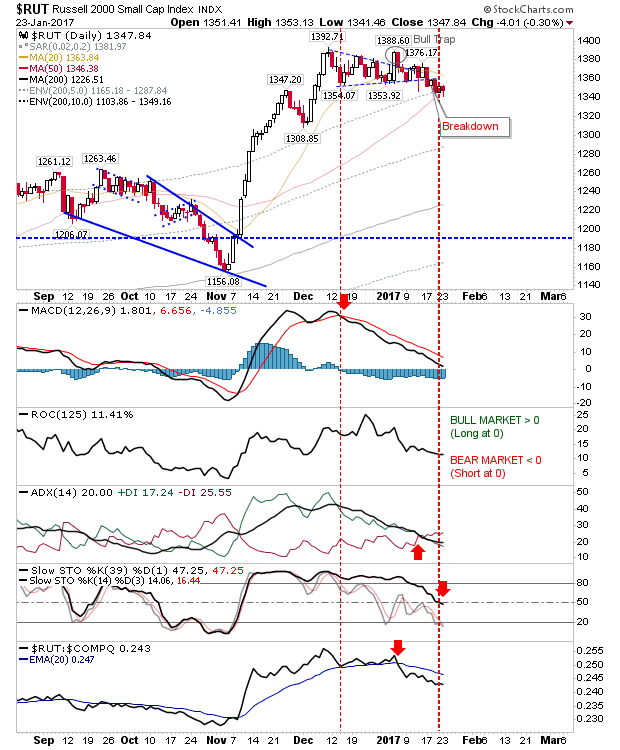

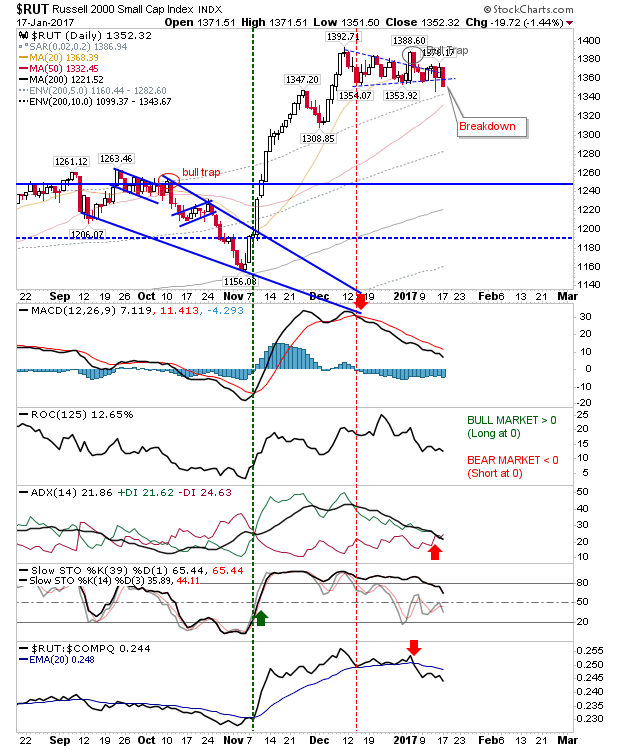

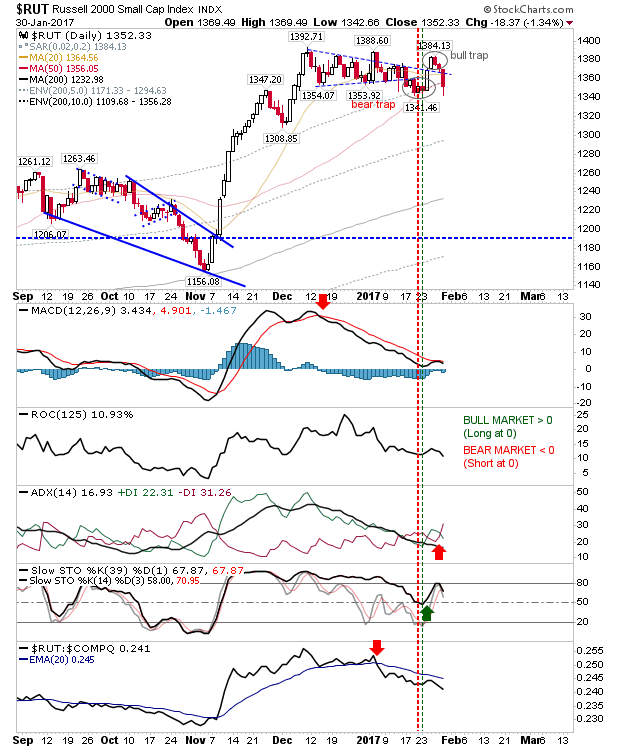

Trump kicked off the week with some market turmoil, but market participants still seem to consider his presence good rather than bad for the market. The only exception was the Russell 2000, which sold off and stayed sold off. This has created a 'bull trap' next to last week's 'bear trap'; a neutral setup. For the Russell 2000, a loss of 1,341 opens up for a retracement down to the 200-day MA at 1,233 and the November swig low of 1,156 (which looks a long, long way away). Technicals saw the trend metric +DI/-DI turn negative as the MACD pulled away from a potential trigger 'buy'; shorts should probably be looking at shorting rallies from here.