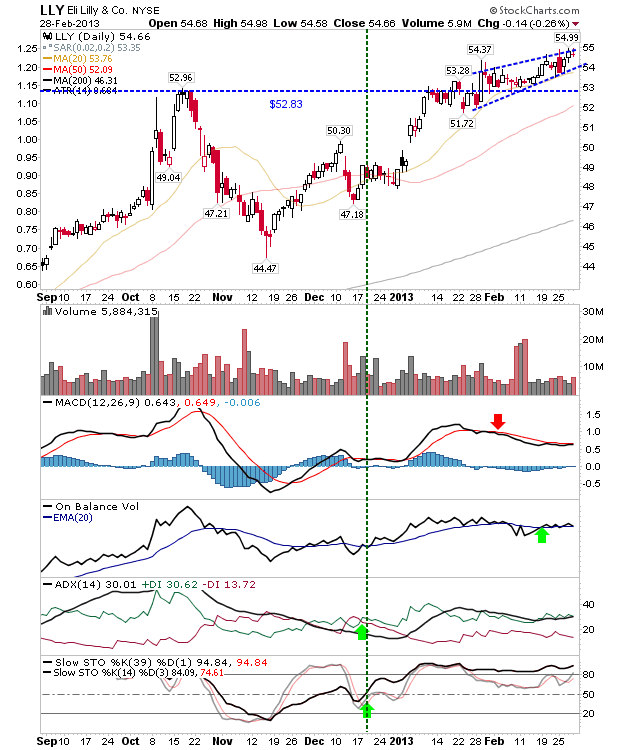

Stock Picks: $LLY, $BEAM, $CVS, $ORLY

Four stocks featured in my latest Fool post here . The technical picture is provided below: Eli Lilly is held in my investment portfolio. The stock cleared $52.83 on modest volume and saw a pick up in volume as the stock made a confirmation test of $52.83. There is a narrowing rising wedge which - if fulfilled - will break downwards. A breakdown could evolve into a false breakout, but should this happen, look for a defense of the 50-day MA.