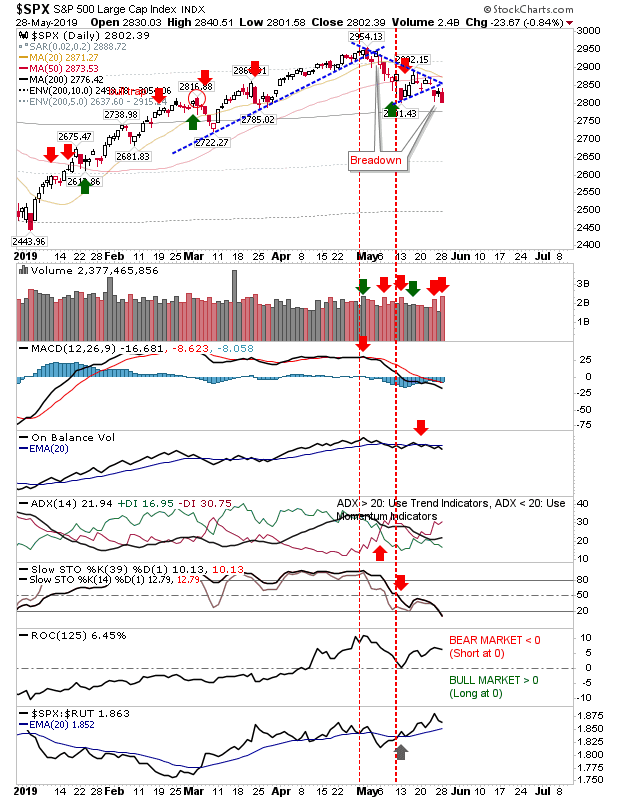

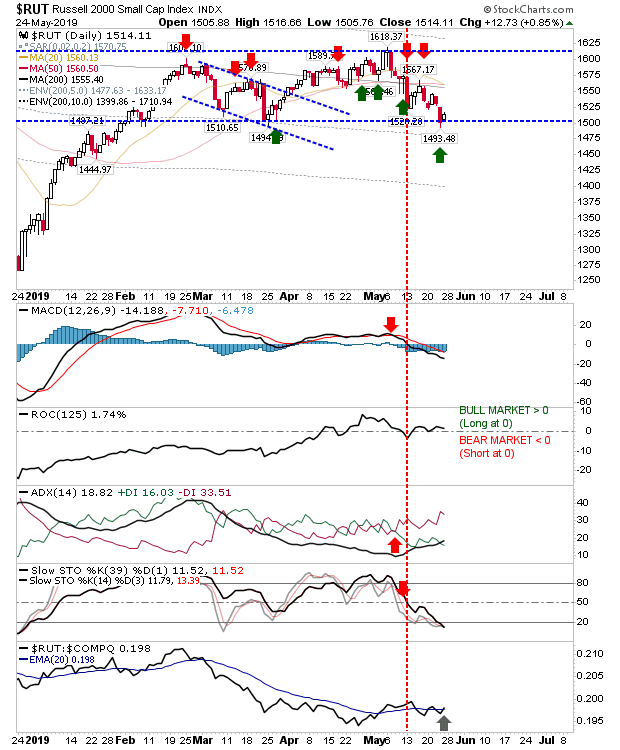

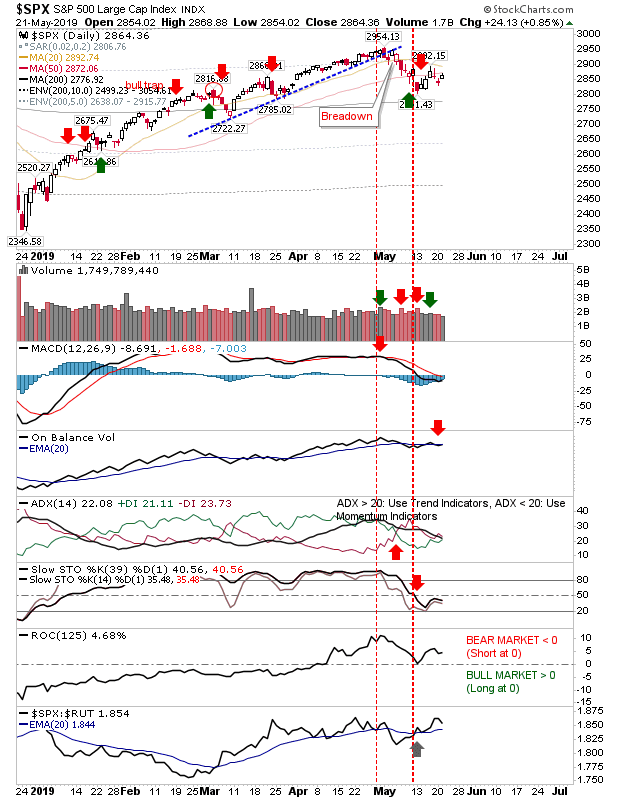

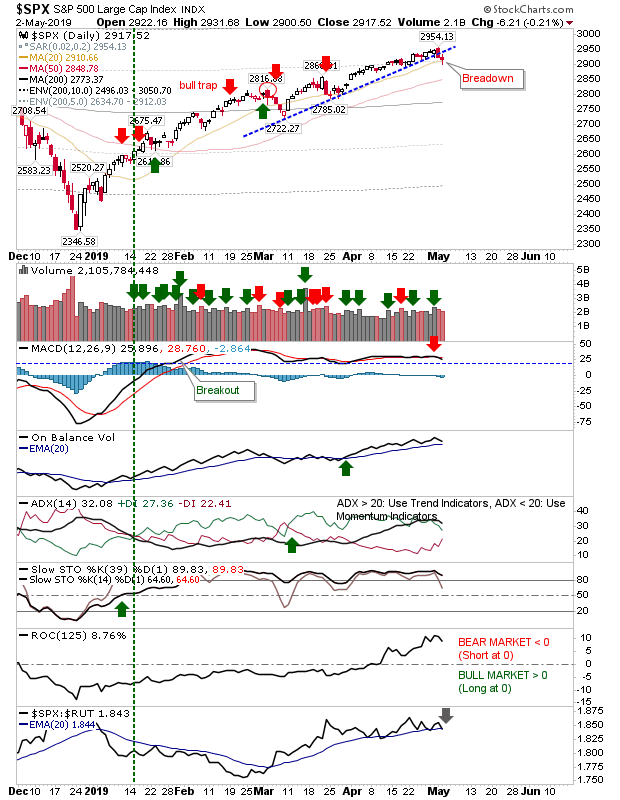

Friday was a bit of a mixed bag. The Russell 2000 was able to defend horizontal support as it continues to build a sideways pattern. While it trades sideways it will keep other indices in check until there is a confirmed directional turn - either a break of current support (for bears) or a rally back to, then beyond 1,615 resistance. With the Russell 2000 caught inside a trading range, the breakdowns in the S&P and Nasdaq are caught in a bit of a no-mans land. As the Russell 2000 failed to break its support, both the S&P and Nasdaq are vulnerable; not just to additional losses, but also to a 'bear trap' and a rally through their respective consolidation triangles. While the Russell 2000 defending support, Semiconductors are heading in the other direction with an undercut of the 200-day MA. Further losses in this index will drag the Nasdaq and Nasdaq 100 with them. Finally, the relationship between Transports and the Dow Jones Index continued to struggl